Tabungan Valas

Tabungan Valas Baru

Keuntungan lebih untuk simpanan valuta asing Anda

Bila simpanan dalam valuta asing telah menjadi kebutuhan Anda, pastikan uang Anda tersimpan dalam Rekening yang memberikan keuntungan, kemudahan dan kenyamanan dalam bertransaksi. Mandiri Tabungan Valas adalah pilihan yang dapat diandalkan untuk memenuhi kebutuhan Anda.

Keuntungan

- Penyetoran banknotes pecahan USD 100 dengan kondisi fisik baik, bebas komisi dan kurs jual beli

- Penarikan banknotes hingga USD 30,000 per bulan (kumulatif) bebas biaya komisi dan kurs jual beli

- Kemudahan transfer dalam valuta asing ke berbagai negara di seluruh dunia

- Nilai tukar mata uang yang kompetitif

- Bunga simpanan yang menarik

Kemudahan

- Penarikan dana secara tunai/non tunai dapat dilakukan di seluruh cabang Bank Mandiri di Indonesia

- Penyetoran dapat dilakukan secara tunai/non tunai dalam valuta Rupiah, US Dollar atau mata uang lainnya

- Penarikan dapat dilakukan dalam berbagai pilihan mata uang, yaitu Rupiah, US Dollar atau mata uang lain selama persediaan tersedia

- Kemudahan akses informasi saldo, mutasi rekening dan transfer valuta asing ke rekening Rupiah Bank Mandiri melalui Livin' by Mandiri

Kenyamanan

Tersedia layanan 24 jam untuk transaksi non keuangan, misalnya informasi saldo/ transaksi rekening, suku bunga dan sebagainya melalui Mandiri ATM, Mandiri SMS, Livin' by Mandiri dan Mandiri Call

Syarat dan Ketentuan

- Nasabah Perorangan

- Dapat di buka atas nama 2 orang dalam bentuk rekening gabungan (joint account “OR”)

- Memiliki bukti identitas yang masih berlaku :

- WNI : e-KTP dengan NIK yang terdaftar di Sistem Informasi Administrasi Kependudukan dan NPWP*

- WNA : Passpor dan KITAS/KITAP/Golden Visa yang berlaku

* Khusus nasabah yang wajib memiliki NPWP dan telah memiliki NPWP

- Setoran awal dan saldo minimal

| Jenis Valuta | Setoran Awal | Saldo Minimum |

|---|---|---|

| USD | USD 100 | USD 100 |

| SGD | SGD 200 | SGD 200 |

| JPY | JPY 10.000 | JPY 10.000 |

| EUR | EUR 100 | EUR 100 |

| CHF | CHF 100 | CHF 100 |

| GBP | GBP 100 | GBP 100 |

| AUD | AUD 100 | AUD 100 |

| HKD | HKD 500 | HKD 500 |

- Dikenakan biaya administrasi bulanan

- Dikenakan biaya saldo di bawah minimum

*Syarat dan ketentuan lain berlaku

Informasi produk lebih lanjut:

Frequently Asked Questions (FAQs)

Apakah yang dimaksud dengan Mandiri Tabungan Valas?

Mandiri Tabungan Valas adalah produk simpanan dalam mata uang valuta asing untuk Nasabah Perorangan, dengan syarat pembukaan dan ketentuan yang berlaku di Bank.

Apa saja benefit Mandiri Tabungan Valas?

- Penyetoran dan penarikan dapat dilakukan dalam berbagai pilihan mata uang

- Penyetoran banknotes USD pecahan USD100 dengan kondisi good atau medium ke rekening valuta USD diberlakukan ketentuan 1:1 dan dikenakan biaya komisi dan kurs jual beli

- Penarikan banknotes USD atau mata uang lainnya dapat dilakukan di seluruh cabang, selama persediaan masih ada

- Penarikan banknotes USD sampai dengan USD20.000/bulan (kumulatif) diberlakukan ketentuan 1:1 dan tanpa dikenakan biaya komisi penarikan

- Kemudahan akses informasi saldo, mutasi rekening dan transfer valuta asing ke rekening Rupiah Bank Mandiri melalui Livin' by Mandiri

Apa saja fitur produk Mandiri Tabungan Valas?

