Strategic Partnership - Wholesale

BKPM - Wholesale

Mandiri BKPM Wholesale

Portfolio

Recognition

Wholesale Banking Performance

Our strong position as a market leader in the Wholesale Banking segment in Indonesia is well established and fueled by dominancy in our top clients ecosystem. We provide a valuable network through our extensive client base that includes key players in various industries/sectors in Indonesia. Wide range of products and solutions offering that can be customized to meet your needs.

Our Portfolio

Our Portfolio comprises of Conglomerates, SOEs and Groups in various sectors

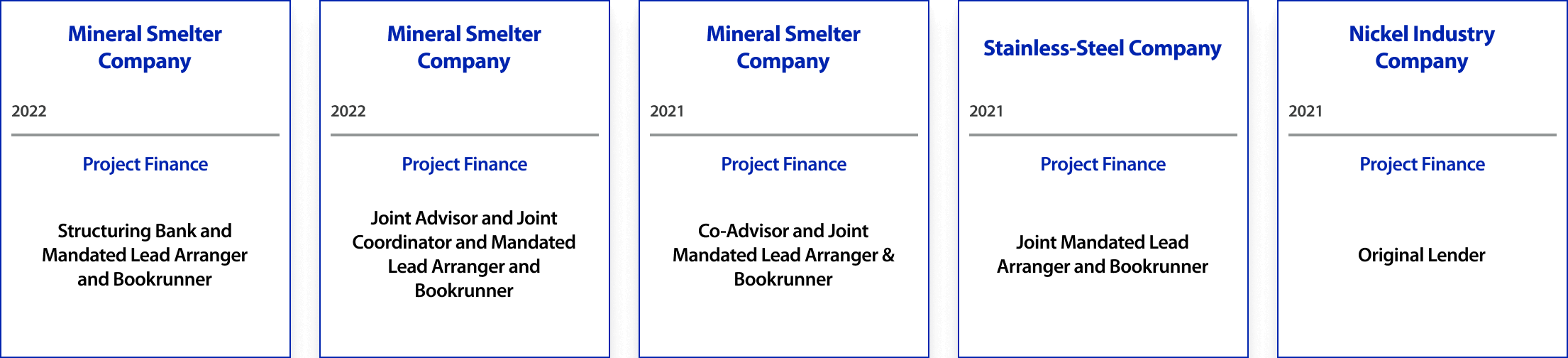

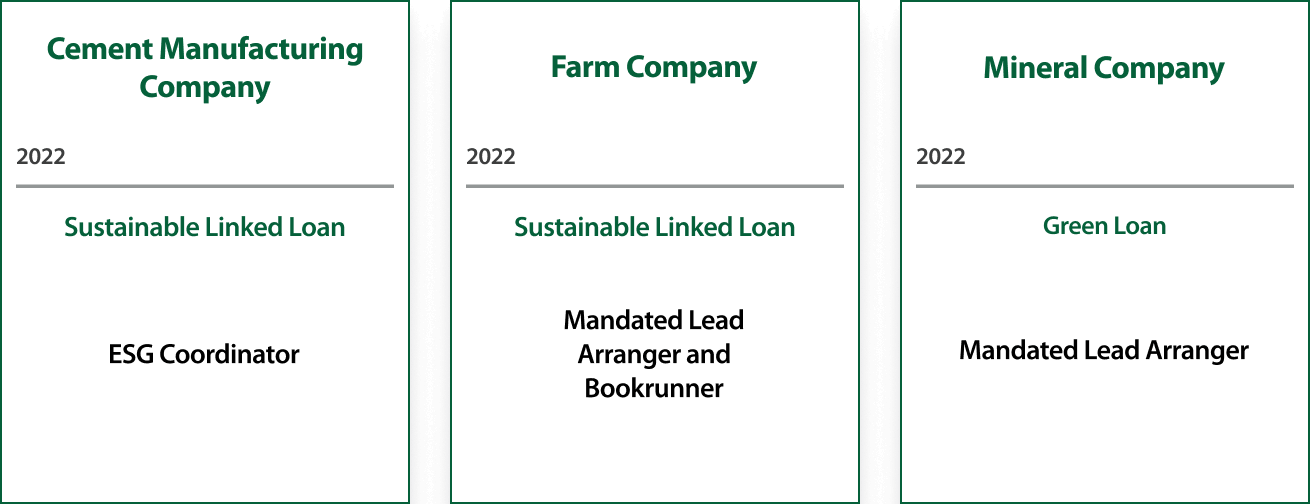

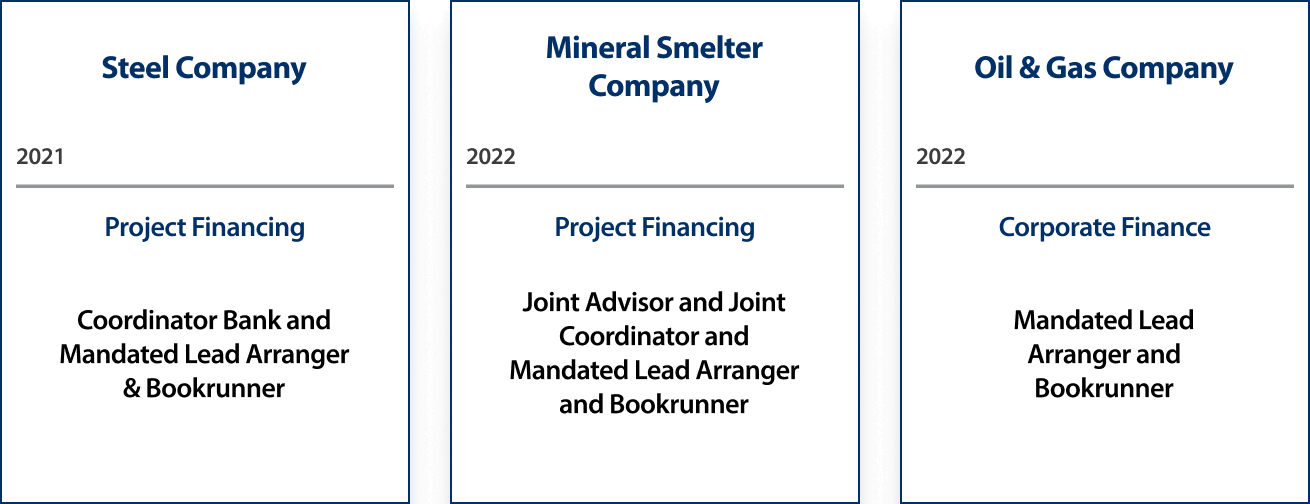

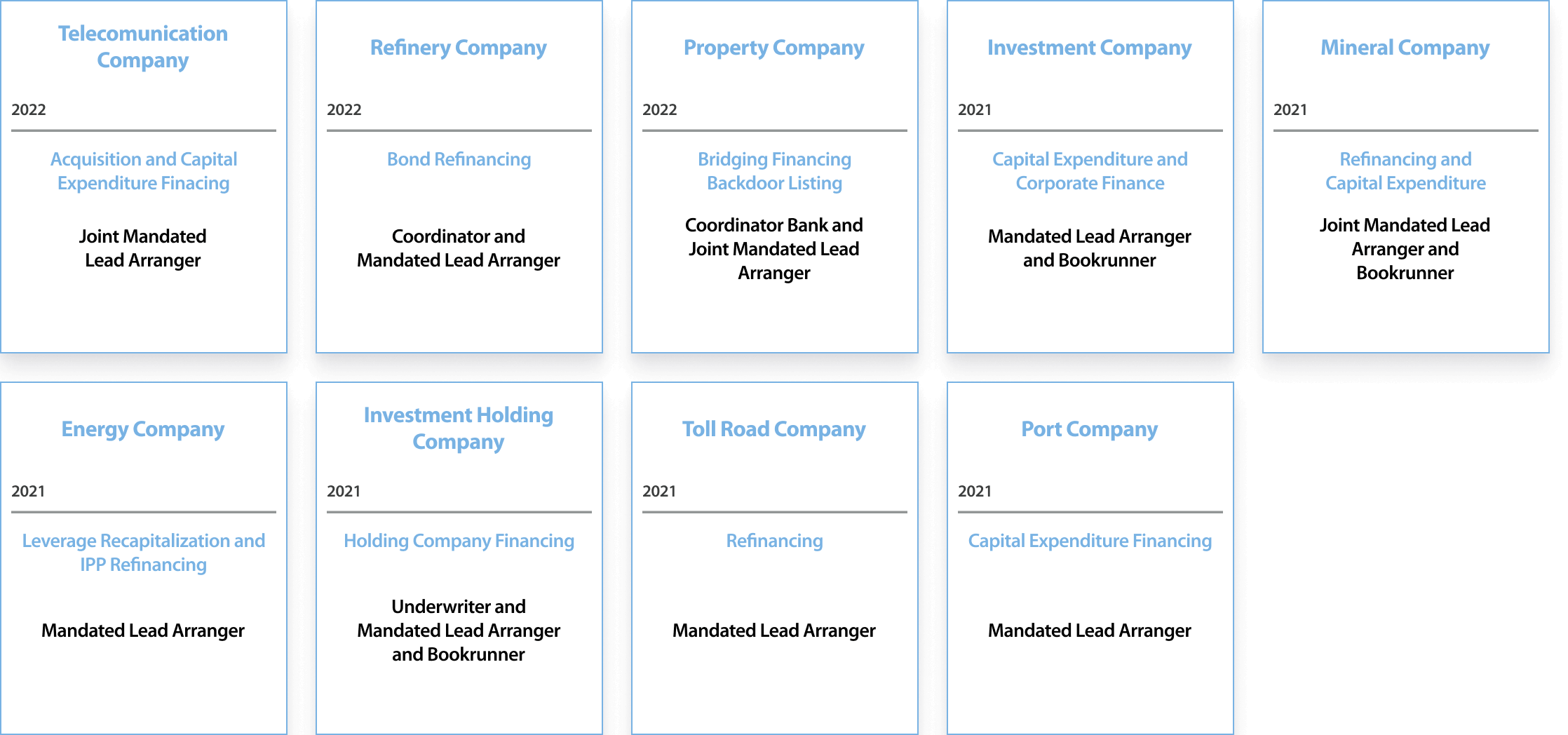

Syndication and Structured Finance Landscape Deals

Bank Mandiri is always ahead in creating innovative financing solution by providing advise and assistance for Project Financing, Structured Loan, Acquisition Financing & other various financing schemes

-

Project Financing

-

ESG Financing

-

Acquisition Financing

-

Cross Border Syndication

-

Other Structured Financing Transaction

Worldwide Recognition

Bank Mandiri continuously improve its capabilities and expertise to tap into bigger market outside Indonesia wherein we successfully gained recognition from various institutions.

