Deposit Swap

Product - PS - Depositswap

Mandiri Deposit Swap

Mandiri Deposit Swap

- POKOK TERPROTEKSI (PRINCIPAL PROTECTED PRODUCT)

Dana penempatan investasi terproteksi secara pasti sehingga tidak ada potensi kerugian seperti berkurang maupun hilang - IMBAL HASIL PASTI DAN LEBIH TINGGI

Imbal hasil sudah dikunci dari awal transaksi dan lebih tinggi daripada produk simpanan valas konvensional - TENOR VARIATIF

Tenor disesuaikan menurut kebutuhan, dimulai dari 7 & 14 hari dengan produk tabungan/giro, dan 1,3,6 bulan dengan produk deposito - PILIHAN MATA UANG

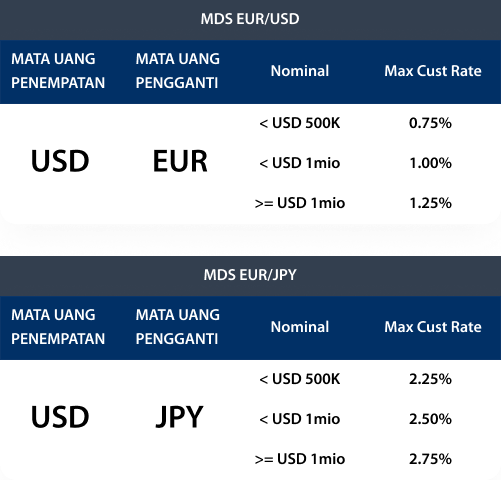

Dana penempatan investasi adalah dalam mata uang Non-IDR seperti USD, SGD, AUD, atau GBP. Tidak dapat dicairkan sebelum jatuh tempo - BIAYA DAN PAJAK

- Biaya materai untuk Bilyet dan Perjanjian

- Pajak akan diperhitungkan terhadap selisih dari hasil investasi akhir (dalam Mata Uang Asal) dengan jumlah penempatan awal (dalam Mata Uang Asal).

- Perjanjian Mandiri Deposit Swap (berlaku 2 tahun)

- Formulir Kuisioner Nasabah Structured Product (berlaku 2 tahun)

- Product Highlight (setiap transaksi), berisikan informasi detail terkait fitur produk

- Term Sheet (setiap transaksi), berisikan detail informasi transaksi MDS nasabah

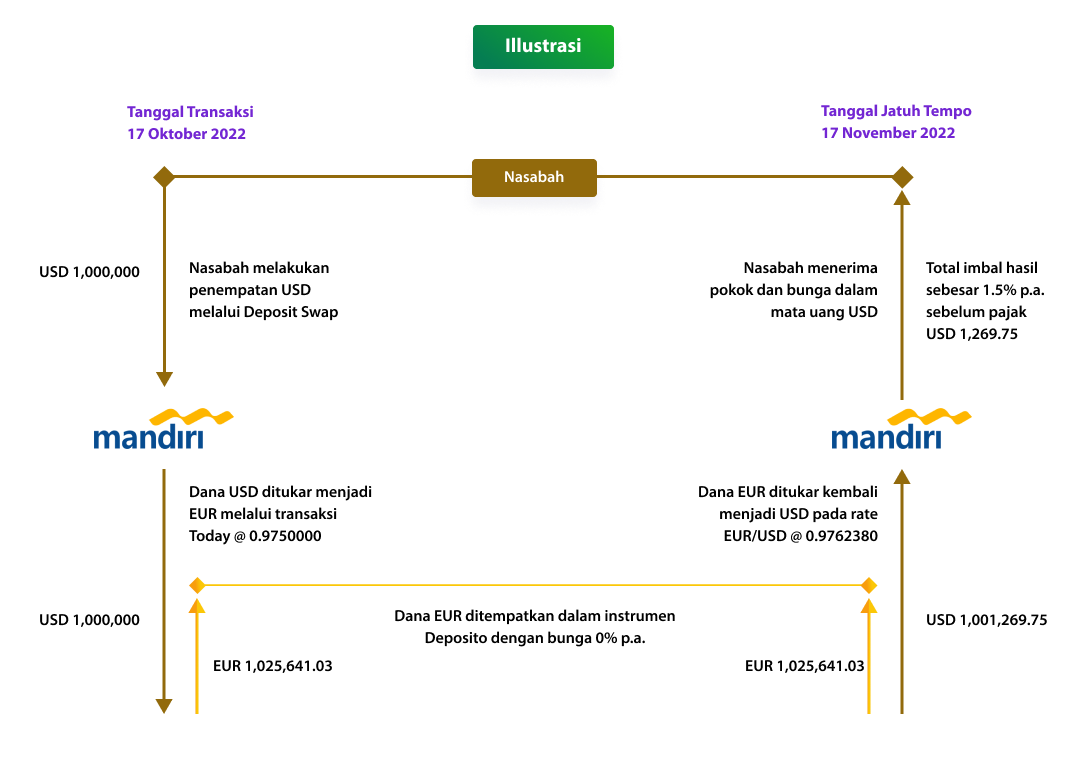

| Dana investasi awal | USD 1,000,000 |

| Produk Simpanan | Deposito |

| Mata uang penempatan Deposito | EUR |

| Nilai tukar Konversi Awal | 1.0440000 |

| Nilai tukar Konversi Akhir | 1.0448910 |

| Tenor Deposito | 1 (satu) Bulan |

| Tanggal Transaksi | 17 Oktober 2022 |

| Tanggal Jatuh Tempo | 17 November 2022 |

| Total hari | 31 hari |

| Bunga Deposito EUR | 0% p.a. before tax |

| Total Imba Hasil yang Didapat | 1% p.a. before tax |