Market Linked Deposit

Product - PS - Linked Deposit

Mandiri Market Linked Deposit

Mandiri Market Linked Deposit

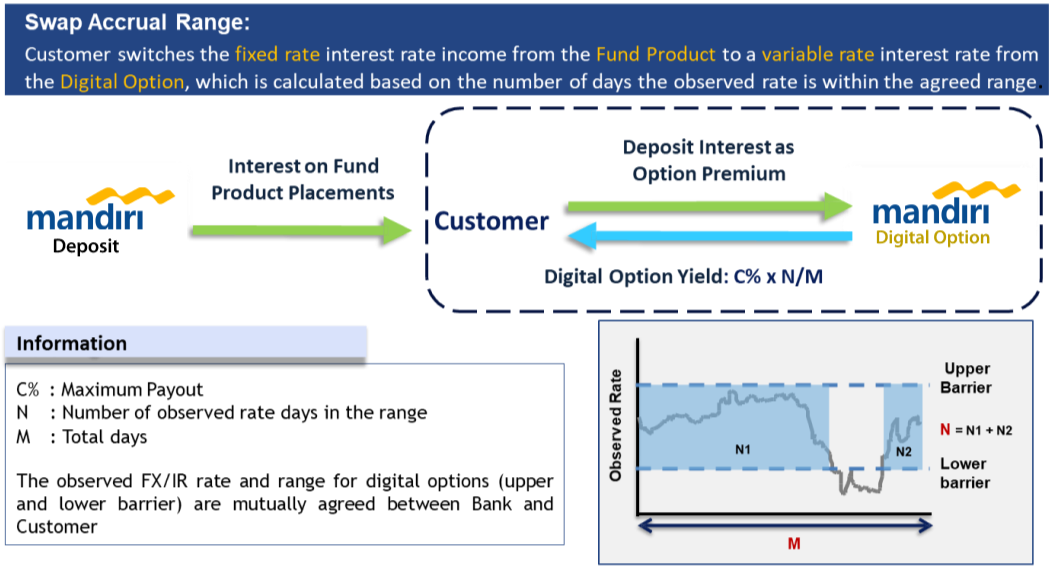

Mandiri Market Linked Deposit (MMMLD) is a combination product between deposit fund products and derivative instruments with the objective to enhance the yield. This product is not secured by the Indonesian Deposit Insurance Corporation (LPS) because it is not a pure savings product and contains elements of derivative instruments.

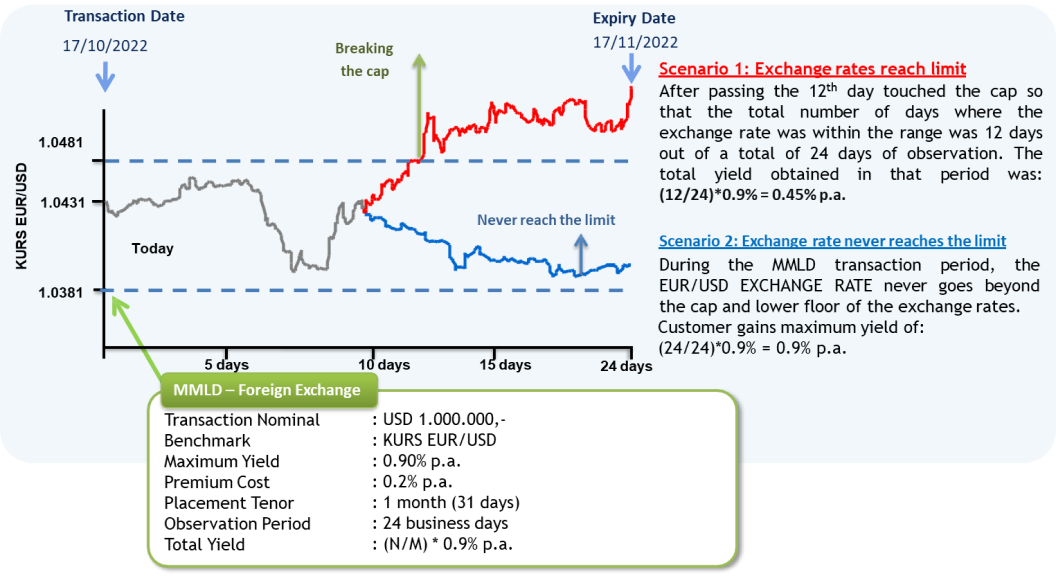

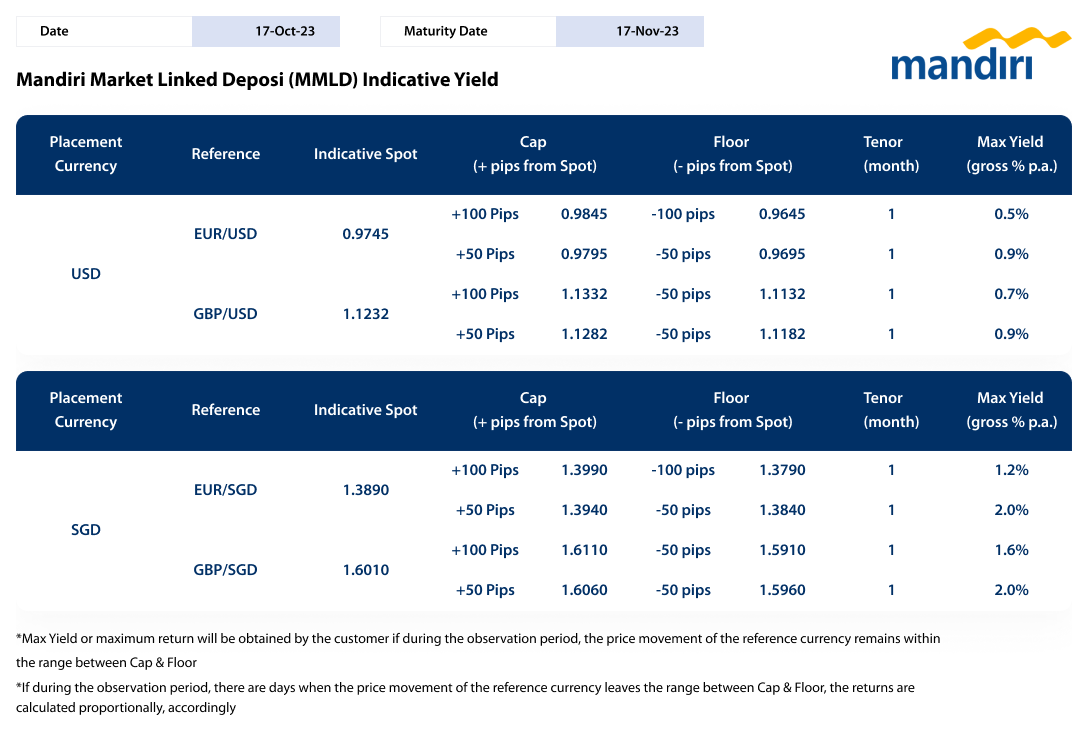

Mandiri Market Linked Deposit (MMLD) is an investment product consisting of a Structured Product, a combination of Deposit and Digital Option products offered to customers in IDR, USD, EUR, JPY or other currencies to the extent allowed by the Bank and in accordance with regulatory provisions, where The customer will receive a return which amount will depend on the number of business days in which the movement of the reference interest rate or the agreed exchange rate level is within 1 upper limit and 1 lower limit as agreed by the Bank and the Customer. As for MMLD in IDR currency, you may only use the digital option features with reference to interest rates. For MMLD based on an exchange rate reference, you nay only use the digital option features with a currency pair reference that does not involve IDR.

- PRINCIPAL PROTECTED PRODUCT

Invested fund is securly protected, co there is no potential decrease nor lost losses. - POTENTIAL FIXED AND HIGHER YIELDS

Potential yields are higher than conventional foreign exchange savings products. Yields obtained depend on the number of days wiuthin the cap and bottom as determined by the reference exchange rate chosen by the customer. - TRANSACTION TENOR

Tenors are 1, 3, 6 and 12 months, 24 months, or according to the deposit period. May not be redeemed before due. - Currency Choice

Investment funds is in Non-IDR currencies such as USD, SGD. - FESS AND TAXES

- Duty Stamp charge for Bills and Agreements

- Tax will be calculated based on the difference between the final investment yield (in Initial Currency) and the initial placement amount (in Initial Currency).

- Mandiri Market Linked Deposit Agreement (effective for 2 years)

- Structured Product Customer Questionnaire Form (valid 2 years)

- Product Highlight (each transaction), contains detailed information regarding product features

- Term Sheet (each transaction), contains detailed customer MMLD transaction information