-

APLMA

2018 - 2023 Syndicated Loan House of the Year - Indonesia

-

Bloomberg

1st Rank Indonesia Loans Borrower Mandated Lead Arranger (2018-2019, 2021-2024)

1st Rank Indonesia Loans Bookrunner (2018 - 2023)

-

Finance Asia

Best Bank (2024)

Best Sustainable Bank (2024)

Biggest ESG Impacts Bank (2024)

Best Corporate Bank - Large Corp & MNCs (2024)

-

Alpha Southeast Asia

The Best Cash Managemnet Bank in Indonesia (2021-2024)

The Best Digital Bank (2023-2024)

The Best FX Bank for Corporate & FIs (2024)

The Best FX Bank for Retail Clients (2024)

The Best Local Currency Bond Deal of the Year in Indonesia (2024)

Management Solution in Indonesia (2021 - 2023)

-

Global Business Outlook

The Best Trade Finance Bank in Indonesia (2022-2024)

The Most Innovative Trade Financing Solutions Banking in Indonesia (2024)

-

Asian Banking & Finance Wholesale Banking

Indonesia Domestic Trade Finance Bank of the Year (2021-2024)

-

13rd Digital Brand 2024 Infobank Magazine

The Best Securities Underwriter and Broker Dealer Companies with Assets of IDR 5 Trillion and Above (2024)

The 3rd Best Securities Company (2024)

-

FinanceAsia Awards

The Best Investment Bank in Indonesia (2023-2024)