- Tersedia dalam 8 pilihan valuta Tabungan Valas :

- US Dollar (USD)

- Singapore Dollar (SGD)

- Japanese Yen (JPY)

- Euro (EUR)

- Swiss Franc (CHF)

- Pounsterling (GBP)

- Australian Dollar (AUD)

- Hongkong Dollar (HKD)

- Diberikan Buku Tabungan sebagai bukti kepemilikan rekening Tabungan Valas.

- Setoran awal dan saldo minimal Tabungan Valas :

Valuta USD SGD JPY EUR CHF GBP AUD HKD Nominal 100 200 10.000 100 100 100 100 500 - Setoran selanjutnya dalam bentuk Banknotes minimal USD 100, SGD 100, JPY 10.000, EUR 100, CHF 100, GBP 100, AUD 100 dan HKD 500. Ketentuan setoran ini tidak berlaku untuk setoran dalam bentuk DU atau pemindahbukuan.

- Fungsi Kartu Mandiri debit pada Mandiri ATM terbatas untuk inquiry saldo Tabungan Valas.

- Kartu Mandiri debit digunakan sebagai sarana verifikasi melalui PINPAD untuk transaksi Tabungan Valas di Cabang.

- Rekening Tabungan Valas dapat di-link ke Livin' by Mandiri

Apakah produk Mandiri Tabungan Valas dapat dihubungkan dengan Kartu Mandiri Debit Existing ?

Mandiri Tabungan Valas dapat dihubungkan ke kartu Mandiri Debit Nasabah, dengan persyaratan sebagai berikut:

- Pemilik rekening merupakan Nasabah Existing yang telah memiliki rekening tabungan atau giro Rupiah sebagai primary account.

- Rekening Mandiri Tabungan Valas sebagai secondary account.

Dimanakah pembukaan Mandiri Tabungan Valas dapat dilakukan?

Pembukaan rekening Mandiri Tabungan Valas dapat dilakukan di seluruh Cabang Bank Mandiri, dengan catatan hanya untuk transaksi yang menggunakan Devisa Umum (non Banknotes). Khusus transaksi yang menggunakan Bank Notes hanya dapat dilakukan di Cabang Bank Mandiri yang juga menyediakan layanan Money Changer.

Bagaimana ketentuan transaksi menggunakan rekening Mandiri Tabungan Valas ?

- Untuk akses layanan melalui ATM saat ini Mandiri Tabungan Valas hanya dapat melakukan pengecekan saldo dan mutasi transaksi

- Mandiri Tabungan Valas saat ini belum dapat digunakan untuk berbelanja di merchant

- Khusus di Livin' by Mandiri, Nasabah dapat dengan mudah mengakses informasi saldo, pengecekan mutasi rekening serta dapat melakukan transfer ke rekening Rupiah Bank Mandiri dari Mandiri Tabungan Valas yang dimiliki.

- Fitur transfer inhouse valuta asing saat ini hanya dapat dilakukan melalui Livin' by Mandiri saja dengan token sebagai otentikasi transaksi (belum dapat dilakukan pada Livin' by Mandiri).

Apa saja fitur transaksi rekening Mandiri Tabungan Valas di Livin' by Mandiri?

Fitur Tabungan Valas di Livin' by Mandiri adalah sebagai berikut :

- Informasi saldo

- Mutasi rekening

- Transfer inhouse dari 8 valuta asing ke rekening Rupiah Bank Mandiri melalui Livin' by Mandiri

Bagaimana ketentuan transfer inhouse valuta asing di Livin' by Mandiri?

Ketentuan transfer valuta asing via Livin' by Mandiri:

- Fitur transfer inhouse valuta asing saat ini hanya dapat dilakukan melalui Livin' by Mandiri saja dengan token sebagai otentikasi transaksi (belum dapat dilakukan pada Livin' by Mandiri).

- Transfer inhouse hanya dapat dilakukan dari rekening valuta asing Bank Mandiri (sebagai rekening sumber) ke rekening Rupiah Bank Mandiri (sebagai rekening tujuan).

- Limit transaksi transfer antar rekening valuta asing - Rupiah maksimal ekuivalen Rp 100 Juta per hari (di luar limit transaksi antar rekening Rupiah).

