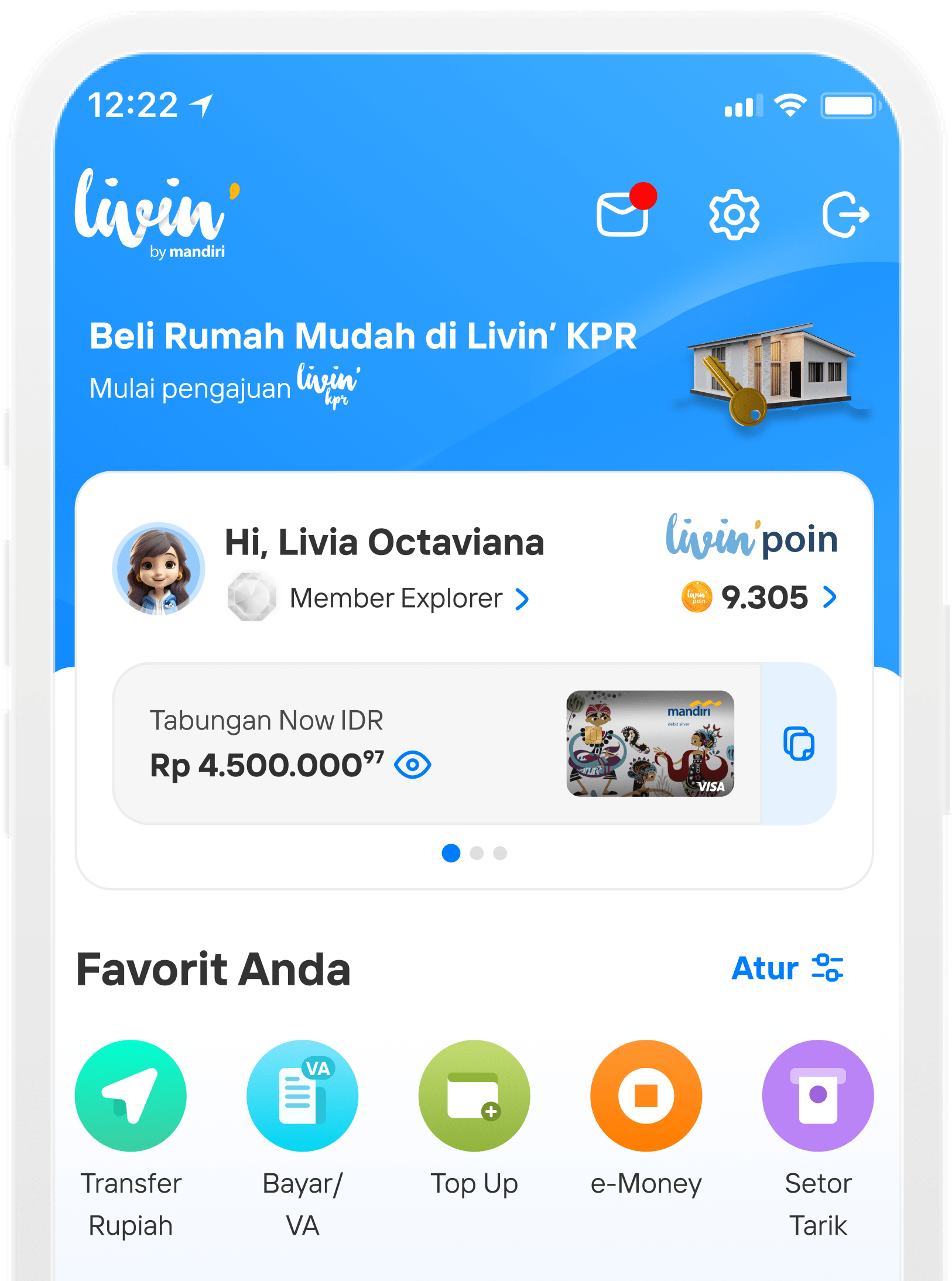

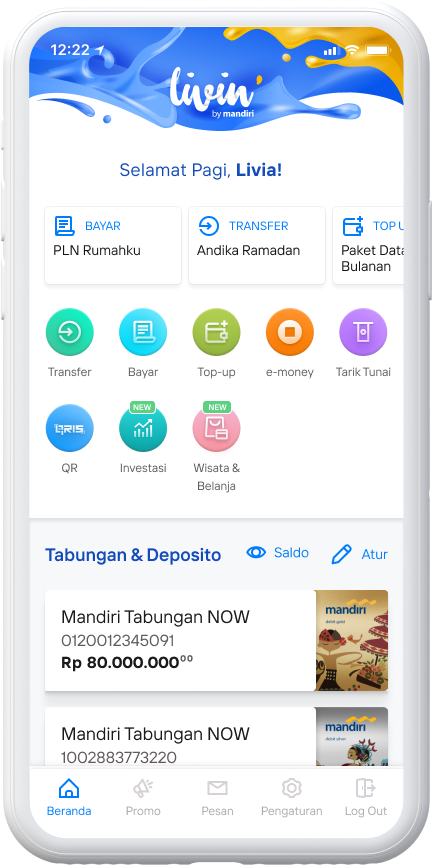

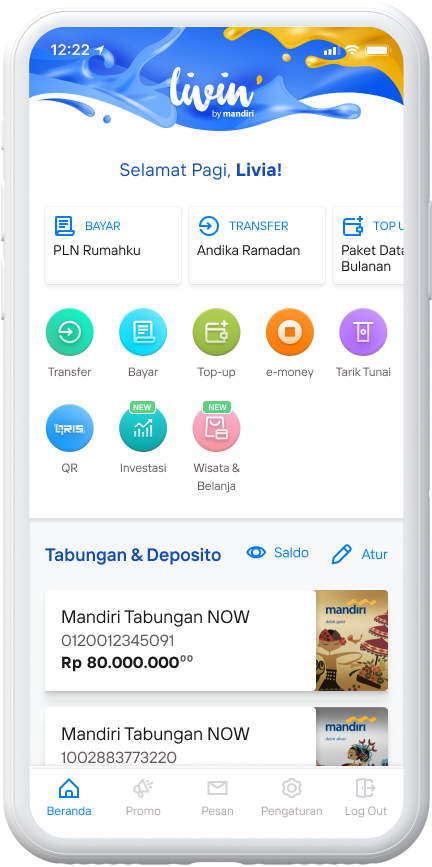

Cara Investasi di Livin' by Mandiri dengan Mudah

Content - Investasi

Investment for All

Whether you're a beginner or a professional, you can invest in Livin' by Mandiri!

Content 2 - Investasi

Start investing in mutual funds more practically by registering through the Livin' by Mandiri Application! All transactions, from buying, selling, to monthly investment arrangements, can be managed quickly and practically in the palm of your hand. With a variety of mutual fund options, investing is now more convenient and according to your financial needs.

Complete product information can be accessed via:https://www.bankmandiri.co.id/web/guest/wealth-management/reksadana

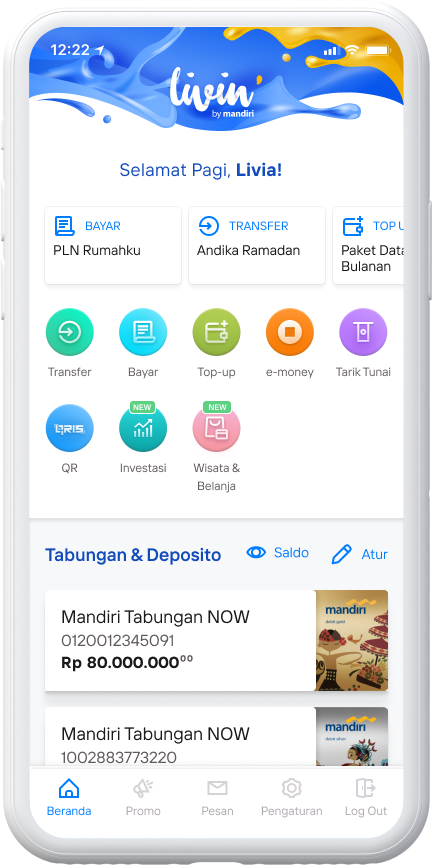

How to Register for Investment

Enter the investment menu

Choose Apply Now

.

Select Open Investment Account

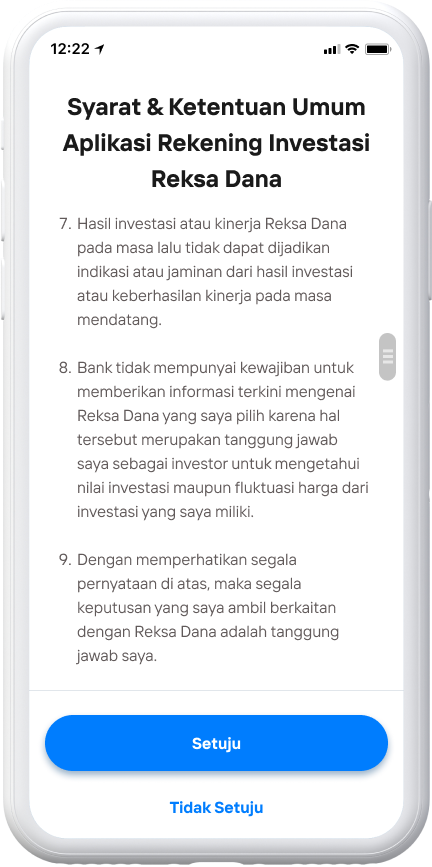

Select I Agree

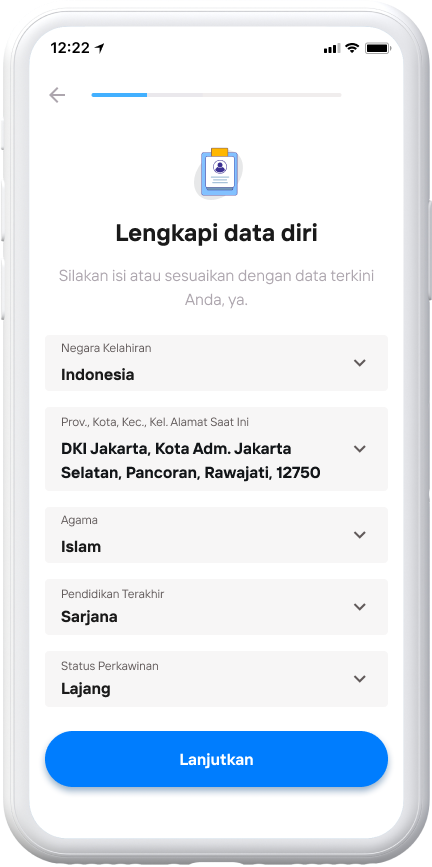

Complete your personal details and select Continue.

