Digital Highlight

Digital Highlight

Digital Highlight

Tell us a story like a digitale

Terus memantapkan diri menjadi yang terdepan dalam arus perkembangan teknologi dan informasi. Bank Mandiri tak hentinya berbenah untuk maju melalui transformasi, inovasi, keamanan data, dan sumber daya manusia yang unggul. Memberikan makna bagi kehidupan yang lebih baik.

Going Digital, Bank Mandiri Thriving in the Era of Digital

Going Digital, Bank Mandiri Thriving in the Era of Digital

The English philosopher Herbert Spencer invented the phrase ‘survival of the fittest’ to easily explain Charles Darwin’s monumental On the Origin of the Species about the theory of evolution. The mechanism of natural selection forces organisms to adapt to the environment. This means that who is the most able to adjust to their environment, he will be able to survive, even dominate.

In the case of the industry today, the ability to adapt is a major demand. Many business giants with large financial capital turned out to be surprisingly quickly uprooted. Large capital does not guarantee business continuity, it is the ability to change mindset to keep up with the dynamics of business in the digitalization period that is the key. At the end of 2019, Bank Mandiri decided to increase the allocation of capital expenditure (capital expenditure) by 30% or equivalent to Rp2.4 trillion for the development of digital services.

Director of Information Technology Rico Usthavia Frans admitted, since the beginning of Bank Mandiri’s journey, which began with the merging of the Indonesian Bank Ekspor Impor Indonesia (Exim Bank), Bank Dagang Negara (BDN), Bank Bumi Daya (BBD), and Bank Pembangunan Indonesia (Bapindo) in 31 July 1999 was indeed closely linked to digitalization.

Digitalization is a demand, considering that Bank Mandiri must combine the systems of the four banks and then carry out an internal transformation in order to create a digital banking system that is agile, reliable and easy to customize.

For the past five years, digitalization of financial products and services has become a major demand for the banking industry to win the competition. Appropriate for millennial generation markets that are digital native, while making the banking ecosystem more effective and efficient.

To support this, Bank Mandiri has 3 pillars in digital banking. First is the internal digitization of processes, namely how the processes within the independent bank are ready in the digital age. The second pillar is the modernization of E-channels, so existing channels such as ATMs, internet banking, mobile banking, call centers and others are modified according to the current digital era. The third pillar is the leverage of the digital ecosystem, be it collaborating with marketplaces or e-commerce. However, these three pillars are still wrapped in good risk management and IT security.

And the core of all the pillars is the digital mindset, which is a long-term challenge for Bank Mandiri. How to change all these processes and also the banking culture that has been running so far into digital culture and thinking. Through E-channel or Mandiri e-banking, it allows customers to make transactions easily anytime and anywhere. While through Mandiri Online or Mandiri Mobile Banking, Bank Mandiri’s banking services make it easier for customers to conduct various financial and non-financial transactions using applications that can be accessed via smartphones.

While from the banking side itself, the digitization option is a business-profitable choice. By creating a digital banking ecosystem that can be accessed anywhere it makes business chains very efficient. In comparison, to open a branch office requires at least Rp 1.5 billion, not including routine costs for operational and maintenance of branch offices. With digitalization these costs will be reduced a lot.

On the other hand, in order to have a system that is agile, reliable as well as easy to be customized, Bank Mandiri is taking steps to reduce dependence on partners (vendors) and develop systems using internal HR. Of course the digital transformation that has been carried out must be integrated with a capable communication strategy to educate old consumers and attract the attention of potential consumers. This is inseparable from the battle over the consumer market dominated by the urban middle-class millennial society which is highly educated technologically and demands effective and efficient digital services.

Executing International Financial Accounting Standard 9 (PSAK) 71, Mandiri Implements Real Time Calculation Technology

Executing International Financial Accounting Standard 9 (PSAK) 71, Mandiri Implements Real Time Calculation Technology

JAKARTA - Bank Mandiri will be stricter in extending its loans, as the regulation in loan loss provisions, the International Financial Accounting Standard 9 (PSAK) 71, started to be effective earlier this year. The new standard for loan-loss provisions requires the financing industry to be more selective in choosing which businesses and at what price to lend to.

With 22 million retail customers, financing the corporate, commercial, and MSME segments, Bank Mandiri must ensure that potential debtors are credit worthy now and in the future. The value of collateral provided is a big determining factor for financing as well.

Director of Technology and Information of Bank Mandiri Rico Usthavia Frans said it required information technology innovation to facilitate and accelerate the calculation of loan-loss provisions so that Bank Mandiri could continuously increase its business readiness. The new reporting standards have more complex calculations, thus up-to-date information technology is vital to the bank’s acceleration.

PSAK 71 provides guidance on the recognition and measurement of financial instruments. It refers to the International Financial Reporting Standards (IFRS) 9, which replaces the previous PSAK 55 (IAS39). The main point in the latest PSAK is the forward looking approach in the calculation of loan-loss provisions for different asset classes.

PSAK 71 obligates credit providers to provide provision for impairment losses (CKPN) for all categories of loans, which includes performing, underperforming, and non-performing ones. This certainly calls for bigger amounts of provisions than before as it also will include forward looking macro-economic variables.

Bank Mandiri has partnered with Empyrean to strengthen its systems to optimize the implementation of PSAK 71. The smart technology developed by Empyrean allows loan-risk calculations to be carried out in a short time by all business units, even without the help of IT.

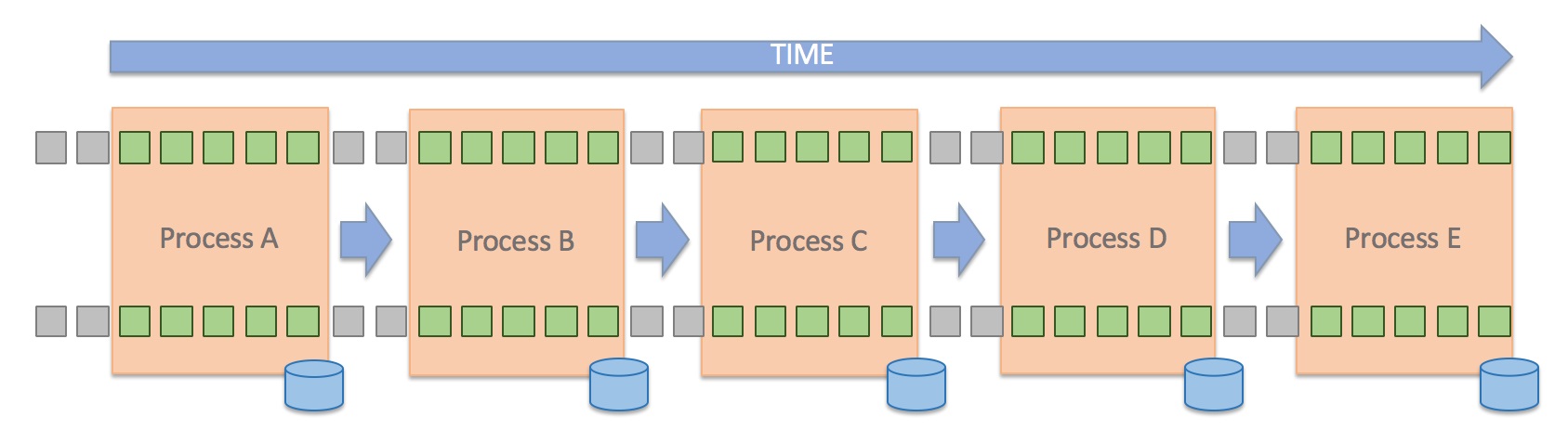

Previously, those type of calculations were made using overnight batch processing cycles. The new standard (PSAK 71) is more complex and requires much more calculations than the prior standard (PSAK 55) so relying on a traditional batch process was not an option. With Empyrean’s IFRS9 solution, which uses a data streaming micro services architecture, Bank Mandiri is able to do these enormous calculations much more efficiently and faster.

Typical Batch Process (EOD)

Data Streaming

Benefits of utilizing this technology include:

| Traditional “Batch Processing” | Empyrean.NXT - “Data Streaming with Microservices” | |

|---|---|---|

| Performance | Needs 5 days to produce the report | Takes less than 2 hours to produce the report |

| Flexibility | Applications can become vulnerable when new features/patches deployed | Deploys new features/patches seamlessly without affecting other microservice components |

| Hardware | Needs server with high specifications, though not all processes need high resources | Allows using servers with lower specifications, the capacity can be adjusted as required |

| Cloud Technology | Is not made to be deployed to the Cloud | Can be natively deployed to the Cloud |

“We continue to innovate and develop our information technology infrastructures to strengthen our business in the midst of developing trends and highly dynamic needs. Together with Empyrean, we do a lot of leaps in system renewal to meet the very complex needs," said Rico Usthavia Frans.

“The main benefit of the Empyrean IFRS9 solution is to empower users to continuously finetune the loan-loss provisions without IT support. Our technology enables users to focus on their core business. Our partnership with Bank Mandiri allows us to keep improving and innovating , using the latest technology, to fulfill business needs beyond IFRS 9,” said Chris Puype, founder and CEO of Empyrean Solutions.

Executing International Financial Accounting Standard 9 (PSAK) 71, Mandiri Implements Real Time Calculation Technology

Executing International Financial Accounting Standard 9 (PSAK) 71, Mandiri Implements Real Time Calculation Technology

JAKARTA - Bank Mandiri will be stricter in extending its loans, as the regulation in loan loss provisions, the International Financial Accounting Standard 9 (PSAK) 71, started to be effective earlier this year. The new standard for loan-loss provisions requires the financing industry to be more selective in choosing which businesses and at what price to lend to.

With 22 million retail customers, financing the corporate, commercial, and MSME segments, Bank Mandiri must ensure that potential debtors are credit worthy now and in the future. The value of collateral provided is a big determining factor for financing as well.

Director of Technology and Information of Bank Mandiri Rico Usthavia Frans said it required information technology innovation to facilitate and accelerate the calculation of loan-loss provisions so that Bank Mandiri could continuously increase its business readiness. The new reporting standards have more complex calculations, thus up-to-date information technology is vital to the bank’s acceleration.

PSAK 71 provides guidance on the recognition and measurement of financial instruments. It refers to the International Financial Reporting Standards (IFRS) 9, which replaces the previous PSAK 55 (IAS39). The main point in the latest PSAK is the forward looking approach in the calculation of loan-loss provisions for different asset classes.

PSAK 71 obligates credit providers to provide provision for impairment losses (CKPN) for all categories of loans, which includes performing, underperforming, and non-performing ones. This certainly calls for bigger amounts of provisions than before as it also will include forward looking macro-economic variables.

Bank Mandiri has partnered with Empyrean to strengthen its systems to optimize the implementation of PSAK 71. The smart technology developed by Empyrean allows loan-risk calculations to be carried out in a short time by all business units, even without the help of IT.

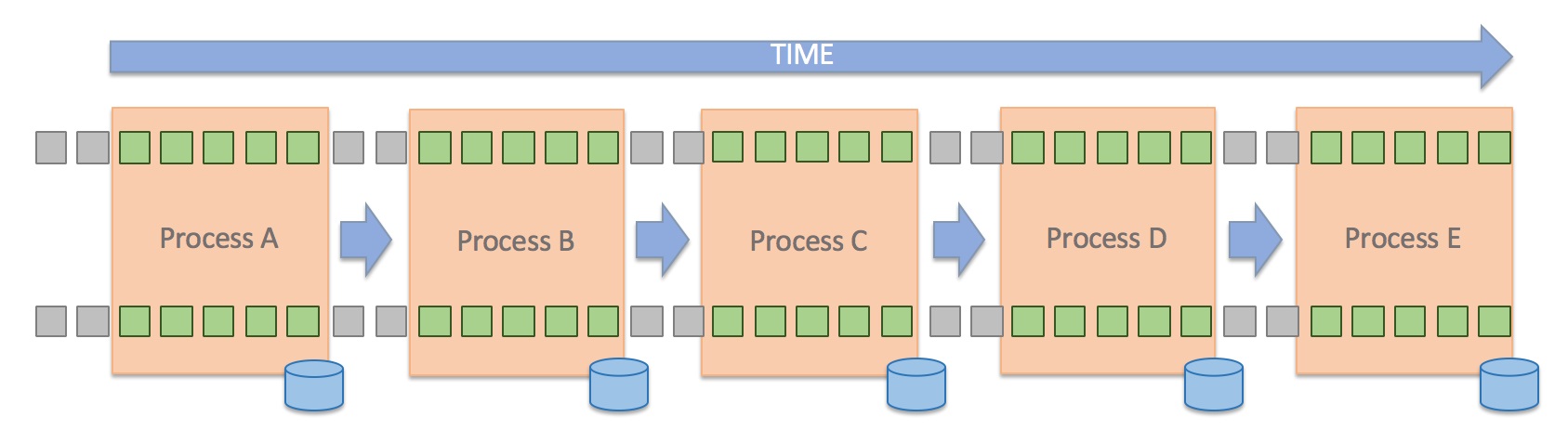

Previously, those type of calculations were made using overnight batch processing cycles. The new standard (PSAK 71) is more complex and requires much more calculations than the prior standard (PSAK 55) so relying on a traditional batch process was not an option. With Empyrean’s IFRS9 solution, which uses a data streaming micro services architecture, Bank Mandiri is able to do these enormous calculations much more efficiently and faster.

Typical Batch Process (EOD)

Data Streaming

Benefits of utilizing this technology include:

| Traditional “Batch Processing” | Empyrean.NXT - “Data Streaming with Microservices” | |

|---|---|---|

| Performance | Needs 5 days to produce the report | Takes less than 2 hours to produce the report |

| Flexibility | Applications can become vulnerable when new features/patches deployed | Deploys new features/patches seamlessly without affecting other microservice components |

| Hardware | Needs server with high specifications, though not all processes need high resources | Allows using servers with lower specifications, the capacity can be adjusted as required |

| Cloud Technology | Is not made to be deployed to the Cloud | Can be natively deployed to the Cloud |

“We continue to innovate and develop our information technology infrastructures to strengthen our business in the midst of developing trends and highly dynamic needs. Together with Empyrean, we do a lot of leaps in system renewal to meet the very complex needs," said Rico Usthavia Frans.

“The main benefit of the Empyrean IFRS9 solution is to empower users to continuously finetune the loan-loss provisions without IT support. Our technology enables users to focus on their core business. Our partnership with Bank Mandiri allows us to keep improving and innovating , using the latest technology, to fulfill business needs beyond IFRS 9,” said Chris Puype, founder and CEO of Empyrean Solutions.

Executing International Financial Accounting Standard 9 (PSAK) 71, Mandiri Implements Real Time Calculation Technology

Executing International Financial Accounting Standard 9 (PSAK) 71, Mandiri Implements Real Time Calculation Technology

JAKARTA - Bank Mandiri will be stricter in extending its loans, as the regulation in loan loss provisions, the International Financial Accounting Standard 9 (PSAK) 71, started to be effective earlier this year. The new standard for loan-loss provisions requires the financing industry to be more selective in choosing which businesses and at what price to lend to.

With 22 million retail customers, financing the corporate, commercial, and MSME segments, Bank Mandiri must ensure that potential debtors are credit worthy now and in the future. The value of collateral provided is a big determining factor for financing as well.

Director of Technology and Information of Bank Mandiri Rico Usthavia Frans said it required information technology innovation to facilitate and accelerate the calculation of loan-loss provisions so that Bank Mandiri could continuously increase its business readiness. The new reporting standards have more complex calculations, thus up-to-date information technology is vital to the bank’s acceleration.

PSAK 71 provides guidance on the recognition and measurement of financial instruments. It refers to the International Financial Reporting Standards (IFRS) 9, which replaces the previous PSAK 55 (IAS39). The main point in the latest PSAK is the forward looking approach in the calculation of loan-loss provisions for different asset classes.

PSAK 71 obligates credit providers to provide provision for impairment losses (CKPN) for all categories of loans, which includes performing, underperforming, and non-performing ones. This certainly calls for bigger amounts of provisions than before as it also will include forward looking macro-economic variables.

Bank Mandiri has partnered with Empyrean to strengthen its systems to optimize the implementation of PSAK 71. The smart technology developed by Empyrean allows loan-risk calculations to be carried out in a short time by all business units, even without the help of IT.

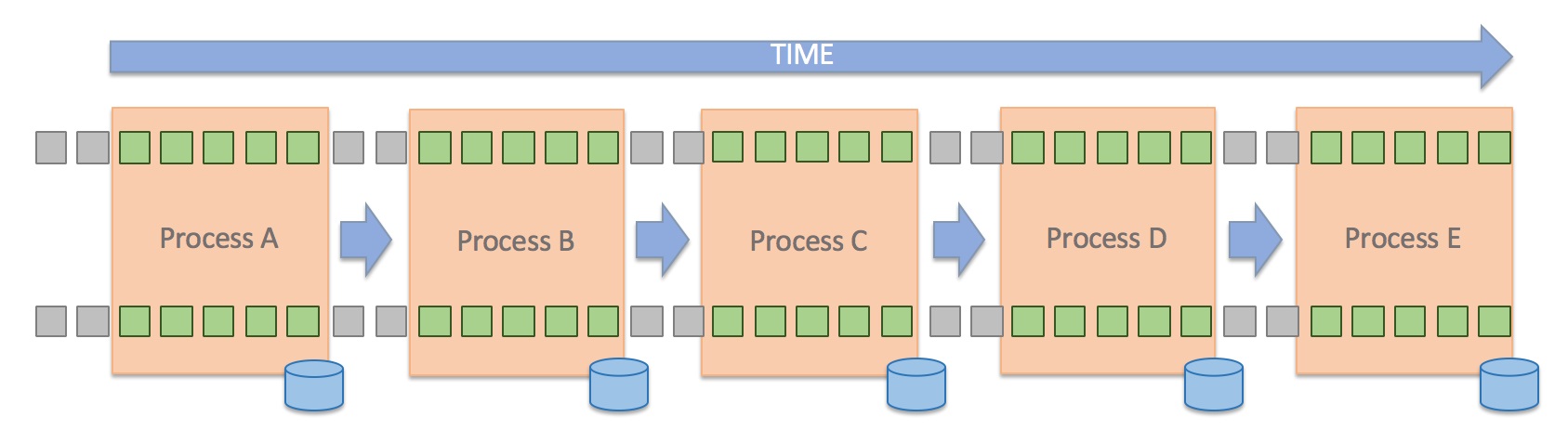

Previously, those type of calculations were made using overnight batch processing cycles. The new standard (PSAK 71) is more complex and requires much more calculations than the prior standard (PSAK 55) so relying on a traditional batch process was not an option. With Empyrean’s IFRS9 solution, which uses a data streaming micro services architecture, Bank Mandiri is able to do these enormous calculations much more efficiently and faster.

Typical Batch Process (EOD)

Data Streaming

Benefits of utilizing this technology include:

| Traditional “Batch Processing” | Empyrean.NXT - “Data Streaming with Microservices” | |

|---|---|---|

| Performance | Needs 5 days to produce the report | Takes less than 2 hours to produce the report |

| Flexibility | Applications can become vulnerable when new features/patches deployed | Deploys new features/patches seamlessly without affecting other microservice components |

| Hardware | Needs server with high specifications, though not all processes need high resources | Allows using servers with lower specifications, the capacity can be adjusted as required |

| Cloud Technology | Is not made to be deployed to the Cloud | Can be natively deployed to the Cloud |

“We continue to innovate and develop our information technology infrastructures to strengthen our business in the midst of developing trends and highly dynamic needs. Together with Empyrean, we do a lot of leaps in system renewal to meet the very complex needs," said Rico Usthavia Frans.

“The main benefit of the Empyrean IFRS9 solution is to empower users to continuously finetune the loan-loss provisions without IT support. Our technology enables users to focus on their core business. Our partnership with Bank Mandiri allows us to keep improving and innovating , using the latest technology, to fulfill business needs beyond IFRS 9,” said Chris Puype, founder and CEO of Empyrean Solutions.