- Fitur transfer inhouse valuta asing ke Rupiah di Livin' by Mandiri hanya dapat diakses pada hari kerja atau selama rate tersedia.

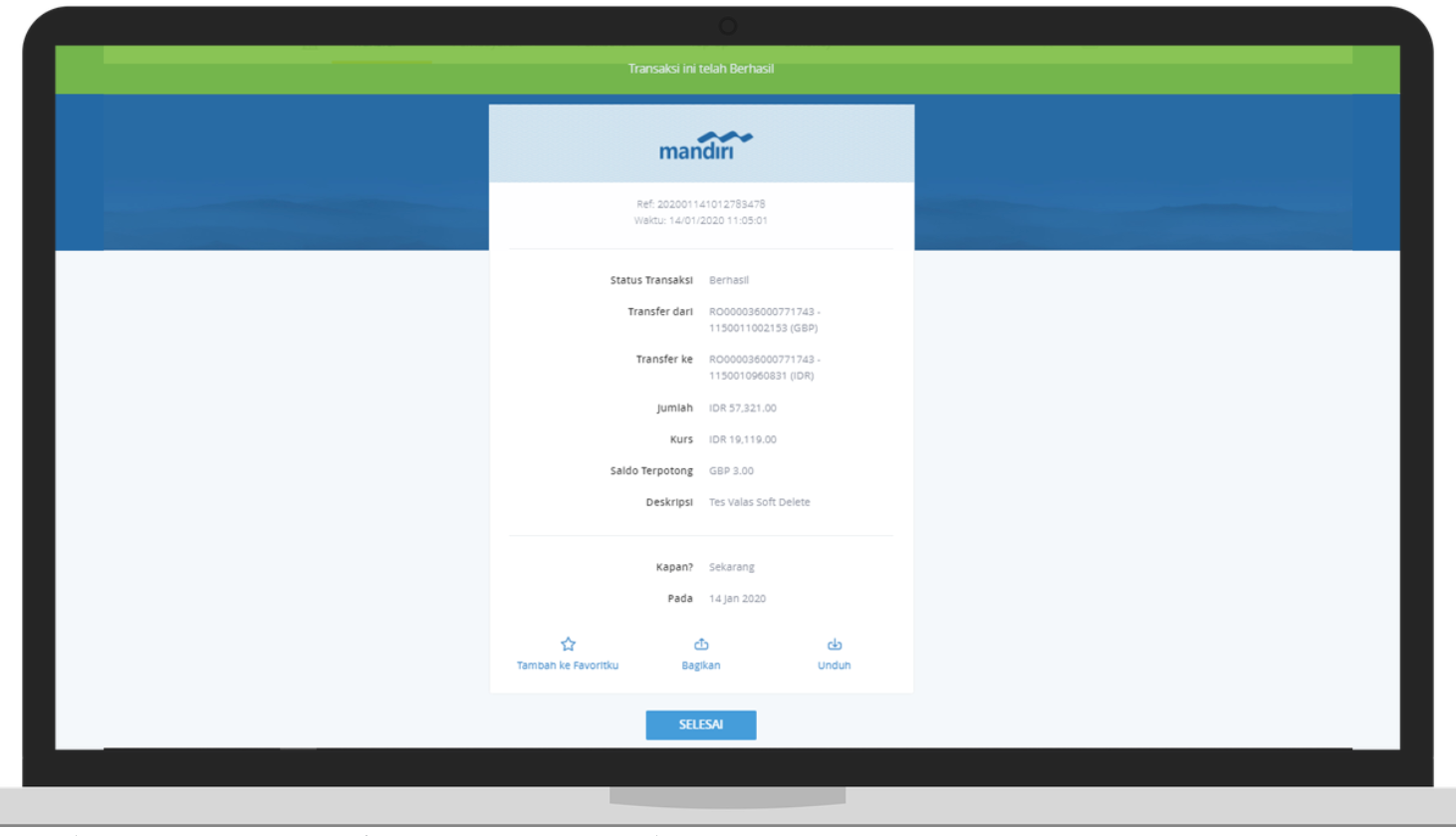

Bagaimana cara melakukan transfer Inhouse rekening Valuta Asing (Valuta Asing ke IDR)?

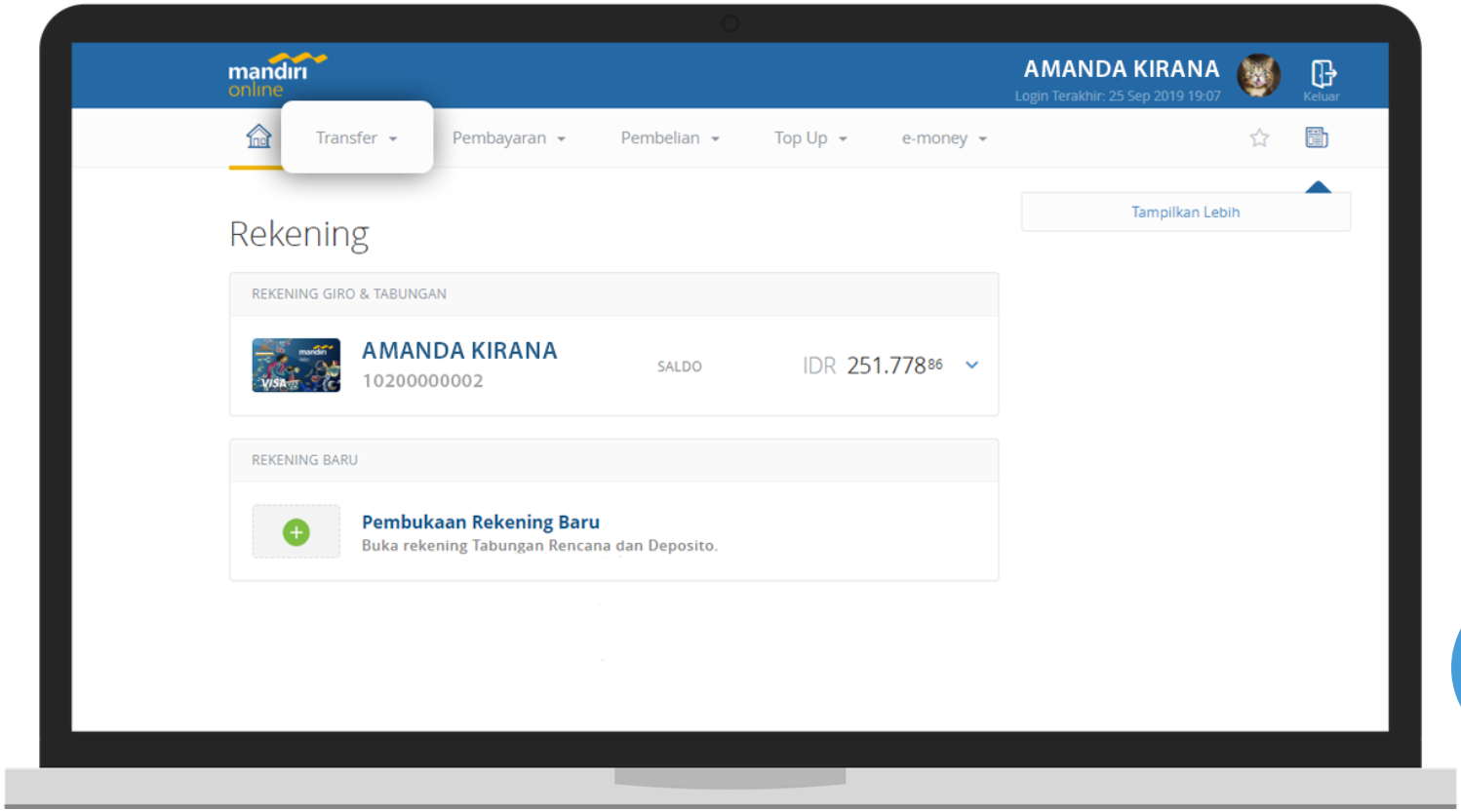

- Pilih menu “Transfer” di halaman dashboard Livin' by Mandiri

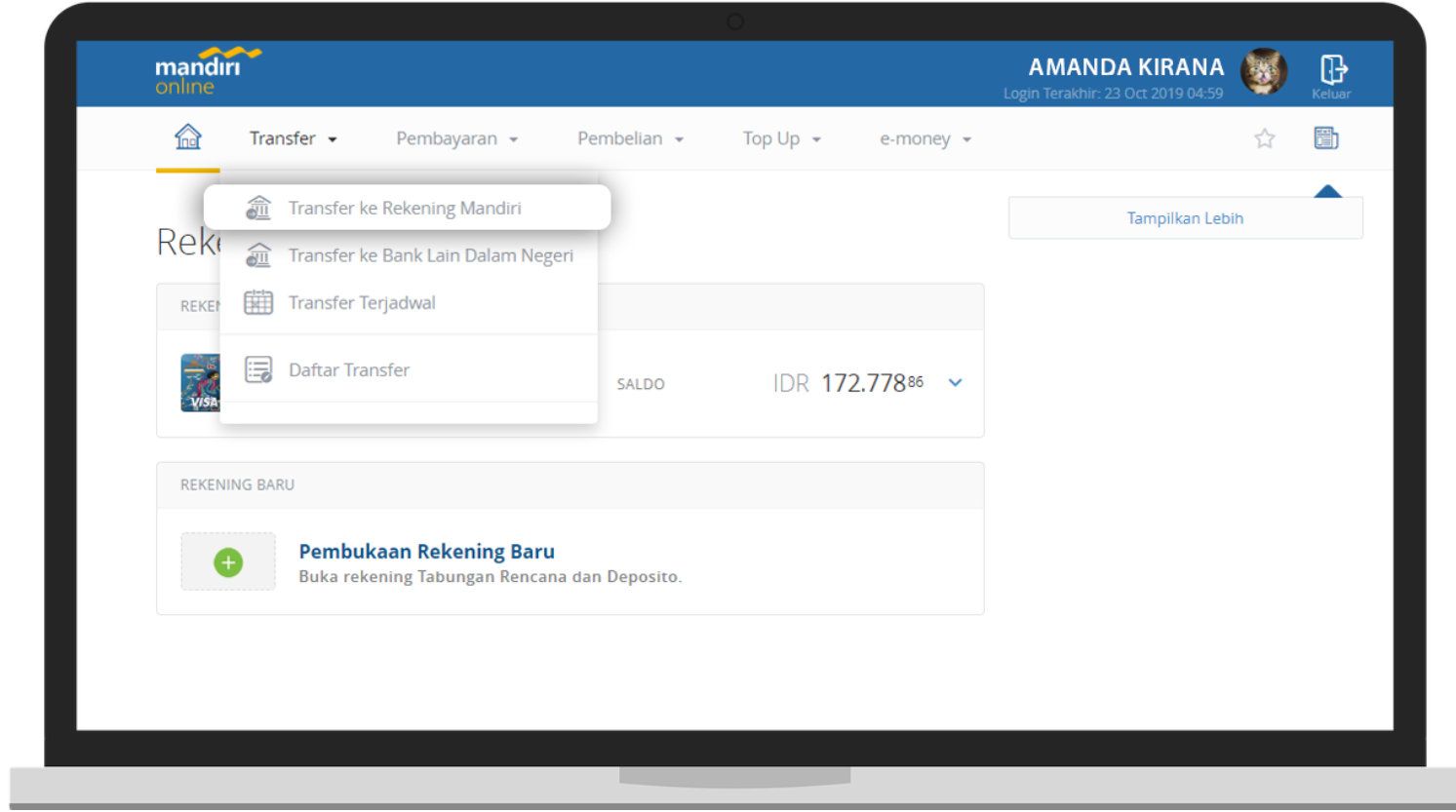

- Pilih “Transfer Ke Rekening Mandiri” pada menu Transfer

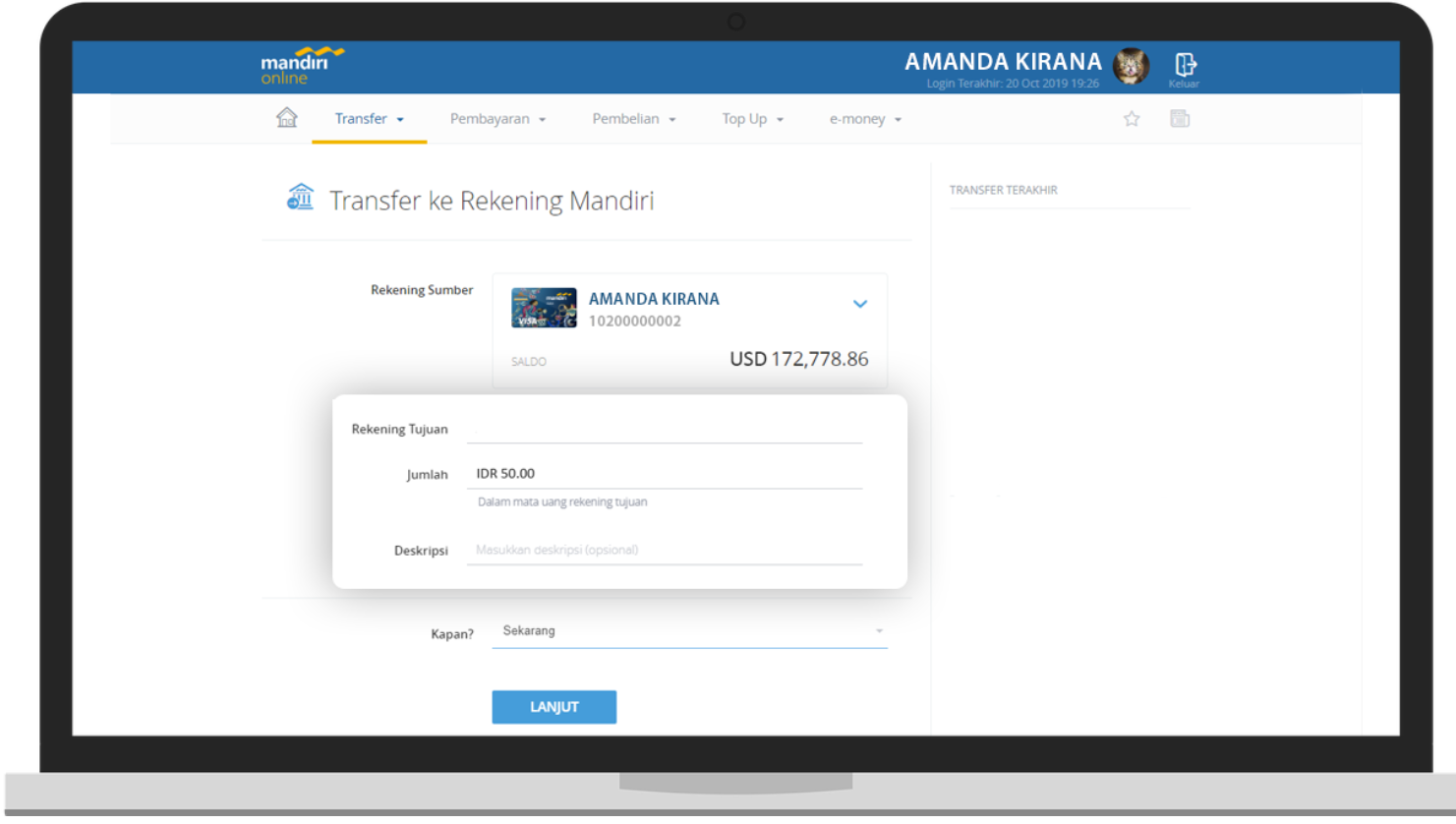

- Masukkan Informasi Transfer untuk transfer valuta asing ke Rekening Mandiri dan klik tombol “Lanjut”.

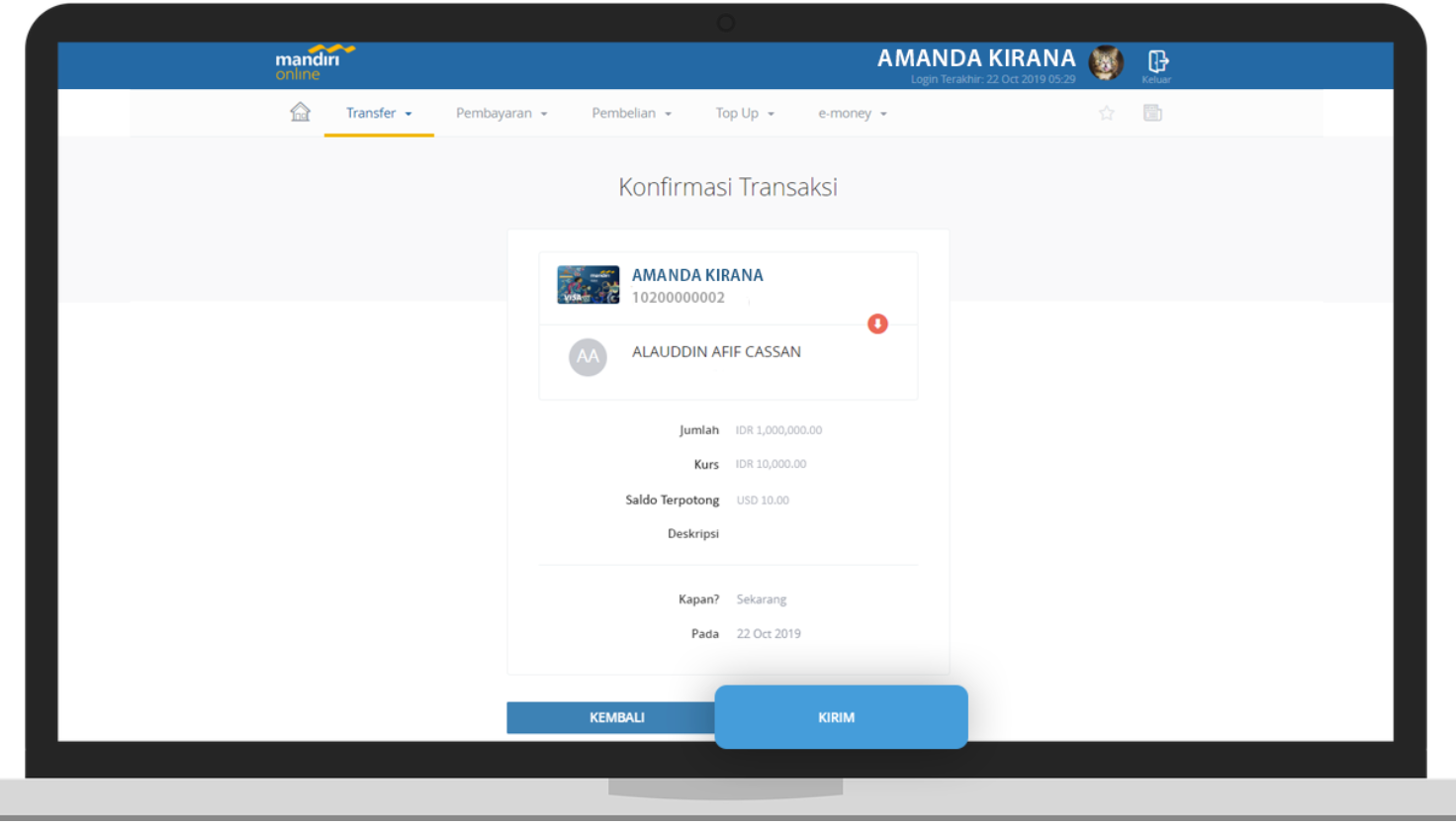

- Setelah input selesai dilakukan, untuk melanjutkan transaksi Transfer selanjutnya klik tombol “Kirim”.

- Tahap selanjutnya adalah melakukan otentikasi menggunakan token.

- Masukkan kode challenge yang didapat dari SMS ke dalam token. Kemudian masukkan kode respon yang diterima di token ke layar.

- Setelah proses otentikasi selesai dilakukan, nasabah dapat melihat halaman resi atas transaksi valuta asing yang telah berhasil dilakukan. Pilih “Selesai” untuk kembali ke halaman utama.

Bagaimana nasabah dapat memperoleh informasi mengenai Mandiri Tabungan Valas?

Nasabah dapat menghubungi :

- Mandiri Call 14000

- Cabang Bank Mandiri terdekat

| Saldo Nasabah | Suku Bunga per tahun sesuai saldo | Nominal Suku Bunga Bulanan |

|---|---|---|

| Rp 10.000.000,- | 0% | Rp 0,- |

Keterangan

- Bunga tabungan dikreditkan setiap akhir bulan ke rekening yang bersangkutan

- Dalam hal terdapat perubahan suku bunga, maka akan berpengaruh pada nominal bunga yang diterima nasabah

| Informasi Risiko Terkait Produk |

|---|

|