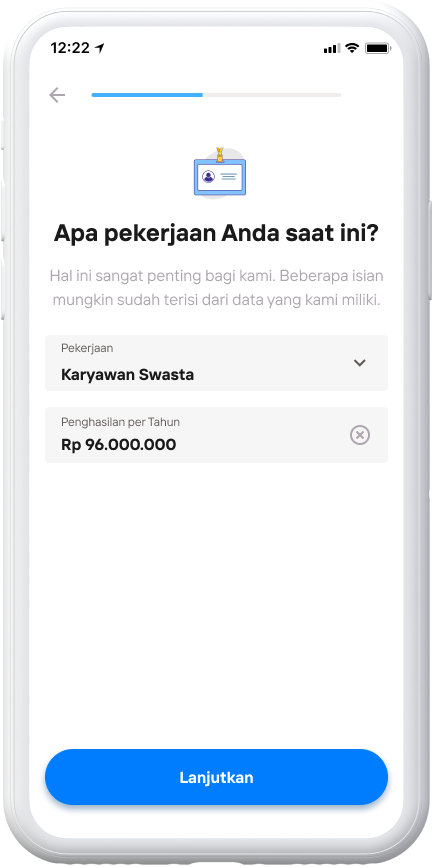

Complete your employment details and select Continue.

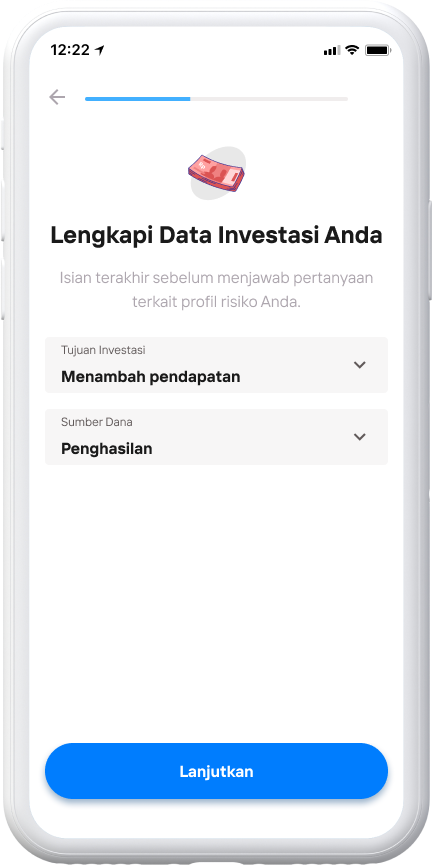

Complete your investment details and select Continue.

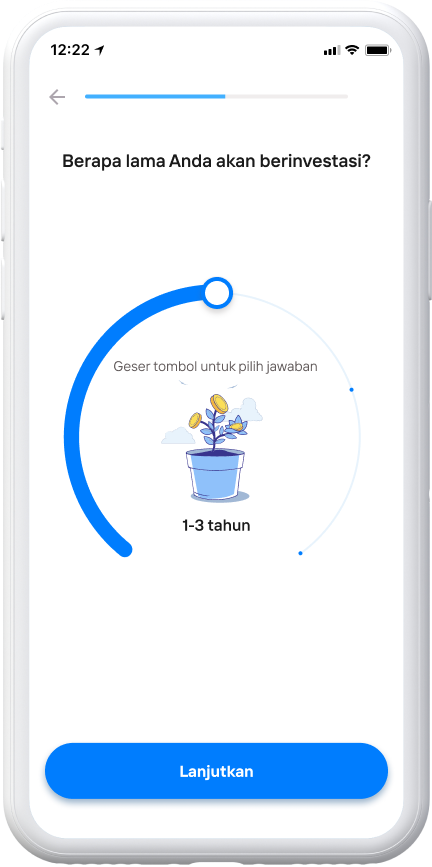

Swipe and select the length of your Investment then select Continue.

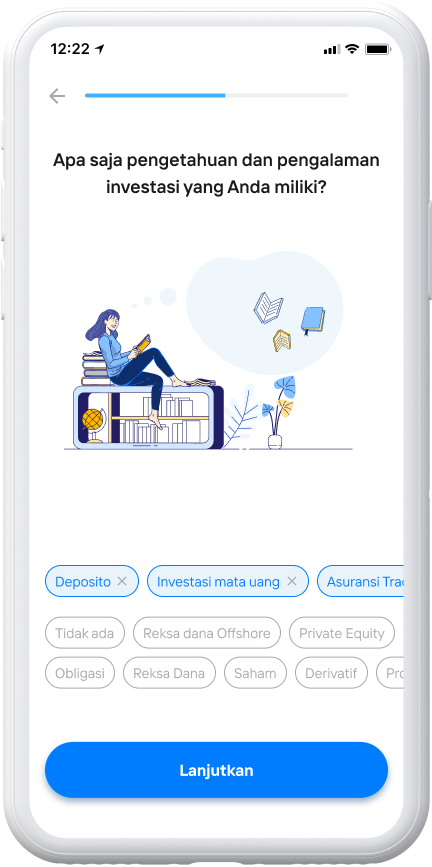

Select your investment knowledge & experience then select Continue.

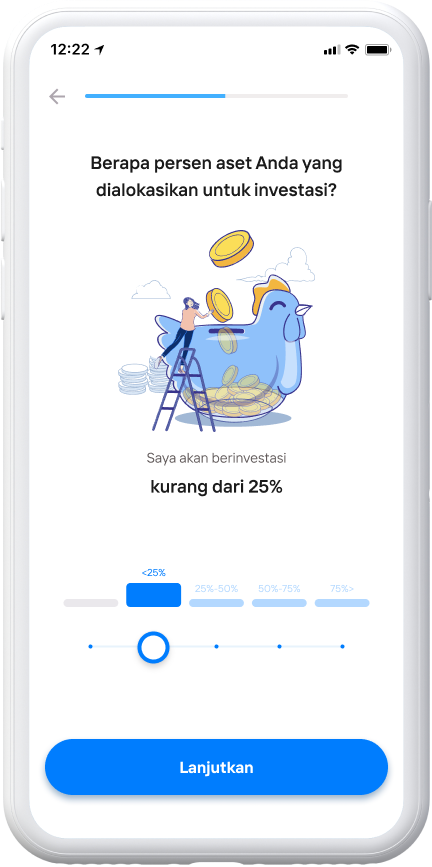

Swipe and select your asset allocation per cent for investment and then select Continue.

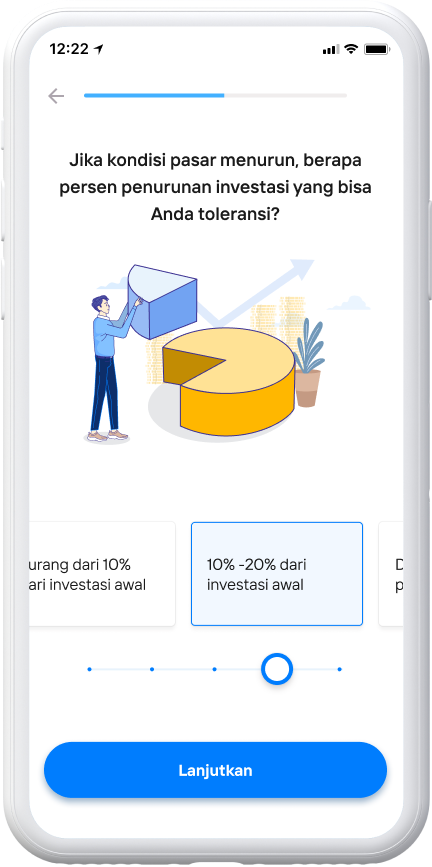

Swipe and select the amount of risk you can tolerate and then select Continue.

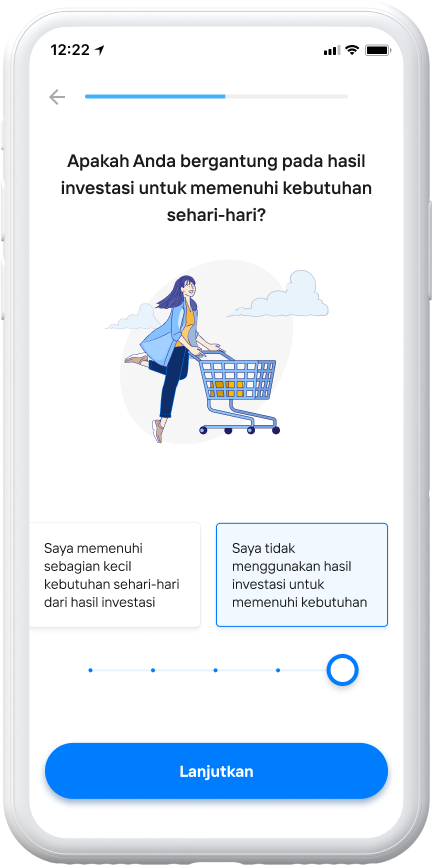

Swipe and select the dependency on your investment returns and then select Continue.

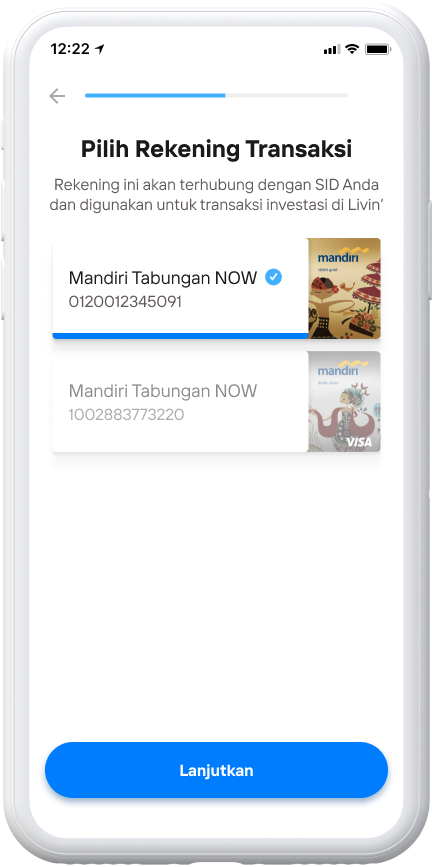

Select the transaction account to be used and then select Continue.

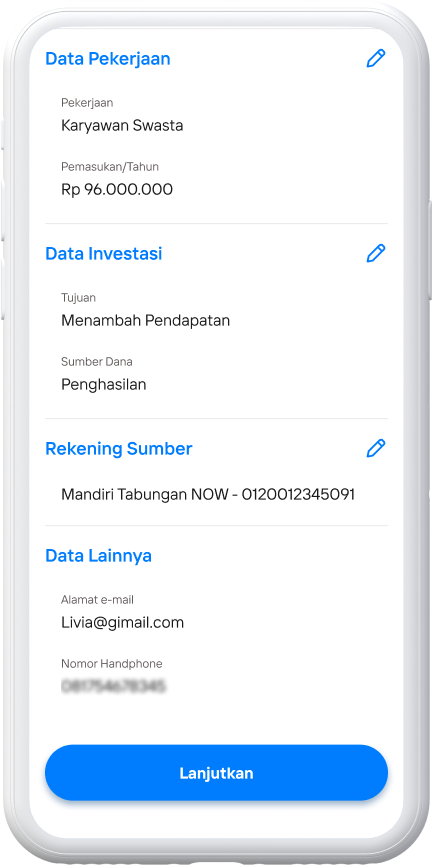

Make sure your data is correct and then select Continue.

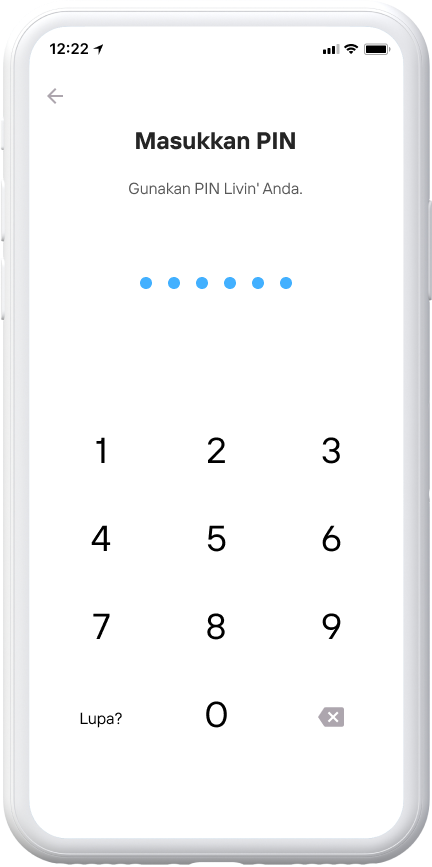

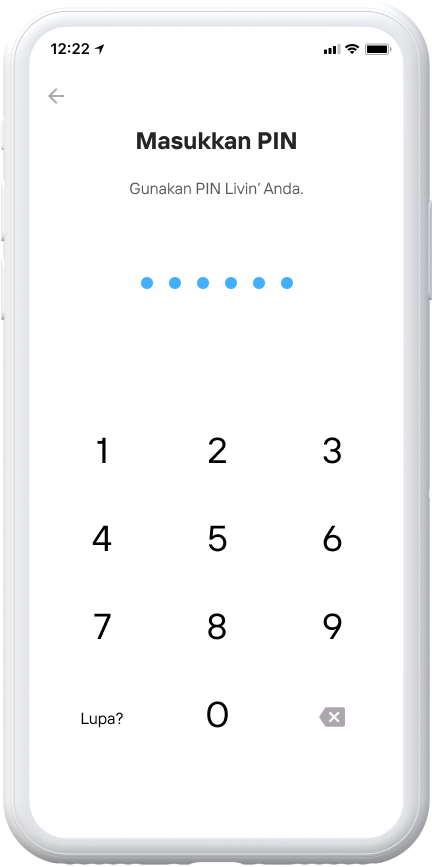

Enter your PIN

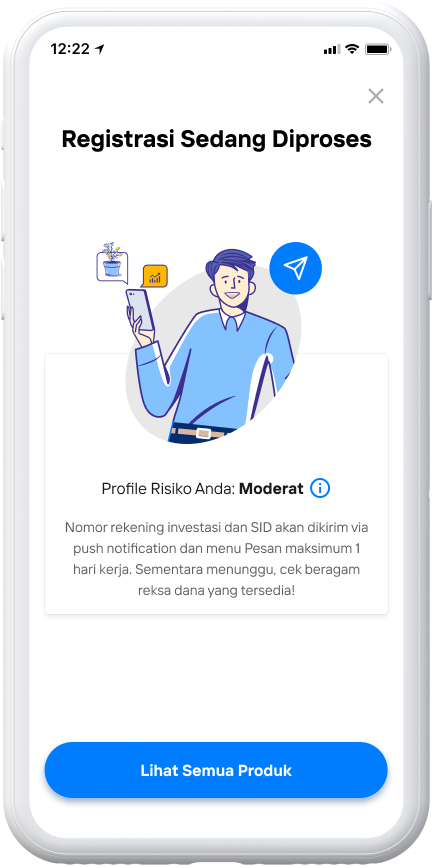

Registration is in process, investment account number and SID will be sent via push notification and message menu maximum 1 working day.

