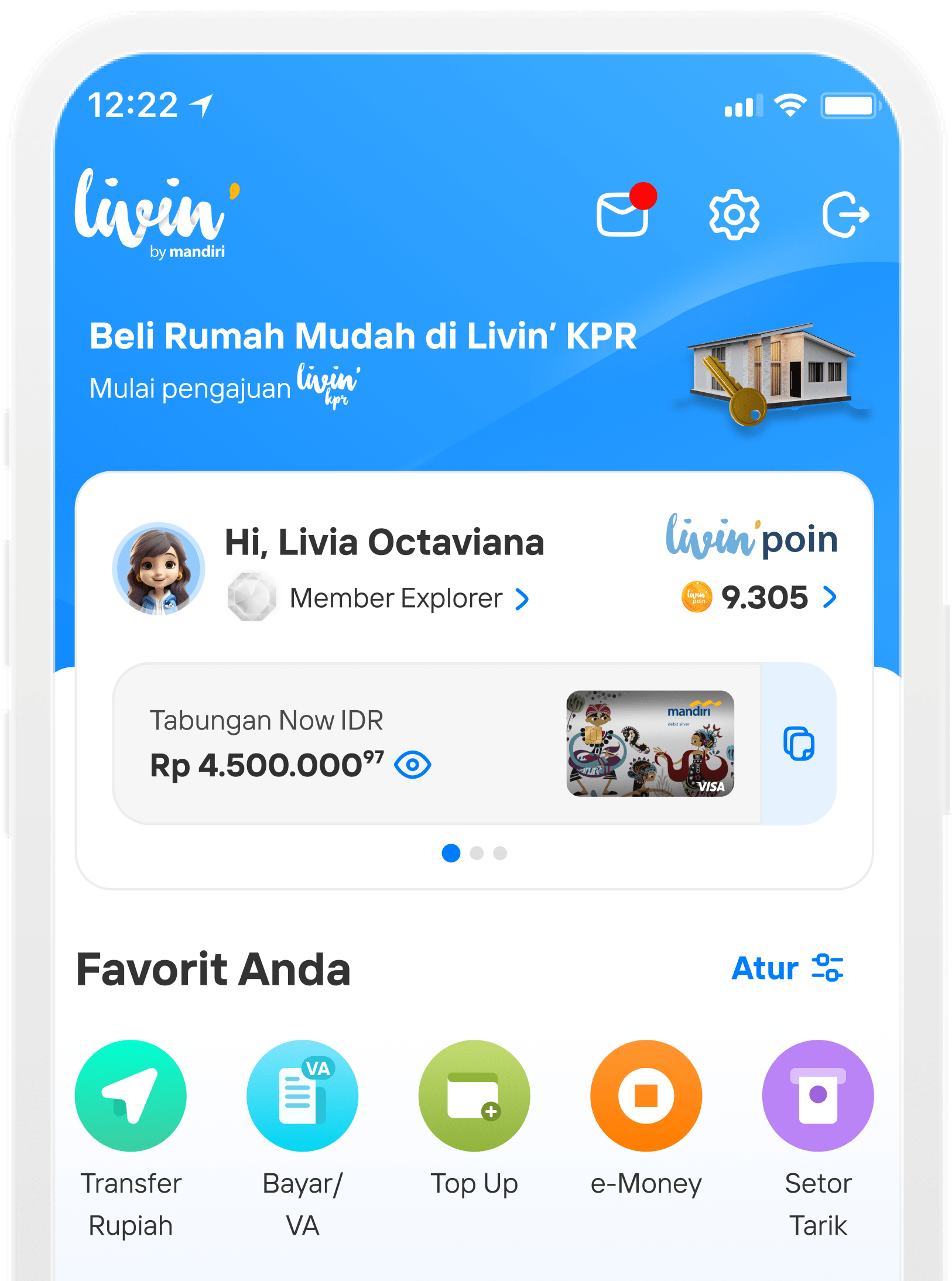

Livin' KPR

KPR 2024

1-Day Max. Approval

Competitive Interest Rates

Tenor up to 25 Years

Top Developers

KPR Simulation and Appointment

Learn MoreSubmission KPR

Learn MoreLivin' KPR

Cara Mudah Daftar Livin' Merchant

Tambah Produk

Cara menerima pesanan via Kasir

Mulai Belanja Online

Pengaturan Akun

Menerima Pesanan Online

FAQ KPR

Frequently Asked Questions (FAQs)

Livin' KPR is one of the features in Livin' by Mandiri application, offering a comprehensive features related to property purchasing using mortgage financing. From immersive property showcases to dynamic KPR simulations, convenient appointments for a developer visit, and seamless application submission with mortgage application tracking.

- House

- Apartement

Livin' KPR from Bank Mandiri offers several attractive benefits for it’s customers, including:

- Special Interest Rates and Exclusive Promotions

- Fast Application Process and Short Form*

- Hundreds of Property Listings to choose from

- Flexible Tenure Options of up to 25 years.

- Easy Monitoring of Application Progress directly through Livin’.

*) The application process is available to selected customers based on criteria set by Bank Mandiri.

Here are the details of the features available in Livin’ KPR:

- Property Showcases

Customers can obtain comprehensive information about the properties they intend to purchase. They can also contact Bank Mandiri representatives via WhatsApp for assistance property visits/surveys before purchase and for consultations regarding the Livin' KPR process. - Wishlist Property

Customers can save their favorite property listings in a “wishlist” within Livin' KPR, making it easier to access them again in the future. - Property Explore

This feature allows customers search properties more quickly and easily by entering keywords such as the name of the housing complex, developer, location, and unit type. It also includes “sorting” and “filtering” options to help customers find the best home according to their specifications. - Property Recommendation Customers will receive property recommendations based on their location and previous property searches.

- KPR Simulation

This feature helps customers calculate installment simulations and financing limits based on property prices or their income. 6. Discussion with Mandiri Team Have questions about properties? Contact Bank Mandiri team with just tap a button. Customers can also request an appointment to be accompanied to developer. - KPR Applicaton

Customers can apply for Livin’ KPR online easily and quickly, divided into two stages:- a. Screening Form

- b. KPR Application Form

- Track Application Status*

Customers can monitor KPR application status directly in Livin' by Mandiri. This feature makes the Livin' KPR application process more transparent for both customers and developers, without manually inquire with bank representatives.

*) Customers eligible to apply for KPR through the New Livin' by Mandiri app are selected based on criteria set by Bank Mandiri.

Customers who are eligible to apply for KPR through the Livin’ by Mandiri app are those selected based on criteria set by Bank Mandiri.

Customers can access Livin’ KPR in the New Livin’ by Mandiri app through:

- KPR Menu

- KPR Widget

- Livin' Promo Page

Applying for KPR through the New Livin’ by Mandiri app offers special pricing benefits as detailed below:

- Special Interest Rates :

Suku Bunga

Mininum Tenure

2.70% fixed 3 Years*

15 Years

3.95% fixed 3 Years

12 Years

5.90% fixed 5 Years

13 Years

8.35% fixed 5 Years

10 Years

8.99% fixed 10 Years

10 Years

11.50% fixed 2 Years

2 Years

14.25% fixed 1 Years

1 Years

- 50% discount on provision fee

- 3. Free adminstrative fees

*Provision fee is 1.25% and administrative fee is 0.1%, calculated based on the credit limit.

- These interest rates are valid until September 30, 2024.

Currently, KPR applications through the Livin’ by Mandiri app are specifically for purchasing new properties from developers partnered with Bank Mandiri.

For applications related to the program, For more information, please visit bmri.id/mandirikpr

The maximum credit limit for a KPR application through Livin’ KPR is IDR 10 billion.

- Up to 25 Years for purchasing a landed residential property.

- Up to 15 Years for purchasing an apartment.

The maximum tenure is also subject to the maximum retirement age limit (55 years), whichever is shorter.

KPR applications through the New Livin’ by Mandiri app cannot currently be processed using joint income.

When applying for KPR through the New Livin’ by Mandiri app, you need to prepare the following documents:

|

No |

Dokumen |

Payroll |

Non Payroll |

|

1 |

Spouse's ID Card (if married) |

V |

V |

|

2 |

SPR |

V |

V |

|

3 |

Recent 2 months' payslips or bank statements |

- |

V |

|

4 |

ID Card, Employee Decree, or HRD Employment Certificate |

V |

V |

Additional documents to be submitted after credit approval include:

- Copy of the applicant’s ID Card

- Copy of NPWP (Tax Identification Number)

- Copy of KK (Family Card)

- Copy of Marriage/Divorce Certificate (for those who are married or divorced)

- Any Additional documents required for the KPR application (if applicable).

Customers will receive a notification when their KPR application has been successfully submitted. Customers can track the status of their KPR application via Inbox in the Livin’ by Mandiri app for updates. Or use the Status Menu on the Livin’ KPR page to monitor the application progress.

Once you receive KPR approval, which can be accessed through Livin’ by Mandiri, a bank representative will contact you. The KPR process will then proceed through offline meeting methods in the Consumer Loan Area.

The KPR application will be processed at the Bank Mandiri Consumer Loan Area based on the customer's preference indicated in the "Processing Branch" field when filling out the KPR application form.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang