Tabungan Now

Tabungan NOW

Mandiri Tabungan NOW, Anyone Can Open Savings Account, Anyone can do financial Transactions Anytime and Anywhere.

Mandiri Tabungan NOW offers ease and convenience starting from opening a #GaPakeRibet savings account to online or offline transactions using various features and channels from Bank Mandiri.

Easy step from the start

Mandiri Tabungan NOW is reachable just by accessing it on your smartphone, because Mandiri Tabungan NOW is easy from the start.

Just access Livin' by Mandiri or join.bankmandiri.co.id

Just access Livin' by Mandiri or join.bankmandiri.co.id via smartphone, you can open a Mandiri Tabungan NOW account without visiting a branch.

Without Worrying About the Costs.

Without Worrying About the Costs, enjoy low fee admin for Tabungan NOW.

More benefits with Livin'poin

Any transactions using Mandiri Tabungan NOW generates benefits of Livin'poin, you can get and for vouchers or even discounts.

Get Livin'poin as Loyalty Reward.

Each time you do transaction using Mandiri Tabungan NOW, you will get Livin'poin as a loyalty reward.

Direct Reward Redemption Option

You can use Livin'poin as many as possible and redeem it for various attractive prizes such as shopping voucher, gadget, and discounts or event free products from shops under collaboration with Bank Mandiri.

Convenience in Transactions

Opening an account, deposit cash and withdraw savings funds in all Bank Mandiri’s channels which are widely spread with the best services.

Withdrawing Cash at All Mandiri ATM.

Withdrawing cash at all Mandiri ATM and ATM networks with the LINK, ATM Bersama, PLUS, VISA and VISA Electron logos throughout the world.

Available Facilities at Bank Mandiri.

Mandiri SMS, Livin' by Mandiri and Mandiri Call facilities complete your convenience in doing transactions anywhere and anytime so you can be more efficient doing it during your free time.

Terms and Conditions

Interested in opening a Mandiri Tabungan NOW account? You only need to complete the following terms and conditions.

Requirements for opening Mandiri Tabungan NOW account

- Initial deposit amount is IDR100,000.00

- e-KTP (Id Card) with NIK (Id Card Number) which is registered with Population Administrative Information System.

- Tax Id Number.*

- Signature on a blank white paper.

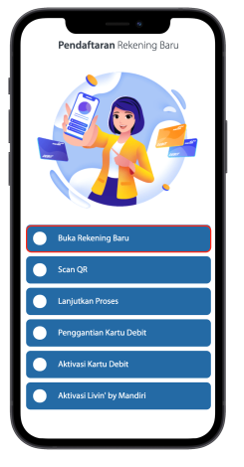

- This saving account mMay only be opened via Livin' by Mandiri or join.bankmandiri.co.id or scan the following QR code.

Livin by Mandiri join.bankmandiri.co.id

* NPWP (Tax Id Number.) is applied as mandatory for all taxpayers in accordance with the applicable taxation laws in Indonesia.

Frequently Asked Questions (FAQs)

What is the online opening saving accounts of

Tabungan Mandiri?

Prospective new customers can open a savings account by clicking the unique link,

scanning the QR or accessing the https://join.bankmandiri.co.id page

using the mobile browser on cellphone/smartphone.

Is the page can only be accessed using a mobile

browser?

Yes, page https://join.bankmandiri.co.id can

only be accessed using a mobile browser (cellphone), cannot be accessed via a

browser on a computer or laptop device.

Is there any criteria of the browser to be

used?

For devices with the iOS operating system (iPhone), the browser used is Safari and

is optimal at version 12 or up.

For Android operating system devices, the browser used is Google Chrome and

optimally runs using version 88 or up.

Who can open a savings account via

online?

Every Indonesian Citizen (WNI) holding Residential Identity Card (KTP) and is

registered in the Population Data of the Indonesian Ministry of Home Affairs

(Dukcapil).

Can prospective customers open a Tabungan

Mandiri account if they have ever / already have had Tabungan Mandiri or other

products from Bank Mandiri before?

Yes, opening a savings account online can be used for prospective new customers or

those who have become Bank Mandiri customers.

Bank Mandiri customers who already have active products at Bank Mandiri and intend

to open an online account must verify their savings and Debit Card PIN and Credit

Card PIN first.

What if the customer doesn't know or forgets or

hasn't created the previous debit card PIN/credit card PIN when opening an

account?

If the customer does not know or has forgotten or has not created the previous debit

card PIN/credit card PIN, thus opening an account online cannot be continued.

What if the customer doesn't have a debit card

in his savings account?

If the customer does not have a debit card for his/her previous savings account, the

online account opening cannot be continued, accordingly.

What documents are required to open a Mandiri

Savings account online?

Customers must prepare documents consisting of:

- Original Residential Id Card (KTP)

- Original Tax Id Number Card (NPWP)*

- Signature on a blank white paper.

*) NPWP (Tax Id Number is mandatory for all taxpayers in accordance with the applicable taxation laws in Indonesia.

When is the online account opening service

hours?

Prospective customers can open an account 7 days in a week and the video call

verification process with Bank Mandiri’s Customer Service may only be done every day

at 08.00 WIB (Western Indonesia Time Zone) – 20.00 WIB.

Is there any other requirement required besides the account opening documents?

- Own's active mobile/cell phone number to receive OTP SMS. This cellphone number will be registered as the SMS banking number for the account.

- Personal active email address to receive OTP emails. This email address will be registered to received e-mail statement for the account.

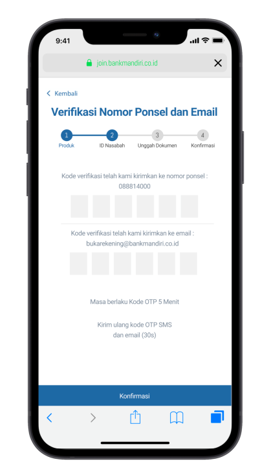

What if the customer only gets 1 OTP on the OTP

SMS and eMail page?

Prospective customers can wait for approximately 5 minutes for the OTP code) or can

resend the code after 1 minute. The recent code will be received again by Customer

by OTP SMS and email, the customer must change both OTP when one of them has been

input.

*) Email OTP code is different from the SMS OTP code.

What if a prospective customer does not receive

any OTP or the OTP received has been expired?

Prospective customers may select the 'resend OTP code' option to get a new OTP code

after 1 minute from the previous OTP request and fill in the latest OTP code again

in the OTP SMS and email columns correctly.

What if a prospective customer gets an error

message limit/account opening limit?

Prospective customers may try opening an account at maximum of 3 times per day,

after that the prospective customers may re open an account in the next following

day.

What if the prospective customer get an OTP

limit error message?

Prospective customers may try resending the OTP code maximum of 3 times a day, after

which the prospective customers may input the OTP in the following day.

Do customers get a savings book by opening a

savings account online?

Mandiri Savings Rupiah account online does not provide any savings book and

customers will receive electronic account’s statement which will be sent to the

verified email address on a monthly basis. Please ensure that the email address used

in account opening is a personal one, so that you can receive e-statement transfers

history.

How do customers fill in data for opening an

account?

Customers fill in the account opening data, employment data, beneficial owner data

if available according to the existing columns with the correct and appropriate

data. If the data entered is not correct, then the account opening process cannot be

continued.

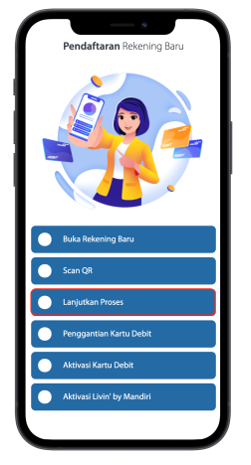

What if customers deal with problems during the

data completion process on the https://join.bankmandiri.co.id

page?

Customers may open the page https://join.bankmandiri.co.id again

then select the 'Continue Process' menu to continue with the last session stored in

the Bank Mandiri system. Please ensure to validate the personal data to continue the

account opening process. Account opening session will be stored for 7 days since the

start of the account opening process, if it’s accessed more than the specified time,

the customer must repeat the process from the beginning.

How do customers submit the account opening

documents?

The original documents of ID Card (KTP), original Tax Id Number (NPWP), personal

photo with the original Id Card (KTP) and signature on the blank white paper are

carried out by taking photos directly by using the customer's cellphone/mobile

camera which will be submitted by the customer when completing account opening data

on the https://join.bankmandiri.co.id.

Please make sure that the photo is taken properly and clearly visible.

How to take photos of documents properly?

- Photo of the original Id Card (KTP)/Tax Id. Number (NPWP) document taken close-up.

- Selfie photos with original the Id Card (KTP) must be clear, with condition where the original Id Card (KTP) does not cover up the customer's face.

- A close-up photo of the signature on blank white paper.

How does the data verification process for

opening an online savings account work?

In the online account opening process, customers will conduct a video call with Bank

Mandiri Customer Service (CS). At this stage, CS will verify the customer data that

has been input by the customer. For smooth and clear video calls, please make sure

your cellphone is within 3G/4G network coverage or connected to Wi-Fi with a good

connection.

Can the account opening be made by a customers’

representative?

The account opening may not be represented by other person, and must be conducted by

the customer himself complying with Id Card (KTP) used account opening, and must

have his/her own active cellphone number and his/her own active email.

How to make a video call?

On the video call verification page, customers can select 'contact now' to

immediately make a video call with Video Call CS. However, if the customer cannot

make a video call the certain time the customer can choose 'contact later'. If the

customer chooses 'contact later', the customer can try making a video call again by

opening the https://join.bankmandiri.co.id page

page, then selecting the 'Continue Account Opening' menu to continue with the last

session stored in the Bank Mandiri system. Please ensure to validate personal data

to continue the account opening process. The account opening session will be stored

for 7 days from the start of the account opening process, if it’s accessed more than

the specified time, the customer must repeat the process from the beginning.

Important: Important: Bank Mandiri never makes video calls to customers automatically, customers must carry out the video call process using the method mentioned above. Bank Mandiri does not make video calls using other applications such as Whatsapp / Zoom / Telegram /other communication applications.

When can customers make video

calls?

A video call process can be carried out by the prospective customers in the same

session of filling in their personal data, at 08.00 WIB – 20.00 WIB (maximum 7 days

from the start of the account opening process).

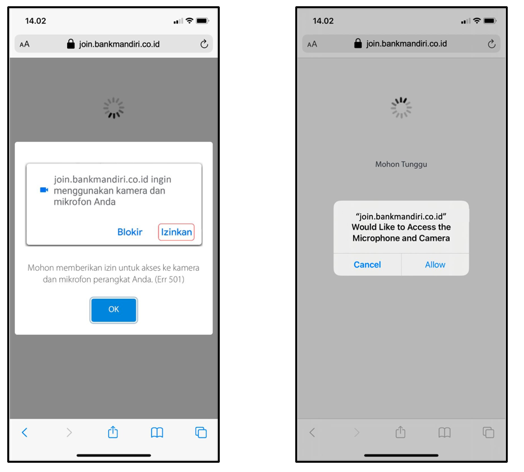

What to do if the video call doesn't

connect?

Please make sure you have an internet network, the preferred browser used is Google

Chrome (Android) or Safari (iPhone) and ensure you allow access to the application

to use the cellphone camera and microphone.

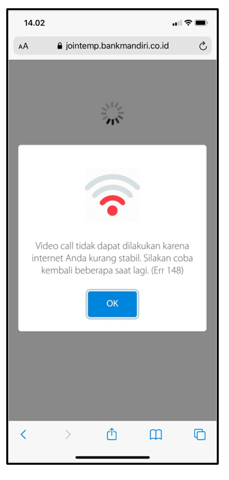

What to do if you have an unstable internet

error when making a video call?

This network quality does not meet the minimum standards for making video calls.

Please try restarting your cellphone to refresh the network / move to other location

to get a better connection.

Is the customer's online account automatically

active?

The account will automatically be active after the customer carries out the

verification process with CS video banking staff, signs electronically (Privy ID),

and creates an SMS banking PIN until the account number appears on the customer's

screen (and the email confirmation of successful account opening).

What is SMS Banking PIN

(MPIN)?

"MPIN" or SMS Banking PIN is a 6 digit numbers created by Customer after the account

opening process. This SMS Banking PIN (MPIN) is required as an authorization when

the Customer do transactions in the Livin' by Mandiri/SMS Banking application. SMS

Banking PIN (MPIN) shall not be given to the other people including to Bank’s

officers.

What is a digital

signature?

Electronic Signature is a signature consisting of Electronic Information which is

embedded, associated or associated with other Electronic Information used as a tool

of verification and authentication.

What is PrivyID?

PT Bank Mandiri collaborates with PT Privy Identitas Digital (PrivyID) as the

provider of electronic signature services and certification, which is having

received recognition from the Ministry of Communication and Information Technology

of the Republic of Indonesia pursuant to the laws and regulations.

HHow does the customer know the account number

opened?

After completion of the account opening process, the customer may view the account

and debit card number. Information on the account and debit card number (if the

product is provided with a debit card feature and the card is sent to the customer's

address) will also be sent to the customer's verified email address.

How do customers make a deposit for Online

Account Opening?

Customers can make deposits by transfer to the online accounts (from Bank Mandiri

accounts or from Other Banks), by Cash Deposit Machine, Cash Recycle Machine and by

tellers at the nearest Bank Mandiri branch.

When can customers make deposits in online

accounts?

CCustomers can make deposits to online accounts directly after the account opening

process is successful. If the customer does not make any cash deposit within a

certain period in accordance with the selected savings product, the account will be

closed automatically.

Does the online Mandiri account opening get

Debit card?

Yes, customers will get a debit card (if the savings product is provided with a

debit card feature) after the online account opening process is successful.

Customers will have options to apply for a debit card at a Bank Mandiri branch (the card is not sent but picked up at a Bank Mandiri branch) or sent according to the delivery address chosen by the prospective customer (domicile / office).

How long delivery of the debit card will

take?

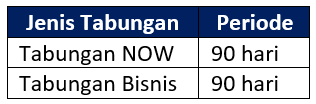

Debit card delivery to customer's address depends on the delivery SLA as

follows:

How does the customer activate and create PIN of

the received debit card?

After receiving the physical debit card, customers can re-open the https://join.bankmandiri.co.id page

then select the 'Debit Card Activation' menu. Make sure to validate personal data to

carry out the card activation process and create a Debit Card PIN.

What is a Debit Card PIN?

Debit Card PIN is a 6-digit number created by the Customer during the activation

process after receiving the physical Debit Card. This Debit Card PIN is required as

an authorization when the Customer makes a transaction at ATM/CDM/EDC. Debit Card

PIN shall not be given to the other people.

What if the customer does not get a debit card

while SLA for delivery a debit card has overdued or the delivery status is

'return'?

If the customer does not get any debit card after the SLA delivery has overdued or

the delivery status is 'return', the customer can visit the nearest Bank Mandiri

branch office to request a new debit card by bringing the original ID card with

him/her to validate.

What if a customer requests getting their

Mandiri Debit earlier and doesn't want to wait for SLA?

Customer must wait for the debit card to be sent to the address according to the

customer's destination based on the specified SLA.

What is Livin' by Mandiri?

Livin' by Mandiri is a financial super app that can be used enjoyably for various

banking transaction services after opening a savings account. The app can be

downloaded on Google Play (Android), App Store (iOS) and App Gallery

(Huawei).

When can customers enjoy Livin' by Mandiri

services?

After the account opening is successful and the debit card has been received by the

customer, then next the customer activates the debit card via

join.bankmandiri.co.id. After the debit activation process is successful, customers

can use the Livin' by Mandiri service by firstly downloading the Livin' by Mandiri

application on a cellphone with a mobile number that has been registered during the

account opening process.

Can the customer try opening an account again

after a rejection?

Yes, customers can try reopening an account again with the account opening menu on

the https://join.bankmandiri.co.id

page by making sure that the data input is in accordance with the KTP data recorded

at the Ministry of Home Affairs population office or customers can visit the nearest

Bank Mandiri branch office.

What if I need account opening information

online?

For further information regarding online account opening, please contact Mandiri

Call 14000.

| Saldo Nasabah | Suku Bunga per tahun sesuai saldo | Nominal Suku Bunga Bulanan |

|---|---|---|

| Rp 10.000.000,- | 0% | Rp 0,- |

Keterangan

- Bunga tabungan dikreditkan setiap akhir bulan ke rekening yang bersangkutan

- Dalam hal terdapat perubahan suku bunga, maka akan berpengaruh pada nominal bunga yang diterima nasabah

| Informasi Risiko Terkait Produk |

|---|

|