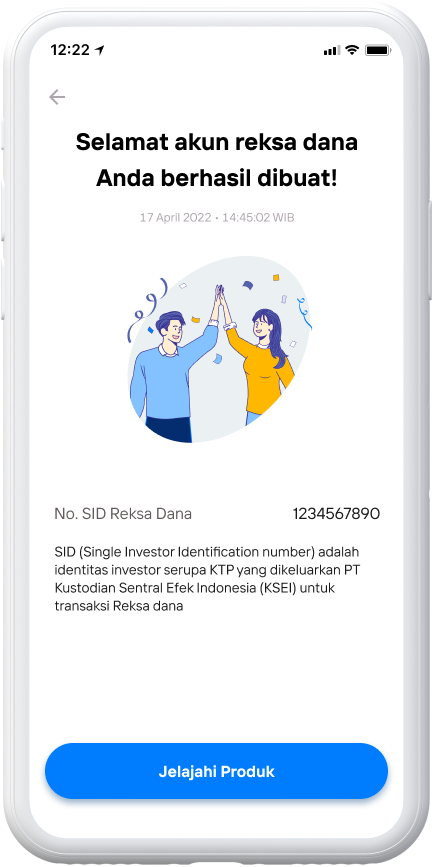

Congratulations your mutual fund account was successfully created

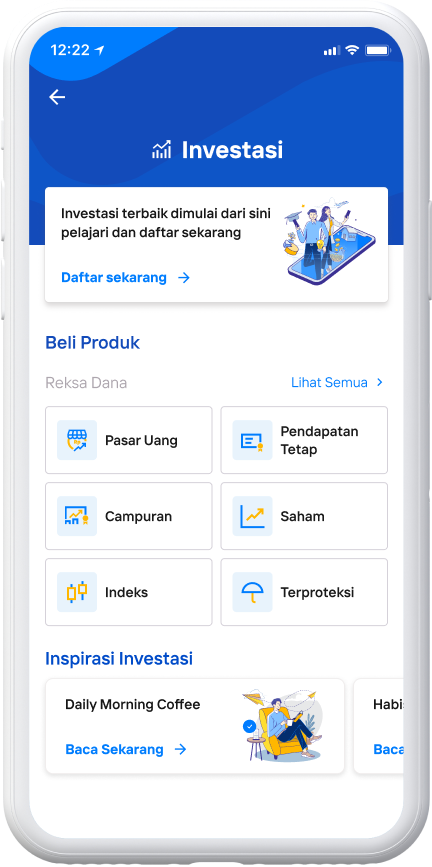

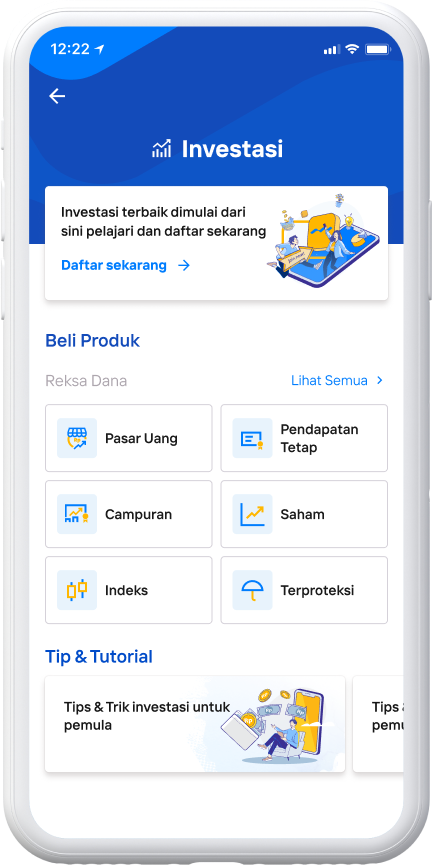

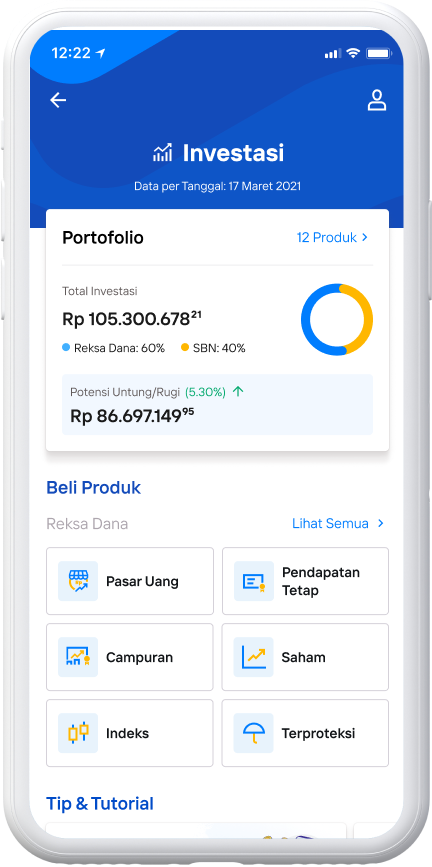

How to Buy Investment Products

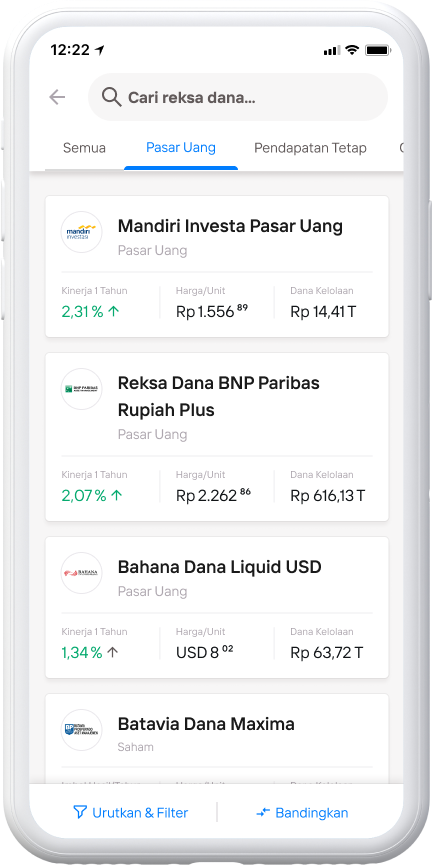

Select one of the product categories or select all products.

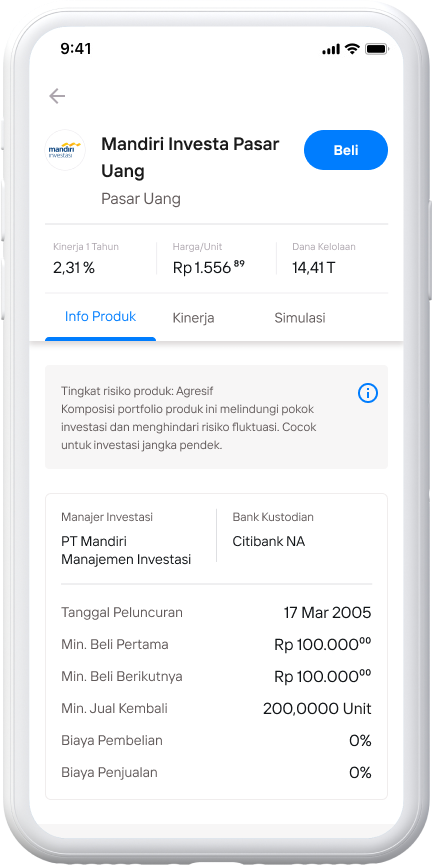

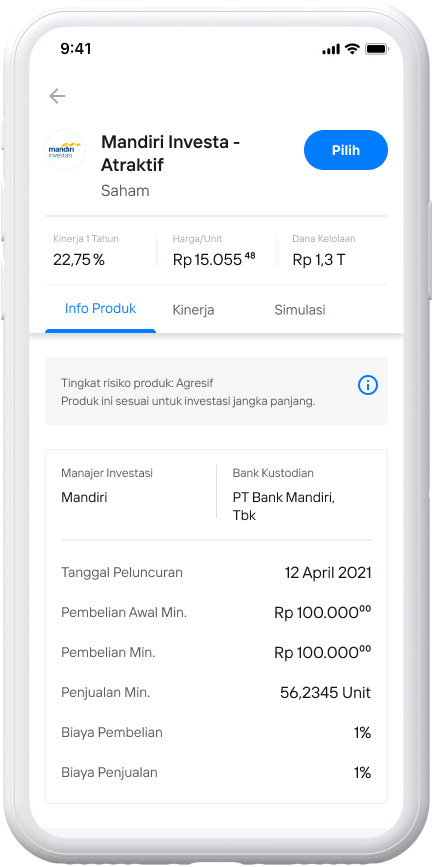

Choose your preferred investment product

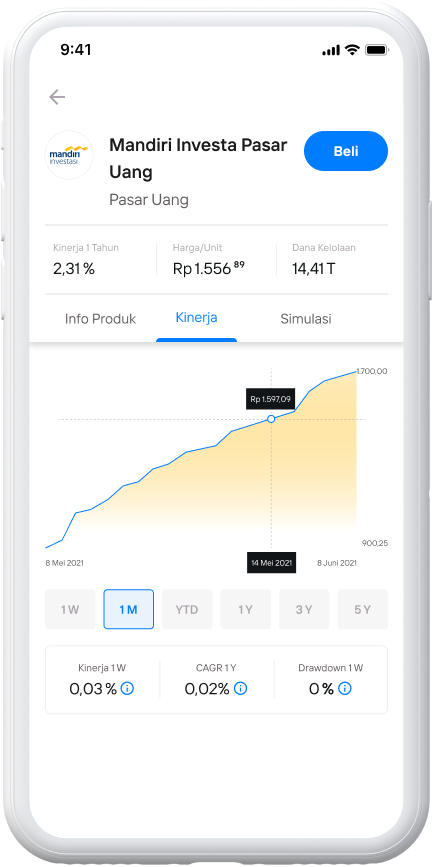

View product information or select performance.

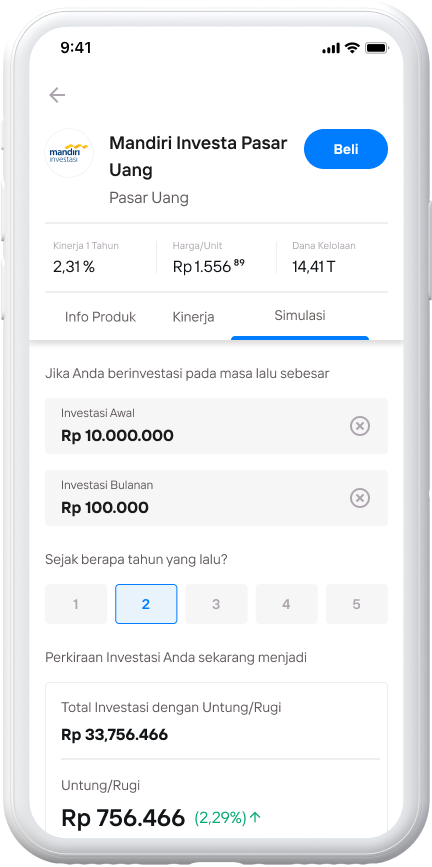

View product performance or select simulation.

Complete the simulation information or select buy.

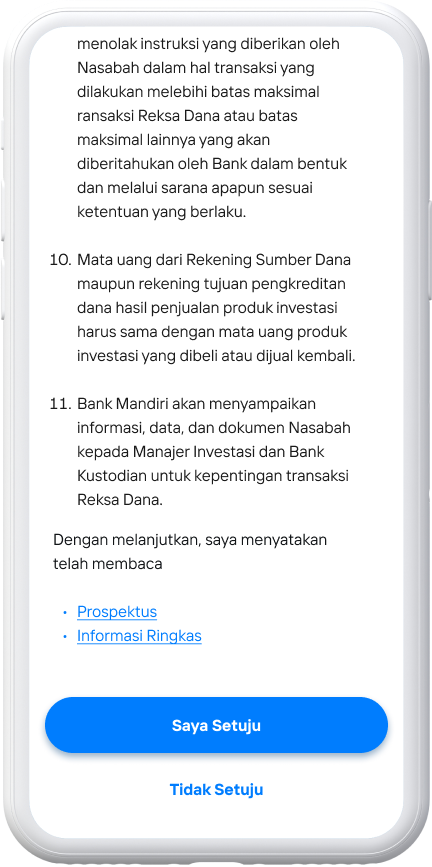

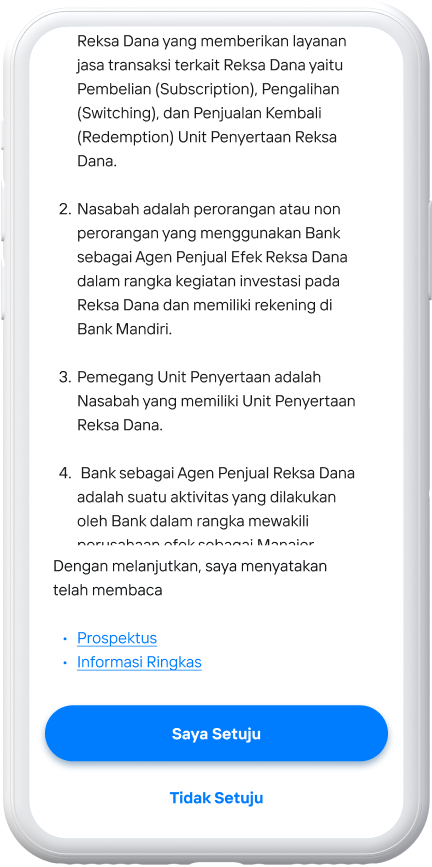

Read and agree to the Terms & Conditions then select I agree.

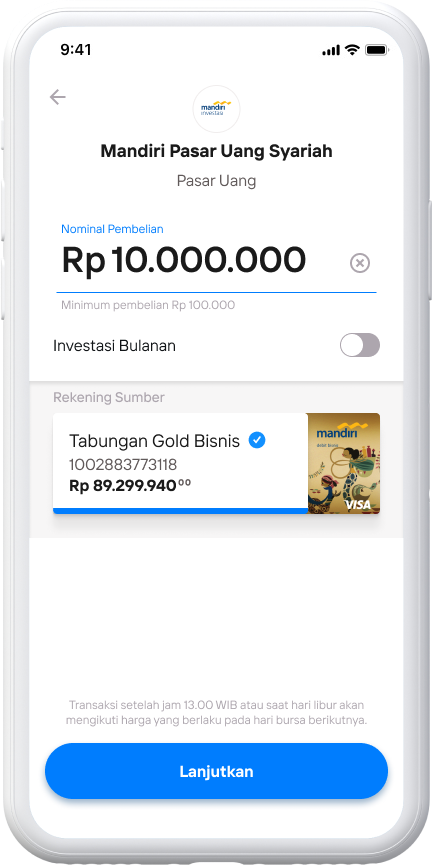

Fill in the Nominal Purchase or you can choose monthly investment then select Continue.

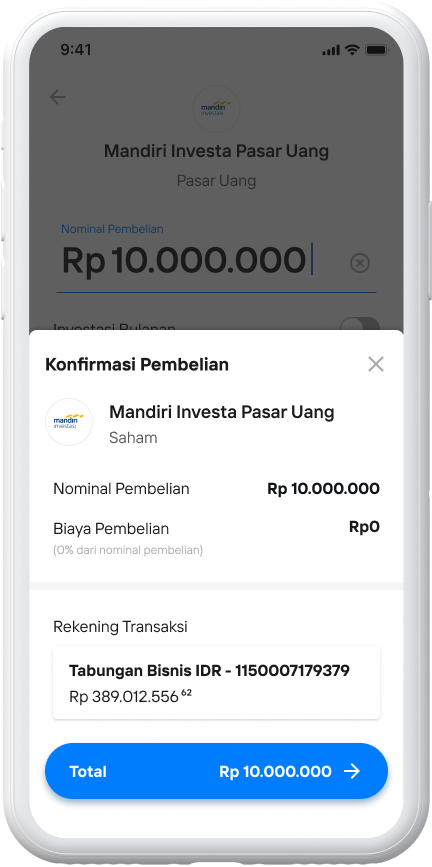

Ensure Investment Information is Correct then continue to select Total Rp 10.000.000

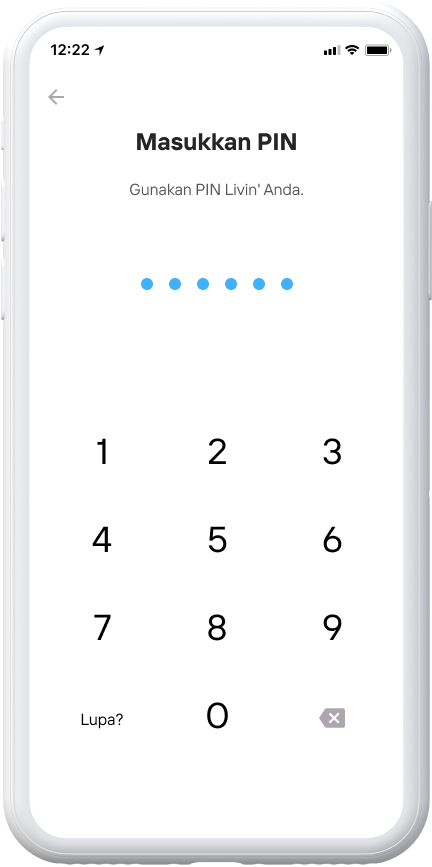

Enter your PIN

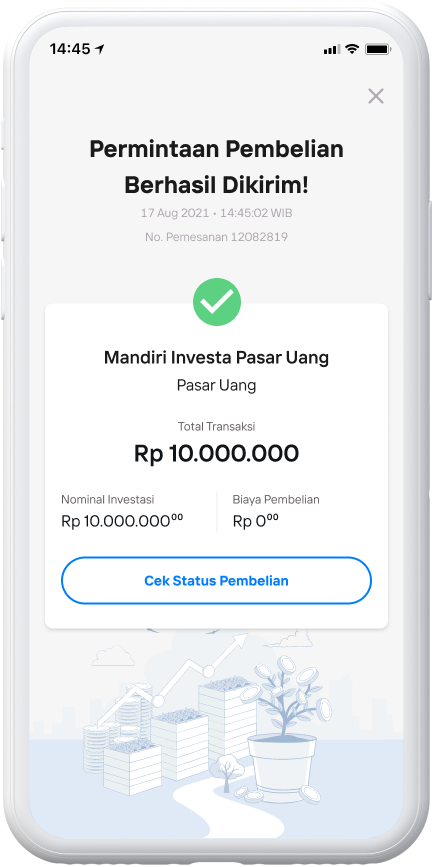

Purchase request sent successfully You can view purchase status details

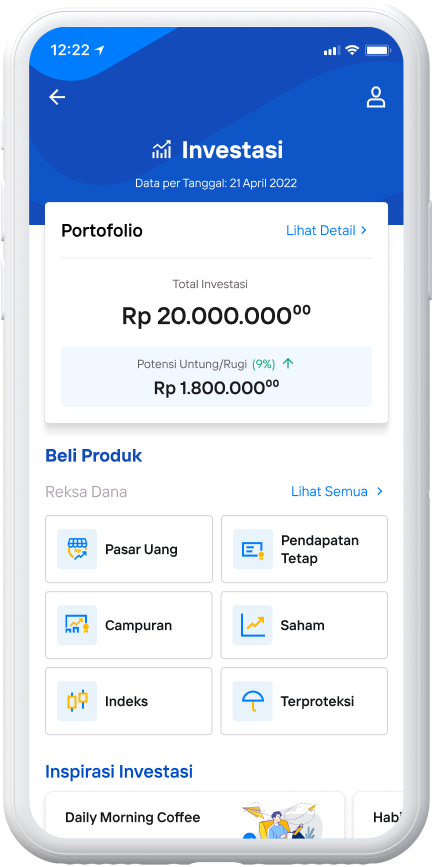

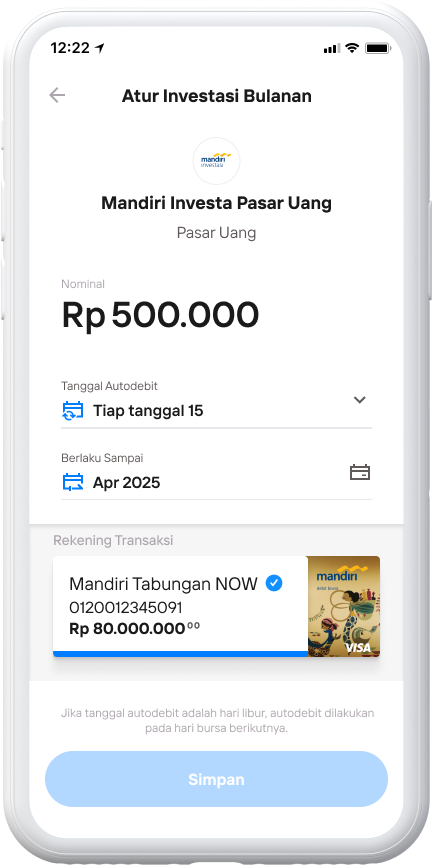

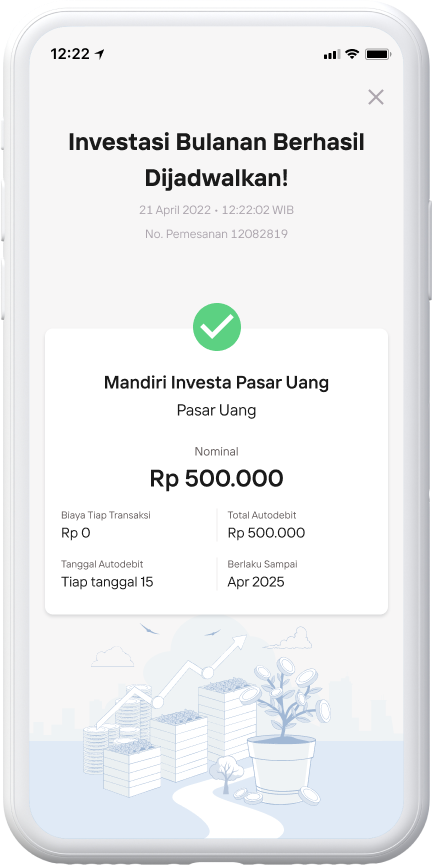

How to Manage Routine Mutual Fund Investments

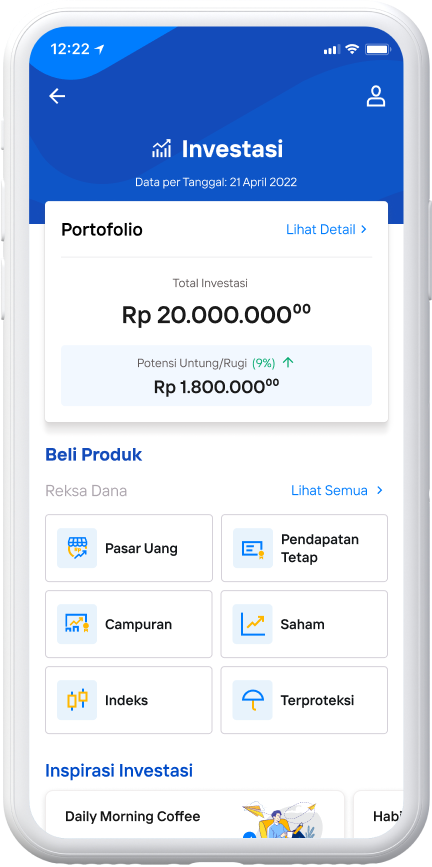

Select Invest on the home menu

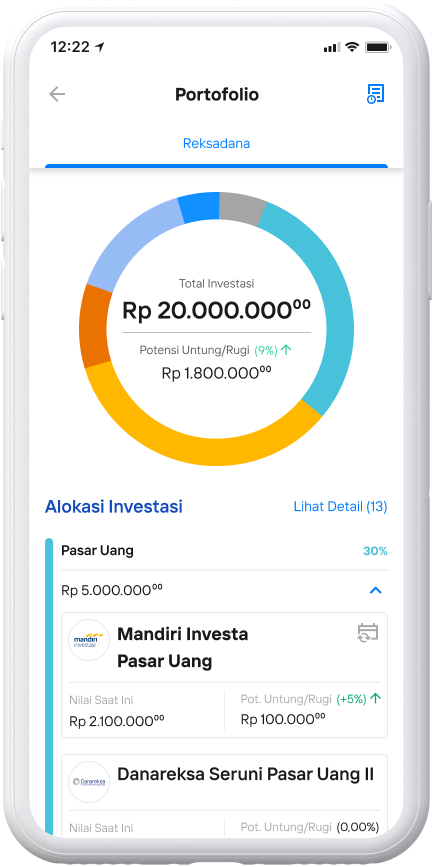

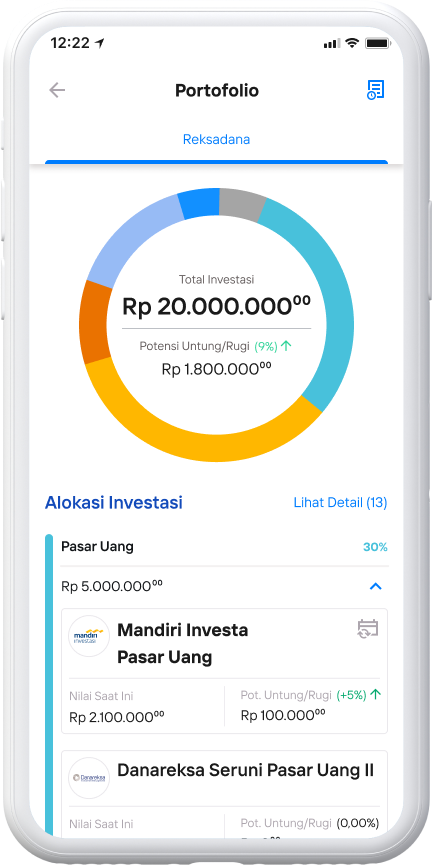

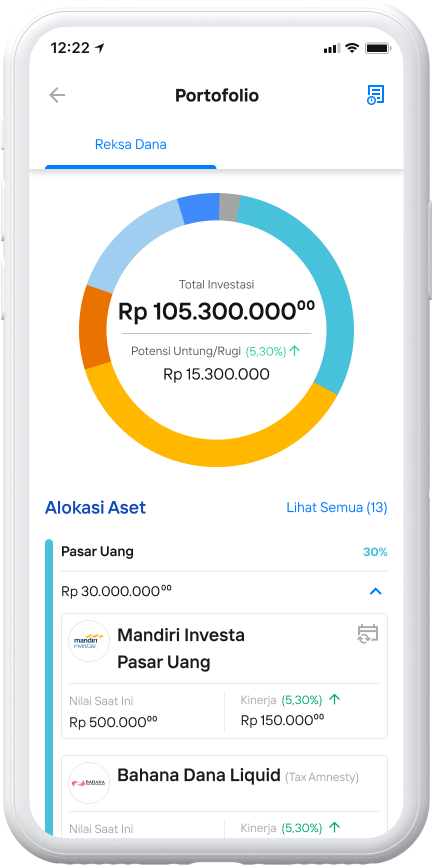

Select Portfolio by selecting view details.

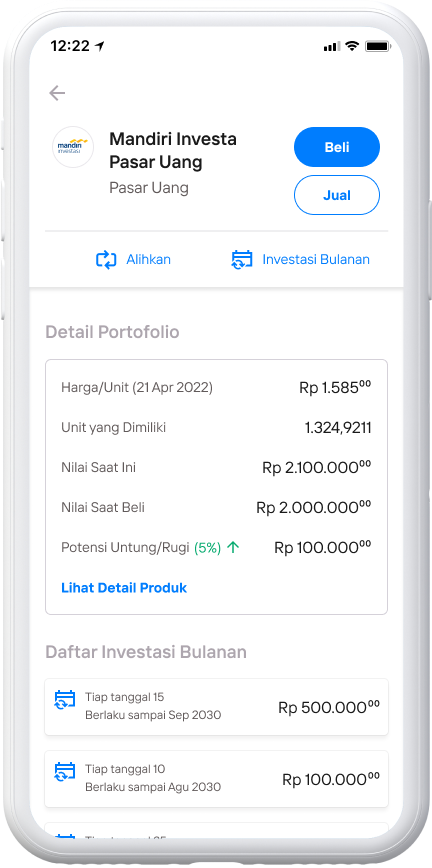

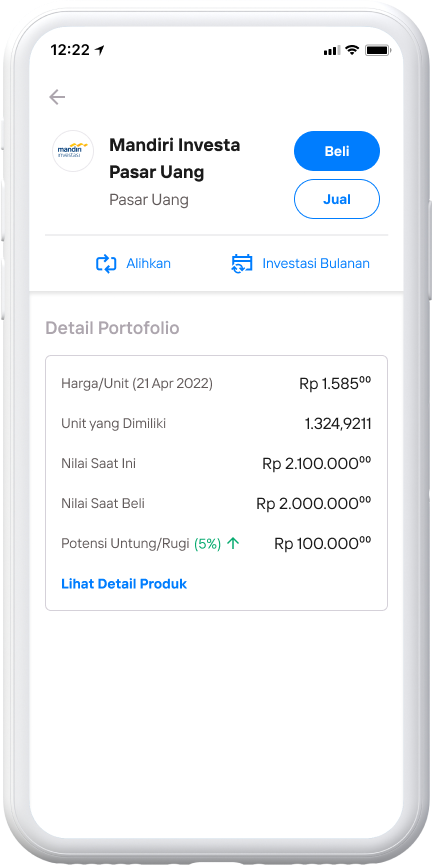

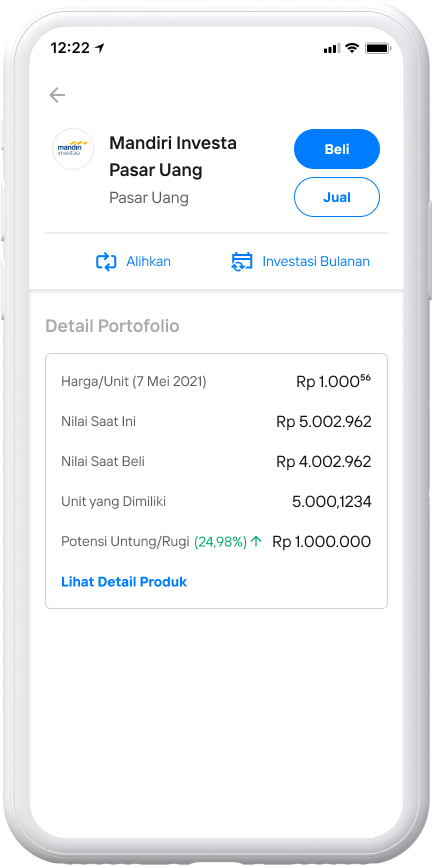

Select the desired Product

Choose Monthly Investment

Fill in the desired Nominal amount

Enter PIN Livin'.