The Best DCM House (Highly Commended) in Indonesia (2023-2024)

The Best ECM House in Indonesia (2023-2024)

-

Alpha Southeast Asia

The Best Equity House in Indonesia (2023-2024)

The Best Investment Bank & Best M&A House in Indonesia (2024)

The Best Retail Broker in Indonesia (2024)

The Best Islamic Finance Sukuk House in Indonesia (2023)

-

Euromoney Securities House Awards

The Best Securities House in Indonesia (2024)

-

Asiamoney Brokers Poll

Best Domestic Brokerage (2010-2023)

Best Brokerage for Research (2018-2023)

Best Brokerage for Sales (2019-2023)

Best Brokerage for Corporate Access (2020-2023)

Best Brokerage for Execution (2020-2023)

Best Brokerage Transformation (2023)

Best Brokerage for ESG Research (2022-2023)

Investment Grade Credit Ratings

We also recognized by reputable credit rating agency wherein Bank Mandiri receives Investment Grade Rating

-

February 2024

Long-Term Counterparty Risk Rating: Baa1;

Long-Term Deposit: Baa2

Long-Term Debt: Baa2;

-

May 2024

International Long Term Rating: BBB;

National Long Term Rating: AAA(idn);

National Short-Term Rating: F1+(idn);

-

February 2024

Long Term General Obligation: idAAA

-

January 2024

Issuer Credit Rating: BBB/STABLE/A-2

-

2024

ESG Rating: BBB