Monthly investment successfully scheduled

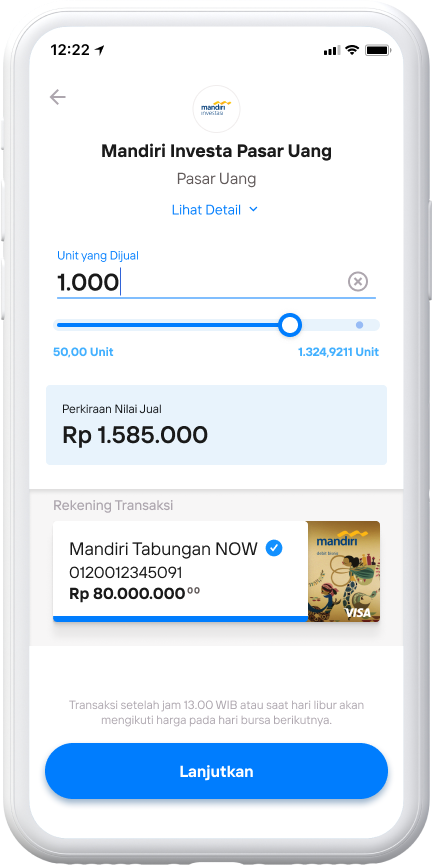

How to Sell Investment Products

Select Invest on the Home menu

Select Portfolio

Select a product

Select Sell

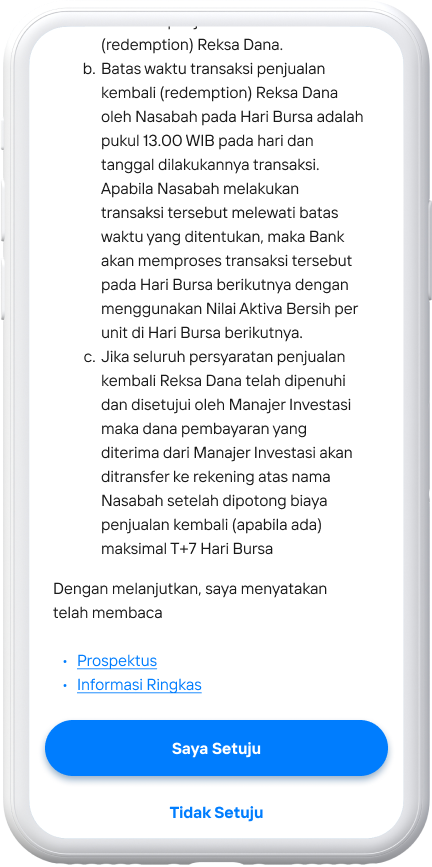

Read and agree to the terms & conditions then select I Agree

Fill in the number of units to be sold then select Continue

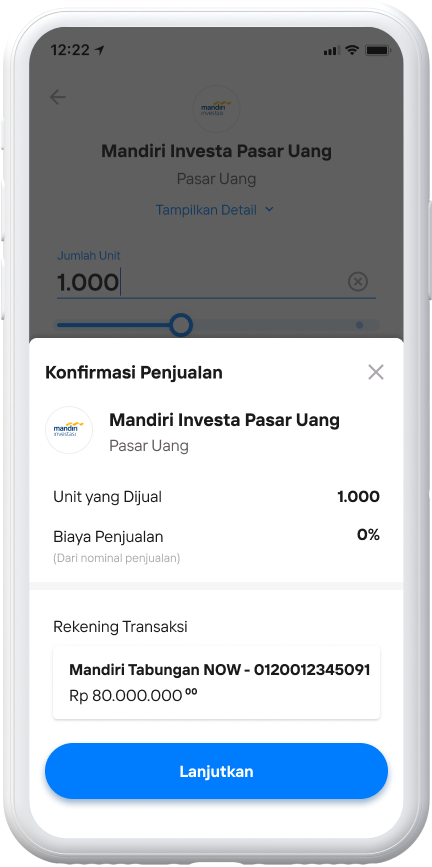

Make sure the sales information is correct then select continue

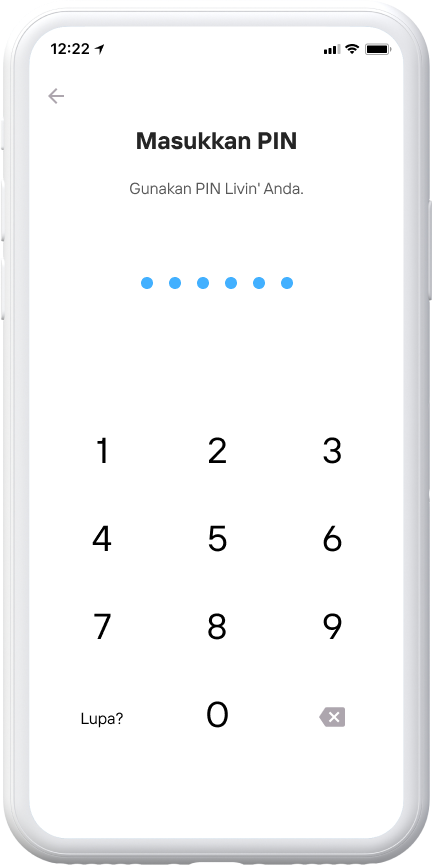

Enter your Livin' PIN

Sales request sent successfully You can view Sales status details

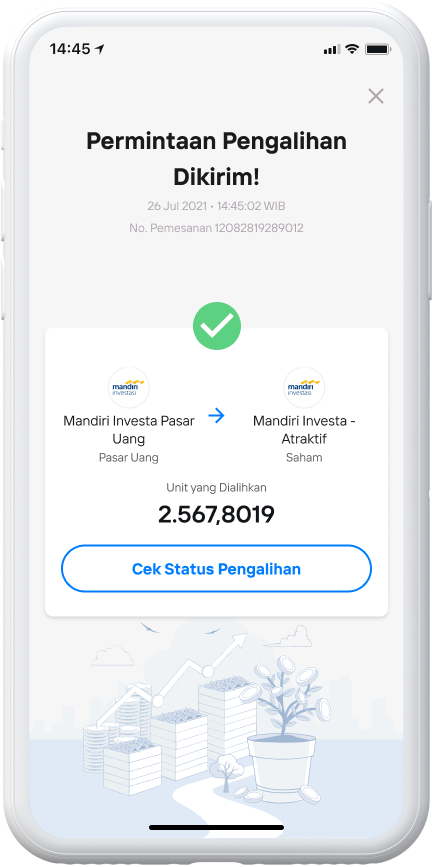

How to Transfer Investment Products

Select Portfolio

Select a product

Select switch

Read and agree to the terms & conditions

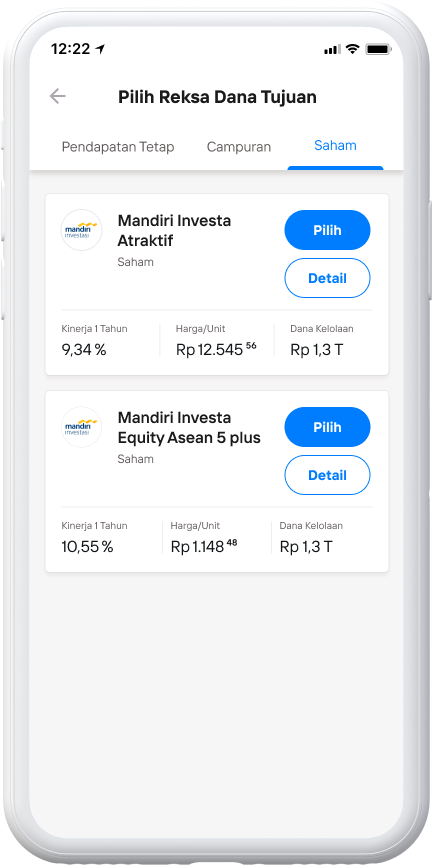

Select the Product you want to switch to

tap Select

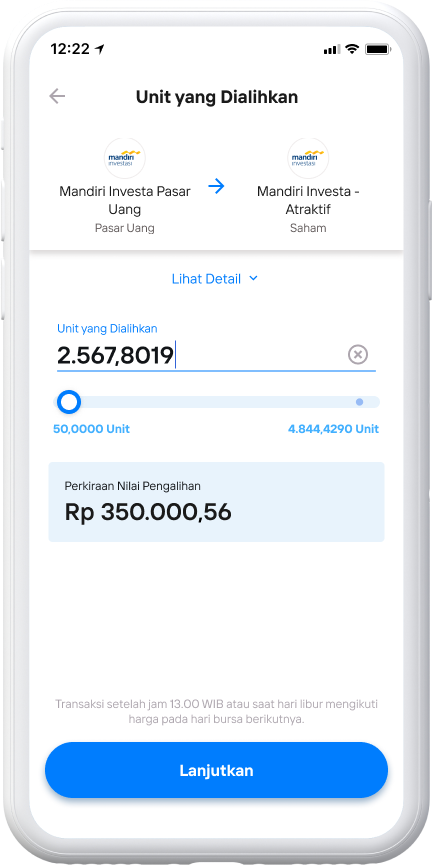

Fill in the number of units to be transferred then select Continue

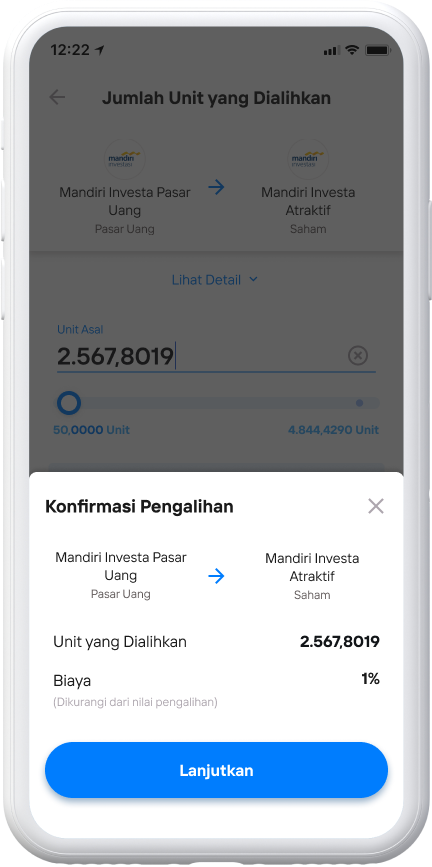

Make sure the redirect information is correct then select continue

Enter your Livin' PIN

Redirect request sent successfully You can view the redirect status details

- Benefits of Investing in Mutual Funds at Livin' by Mandiri

-

Convenient and Practical: Invest in mutual funds directly from your mobile phone anytime, anywhere.

-

Wide Range of Product Choices: Align investment withyour financial goals and risk profile.

-

Fast Transaction: Buy and sell mutual funds in just one application.

-

Safe and Trusted: Invest with a safe and trusted platform through Livin' Mandiri.

-

- Risks in investing in Mutual Funds

-

Economic and Political Risks: Changes in economic and political conditions may affect market performance and investments in mutual funds.

-

Impairment Risk: The value of mutual funds may decrease depending on the price movements of assets in the portfolio.

-

Liquidity Risk: Occurs when an instrument is difficult to trade or the market is unstable.

-

Market Risk: Fluctuations in investment value due to changes in market conditions, such as stock prices or interest rates.

-

Other Risks: The risks listed in each mutual fund prospectus

-

FAQ - Investasi

Frequently Asked Questions

- - Mutual Fund (Investment Fund/Mutual Fund) is a container used to collect funds from the investor community which are then invested in a Securities Portfolio by Investment Managers (MI) who have obtained permission from the Financial Services Authority (OJK).

There are several parties involved in mutual fund products including Investment Managers, Custodian Banks, and Mutual Fund Selling Agents. The Investment Manager is tasked with managing the mutual fund portfolio while the Custodian Bank is the party that administers and records and stores mutual fund assets.

Bank Mandiri in this case acts as a Mutual Fund Selling Agent (APERD) whose task is to sell mutual fund securities based on a cooperation contract with the Investment Manager managing the mutual fund. Bank Mandiri has been registered as an APERD with the Financial Services Authority (OJK) since 2007 with Registered Certificate No. 07/BL/STTD/APERD/2007 dated 21 February 2007.

- 1. Already registered as a Bank Mandiri customer

- 2. You do not have a Mutual Fund SID (Single Investor Identification) and/or IFUA recorded in the SmartClient/Avaloq system

- 3. Customer has at least 1 active Mandiri Rupiah (Rp) Savings account

- 4. There are no restrictions on Private, Priority or Retail customers

- SLA for Mutual Fund investor registration on Livin' by Mandiri takes 1 working day

- Yes, customers will get push notifications, and inboxes from the Livin' by Mandiri app.

- Customers will receive information on the Mutual Fund SID Number.

- SID or Single Investor Identification, is an identity number issued by PT Kustodian Sentral Efek Indonesia (KSEI) for investment transaction purposes.

- As long as the Customer does not have a Mutual Fund SID recorded in the Bank Mandiri system, the Customer needs to register as a Mutual Fund Investor first.

- As long as the Customer does not have a Mutual Fund SID recorded in the Bank Mandiri system, the Customer needs to register as a Mutual Fund Investor first.

The following are the requirements for customers to purchase Mutual Funds at Livin' by Mandiri:

- 1. Customer already has a Mutual Fund SID recorded in Bank Mandiri's system.

- 2. Customers have an active savings account in accordance with the currency of the mutual fund product they wish to purchase (can be IDR or USD)

- 3. Customers are free to choose the risk level of the product, but if they choose a product whose risk is higher than the customer's risk profile, Livin' will provide a warning before the customer can continue the purchase.

- 4. Customer's Mutual Fund account is not blocked in Bank Mandiri's system.

- Mutual Fund subscription fee depends on each Mutual Fund product terms, currently ranging from 0% to 2% of the subscription value (unless otherwise specified in the product prospectus).

- The minimum subscription amount depends on each mutual fund product's terms, currently for IDR denominated products the minimum is IDR 10,000 and for USD products the minimum is USD 100.

- Customers will be subject to a mutual fund purchase transaction limit of IDR 5,000,000,000.

- Performance is the growth in value of a mutual fund over a certain period, generally in percentage terms.

- Managed Funds is the amount of funds managed in a mutual fund product. The higher the Managed Funds generally reflects the higher investor confidence in the product.

- Customers can choose and purchase products with various product risk levels, but if the customer intends to purchase a Mutual Fund with a higher risk level than the customer's risk profile, the customer will be given a pop-up statement that the customer understands and agrees to the risk of purchasing the product, before being able to continue the purchase.

- You will not be able to make the purchase transaction as long as you do not have a USD Tabungan Mandiri product. To open a USD Mandiri Savings Account, please visit the nearest Bank Mandiri Branch Office.

- Trading Hours and Days is a period of time for financial transactions in the capital market that follows the trading hours and days of the Indonesia Stock Exchange (IDX). For Mutual Fund investments, the provisions of Exchange Hours and Days are every Monday to Friday (except red dates and holidays), with a maximum limit of 13.00 WIB each day.

- Customers can make mutual fund purchase transactions at any time, but the mutual funds will be processed by the system on the bourse day. If the transaction is made on a bourse day until 13.00 WIB, the transaction will be processed using the mutual fund NAV on the same day. If the transaction is carried out outside the bourse day or carried out above 13.00 WIB, the transaction will be processed using the mutual fund NAV on the next bourse day.

- The duration of Mutual Fund purchases depends on each product and Investment Manager (MI) company, around 3 (three) working days.

- Yes, you will get push notifications and inboxes from Livin' by Mandiri.

- Customers can immediately contact Mandiri Contact Centre 14000 (retail) to report the matter.

- Total Investment is the sum of all investment values both in total, and each investment asset. This value includes the value of capital and also the value of potential profits / losses.

- The potential gain/loss contained in the portfolio is the amount of increase or decrease in the value of the Customer's investment position that has not been realised. This potential profit or loss will be realised when the investment is resold. Potential profit/loss is the difference between the purchase price and the selling price of an investment product calculated using market value and cost value (purchase value by taking into account the average cost price).

- Mutual Fund products that are listed on Livin' by Mandiri but no longer available for purchase means that the product is no longer sold at Bank Mandiri. However, for customers who still have a balance in the Mutual Fund product, they can still conduct redemption and switching transactions on the product.

The following are the requirements for customers to be able to sell Mutual Funds at Livin' by Mandiri:

- The customer already has a Mutual Fund SID recorded in the Bank Mandiri system

- The customer has an active savings account as a recipient of disbursement funds in accordance with the currency of the mutual fund product to be sold (can be IDR or USD)

- Customer's Mutual Fund account is not blocked in Bank Mandiri's system.

- Mutual Fund sales fee at Livin' by Mandiri is free for all Mutual Fund products (unless otherwise specified in the product prospectus).

- The minimum unit of sales of Mutual Funds depends on the provisions of the prospectus of each product.

- There is no limit for Mutual Fund sales transaction imposed to the Customer.

- Minimum unit ownership is the minimum number of units that must be owned in the Customer's Mutual Fund product portfolio at any one time.

- You will not be able to conduct such sales transactions as long as you do not have a USD Tabungan Mandiri product. To open a USD Mandiri Savings Account, please visit the nearest Bank Mandiri Branch Office.

- Customers can make mutual fund sales transactions at any time, but the mutual fund will be processed by the system on the bourse day. If the transaction is made on a bourse day until 13.00 WIB, the transaction will be processed using the mutual fund NAV on the same day. If the transaction is carried out outside the bourse day or carried out above 13.00 WIB, the transaction will be processed using the mutual fund NAV on the next bourse day.

- Durasi dari penjualan unit Reksa Dana tergantung dari masing-masing produk dan perusahaan Manajer Investasi (MI), namun Peraturan OJK Nomor 23/POJK.04/2016 mengatur bahwa SLA proses penjualan adalah selama 7 (tujuh) hari kerja.

- Yes, you will get push notifications and inboxes from Livin' by Mandiri.

- Customers can wait for a maximum of 1 working day since receiving notification that the sale has been completed. Your investment transaction account must also be active. If you do not receive your funds, please contact Mandiri Contact Centre 14000 (retail) to report the matter.

- Customers can immediately contact Mandiri Contact Centre 14000 (retail) to report the matter.

- Transaction to switch one mutual fund product owned by the Customer to another mutual fund managed by the same Investment Manager. Not all mutual fund products have a switching feature.

The following are the conditions under which customers can perform Mutual Fund switching transactions at Livin' by Mandiri:

- The customer already has a Mutual Fund SID recorded in the Bank Mandiri system

- Not all mutual fund products can be switched as they are subject to each Investment Manager's policy. The "Switch" button will only appear on the portfolio if the product is switchable.

- The customer is free to choose the risk level of the product to be transferred, but if the customer chooses a product whose risk is higher than the customer's risk profile, Livin' will provide a warning before the customer can continue the transfer.

- Customer's Mutual Fund account is not blocked in Bank Mandiri's system.

- Mutual Fund switching fee at Livin' by Mandiri is 0.5% (flat) for all Mutual Fund products (unless otherwise specified in the product prospectus).

- Customers will be given a warning that they want to make transactions in Mutual Fund products that have a product risk higher than the customer's risk profile. However, the Customer can choose to continue the transaction or not.

- Minimum unit switching of Mutual Funds depends on the prospectus of each product.

- There is no limit for Mutual Fund switching transaction imposed to the Client.

- Customers can make mutual fund switching transactions at any time, but the mutual fund will be processed by the system on the bourse day. If the transaction is made on a bourse day until 13.00 WIB, the transaction will be processed using the mutual fund NAV on the same day. If the transaction is carried out outside the bourse day or carried out above 13.00 WIB, the transaction will be processed using the mutual fund NAV on the next bourse day.

- The duration of Mutual Fund switching depends on each product and Investment Manager (MI) company, but OJK Regulation Number 23/POJK.04/2016 stipulates that the SLA for the switching process is 4 (four) working days.

- Yes, you will get push notifications and inboxes from Livin' by Mandiri.

- Customers can immediately contact Mandiri Contact Centre 14000 (retail) to report the matter.

- Transaction to make regular mutual fund purchases with the same product and amount every month. Not all mutual fund products have a monthly investment feature. And, the initial debit of Monthly Investment is made in the following month since the transaction is made.

The following are the requirements for customers to make a Mutual Fund Monthly Investment at Livin' by Mandiri:

- Customer already has Mutual Fund SID recorded in Bank Mandiri system (SmartClient/WM Core)

- Not all mutual fund products can have a regular subscription service because it is adjusted to the policies of each Investment Manager.

- Customers are free to choose the risk level of the product to be purchased regularly, but if they choose a product whose risk is higher than the customer's risk profile, Livin' will provide a warning before the customer can continue the periodic purchase.

- Customer's Mutual Fund account is not blocked in Bank Mandiri's system.

- The monthly investment subscription fee is the same as the Mutual Fund subscription fee, which depends on each product. It currently ranges from 0% to 2% of the monthly investment value of the Mutual Fund (unless otherwise specified in the product prospectus), and will be charged every time it is autodebited.

- Yes, you can create a monthly investment plan for the same Mutual Fund product.

- The term option available on the Livin' by Mandiri app is currently a maximum of 10 (ten) years.

- Customers will be given a warning that they want to make transactions in Mutual Fund products that have a product risk higher than the customer's risk profile. However, the Customer can choose to continue the transaction or not.

- The term option available on the Livin' by Mandiri app is currently a maximum of 10 (ten) years.

- Customers will be given a warning that they want to make transactions in Mutual Fund products that have a product risk higher than the customer's risk profile. However, the Customer can choose to continue the transaction or not.

- The minimum monthly investment amount of the Mutual Fund is equal to the subscription fee of the Mutual Fund, currently the minimum is IDR 100,000 for Rupiah products, and USD 100 for USD products, but depends on each product.

- Then the debiting will be done on the next trading day.

- Yes, you will be given reminder notifications via push notification and inbox in the Livin' by Mandiri app.

- The term option available on the Livin' by Mandiri app is currently a maximum of 10 (ten) years.

- Customers can only change the Monthly Investment settings that have been saved on each trading day, 09.00 - 19.00 WIB.

- Customers can only delete the Monthly Investment settings that have been saved on each trading day, 09.00 - 19.00 WIB.

- No, you will not be charged any additional fees or penalties for cancelling/deleting your monthly mutual fund investment.

- Customers may immediately contact Mandiri Contact Centre 14000 (retail) to report the matter.

- The Customer is indicated to have an account blocking if the Customer is temporarily unable to make Mutual Fund transactions, both purchases, sales, transfers, and monthly investments either through Livin' by Mandiri or the APERD Branch. The customer can be directed to come to the nearest APERD Branch to confirm the data and unblock the account.

- The blocking of the Customer's Mutual Fund account is carried out by Bank Mandiri upon written instruction from the Indonesian Central Securities Depository (KSEI).

- Bank Mandiri as a Mutual Fund Securities selling agent registered with the Financial Services Authority only carries out in accordance with written instructions from KSEI. In this case, KSEI informed that the customer's data was indicated to be invalid so that blocking was carried out.

- In connection with the blocking, customers are temporarily unable to conduct Mutual Fund transactions, including purchases, sales, switches, and monthly investments either through Livin' by Mandiri or APERD Branches until the blocking is lifted by KSEI.

- The Bank can open the block if there is an instruction from the Indonesian Central Securities Depository (KSEI) to open the block.

- Blocking can only be done through APERD Branches, not through Livin' by Mandiri. Customers should update their data at the nearest APERD (Mutual Fund Selling Agent) Branch of Bank Mandiri. The APERD Branch then carries out the mechanism and process of unblocking as it is currently running.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang