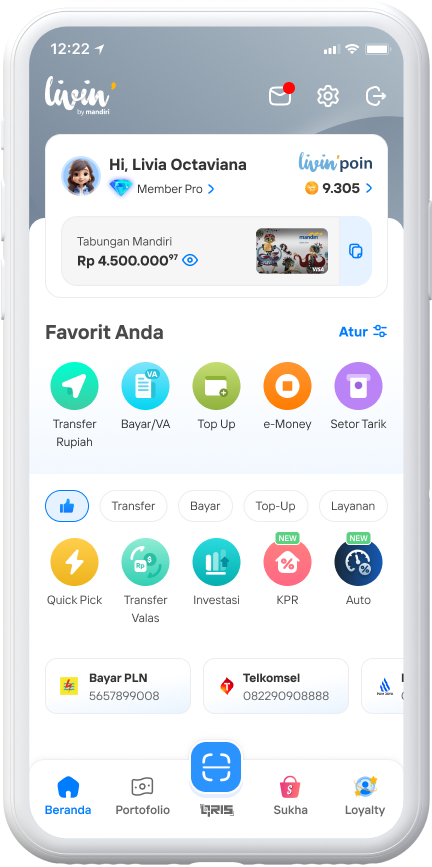

Cara Tarik Tunai Tanpa Kartu Mandiri di Livin' by Mandiri

002 - 004 - Tarik Tunai Tanpa Kartu - DCAS (done)

How to Withdraw Cash Without a Card at Livin' by Mandiri

Download Now! Find all the convenience of financial transactions at Livin'. And learn how to use it here.

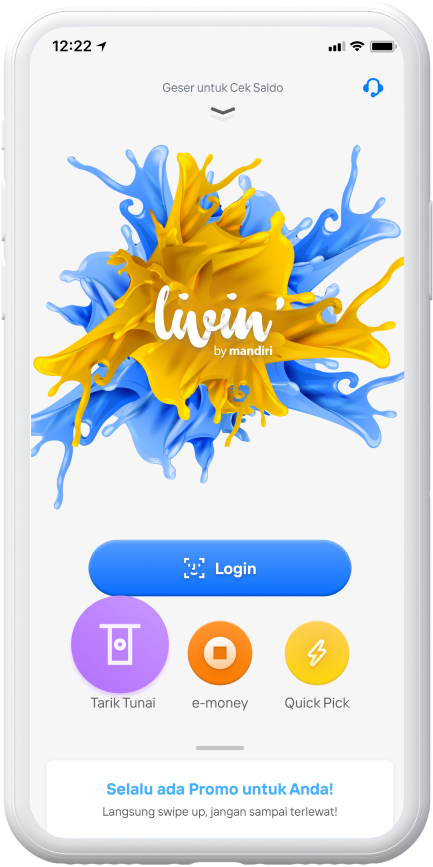

How to Withdraw Cash from Login Page

On the Livin' login page tap Cash Withdrawal

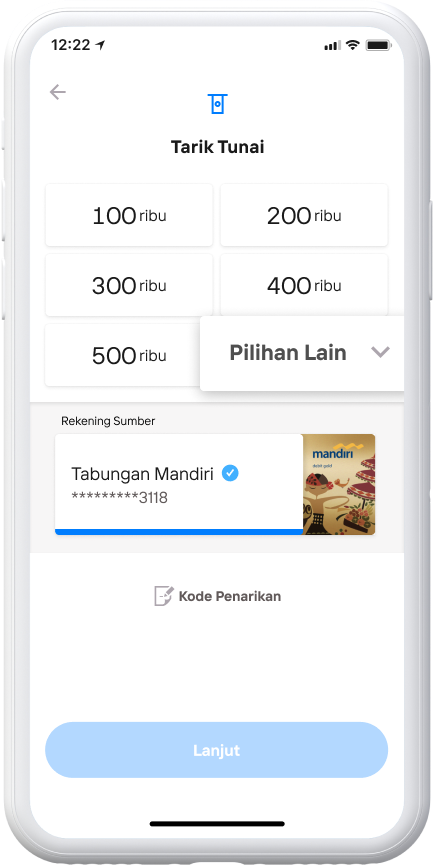

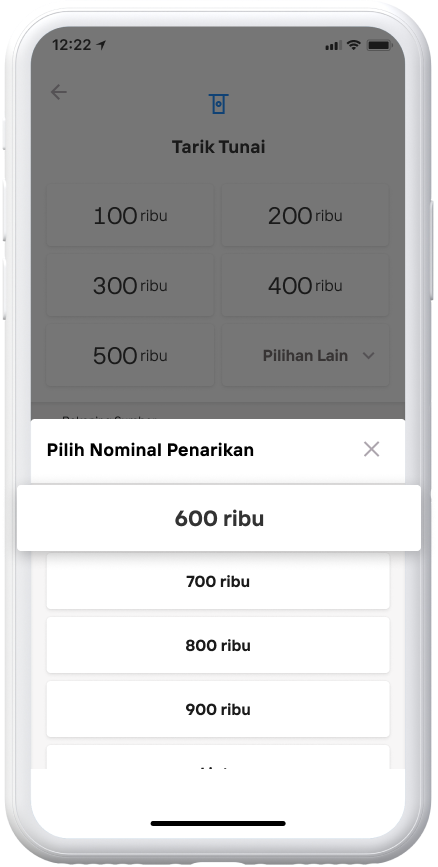

Select Other Options

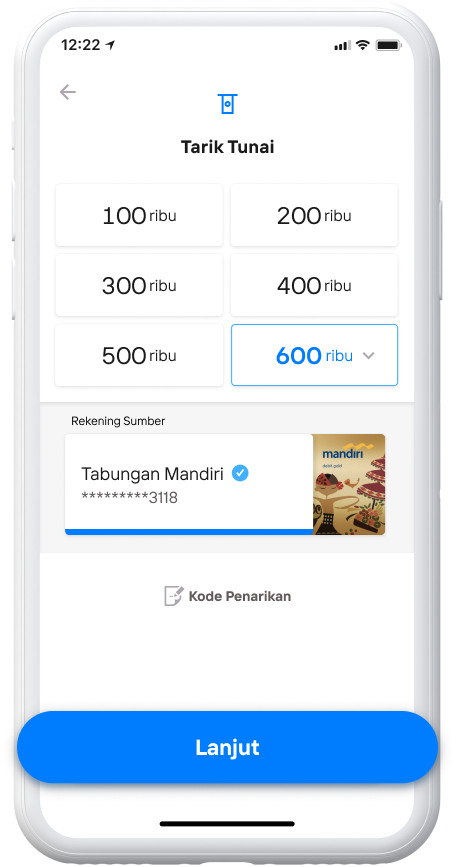

Select Withdrawal Amount

Select the amount available and tap Continue.

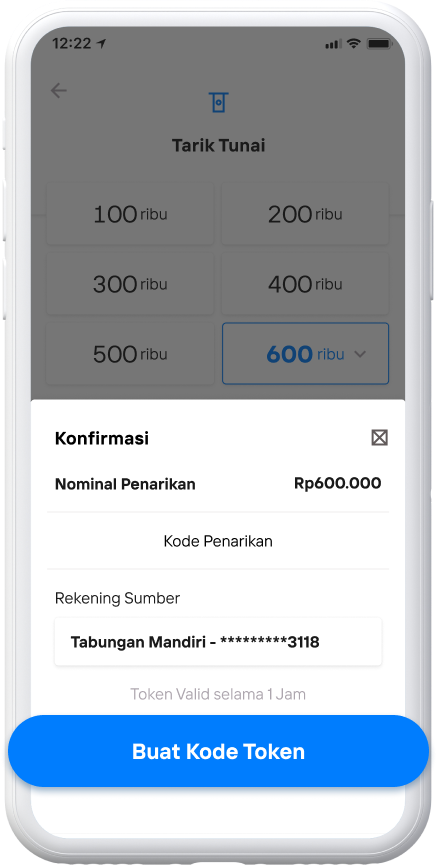

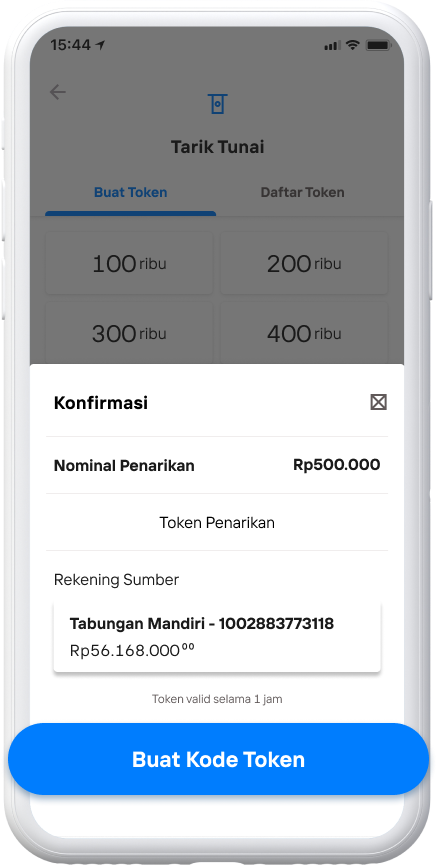

Double check the amount then tap Create Token Code

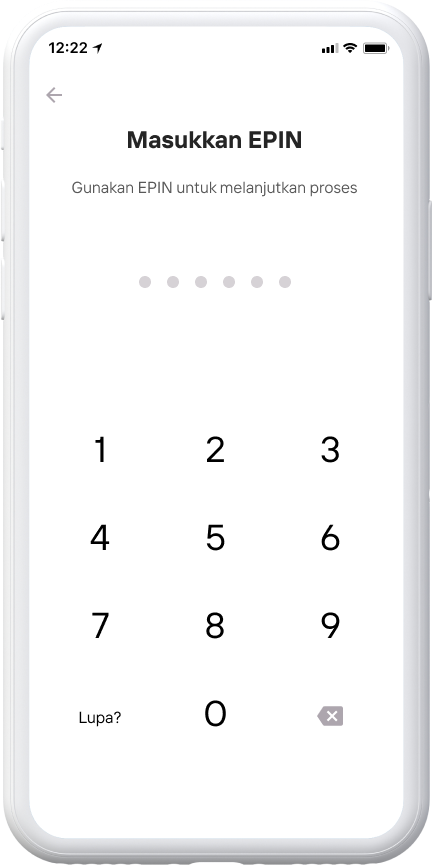

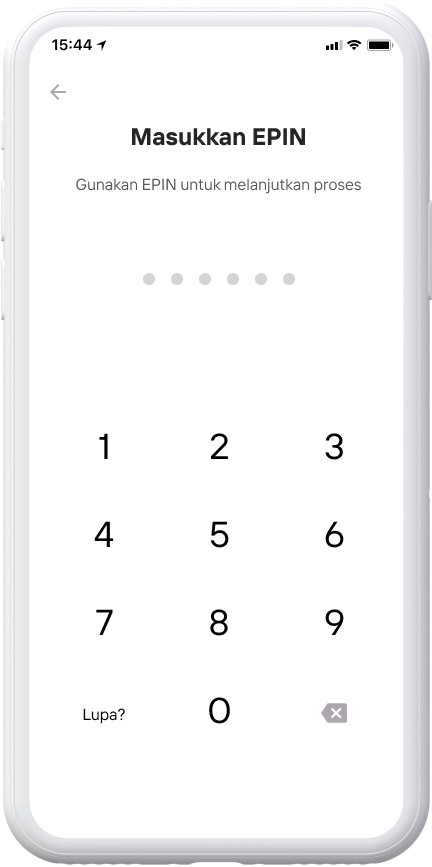

Enter PIN Livin'

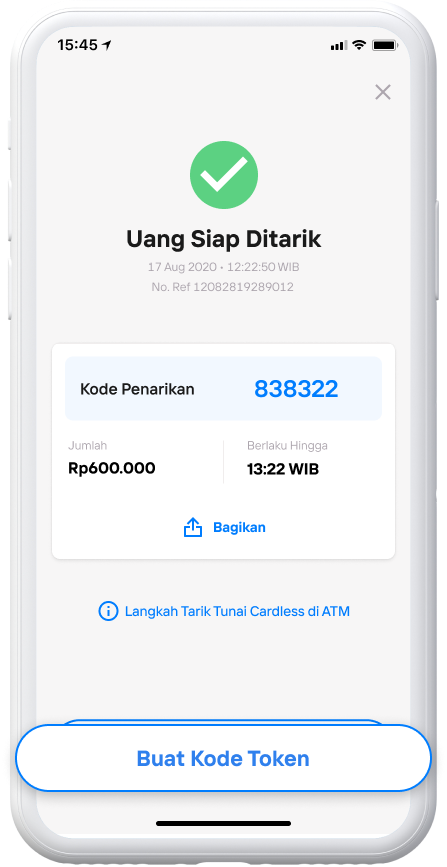

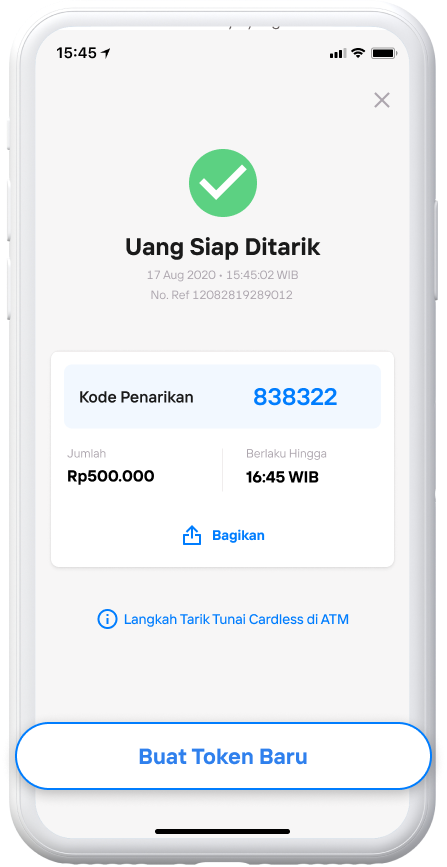

Withdrawal Code and withdrawal time limit appear, Tap Create Token Code if the withdrawal time limit is over

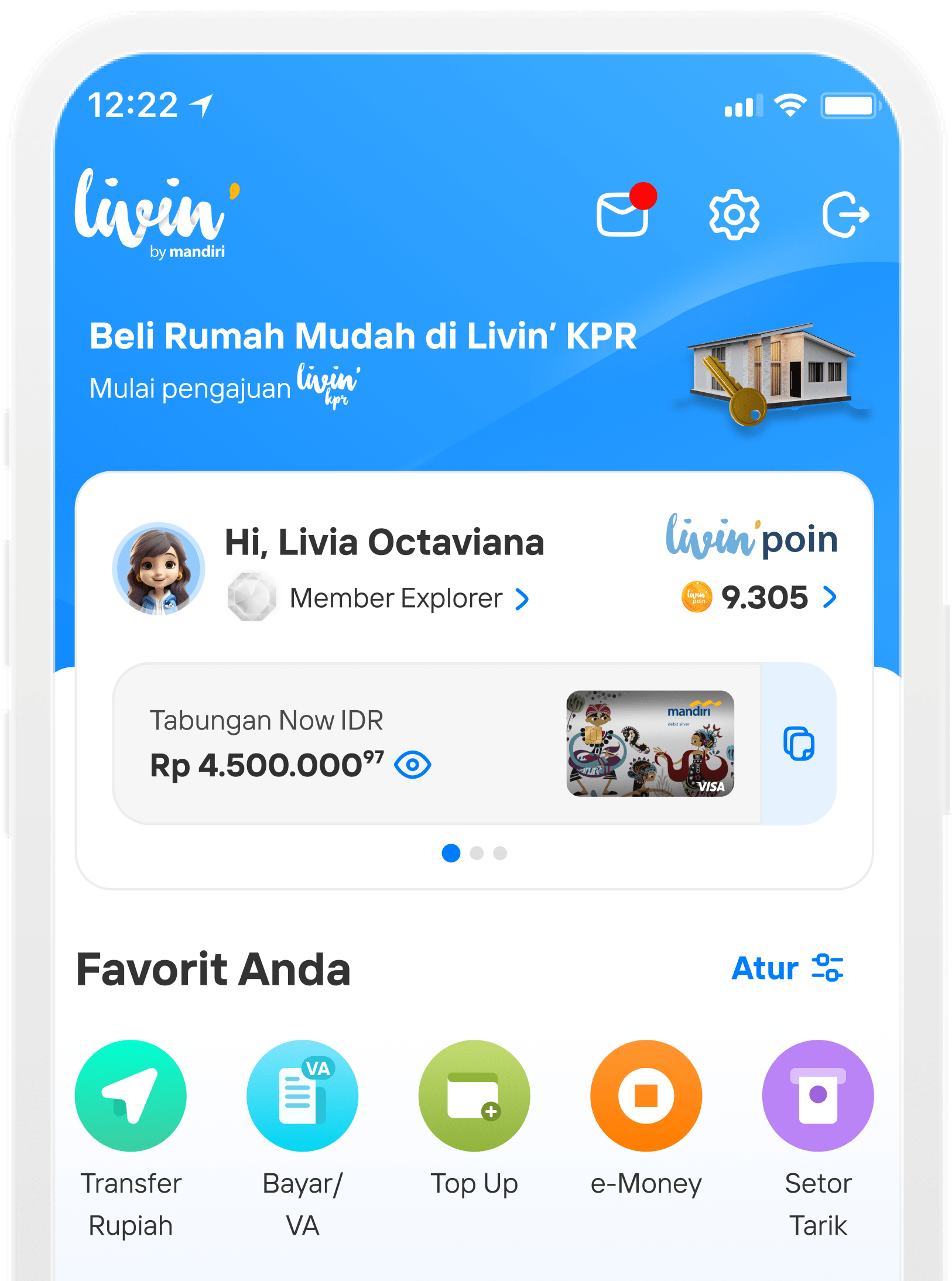

How to Draw Cash from Home Page

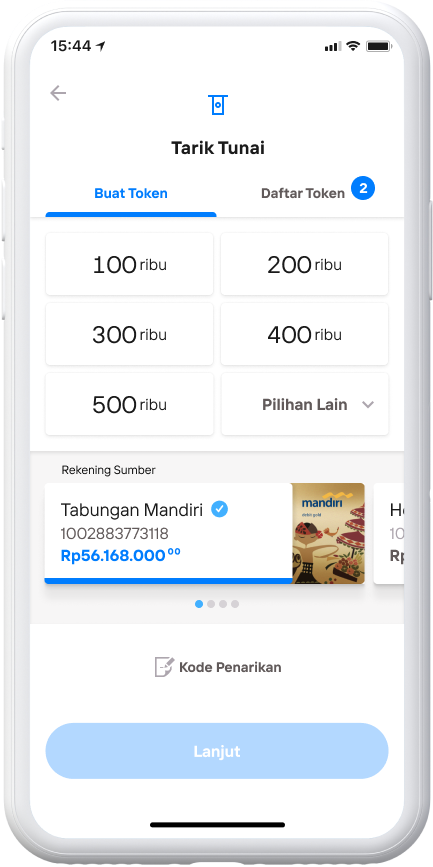

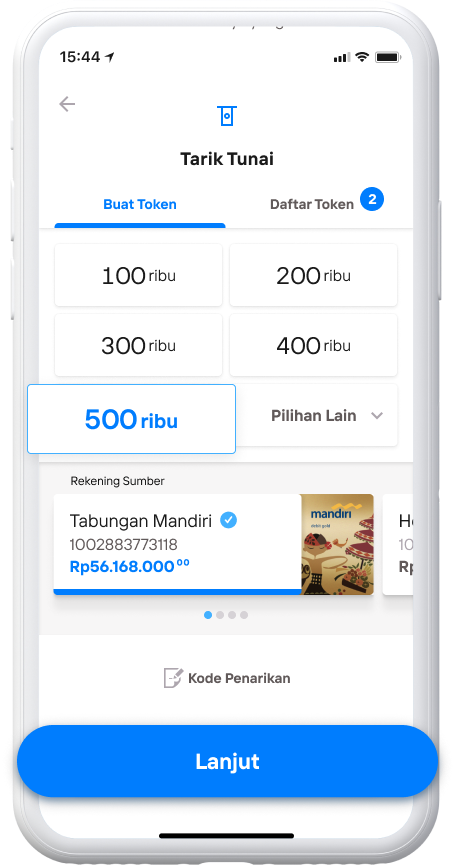

On the menu page tap Cash Withdrawal

Select your desired nominal

Select Next

Check the amount again and tap Generate Token Code

Enter PIN Livin'

Withdrawal Code and withdrawal deadline appear, Tap Generate Token Code if the withdrawal deadline is over

Advanced ways to withdraw cash at ATMs

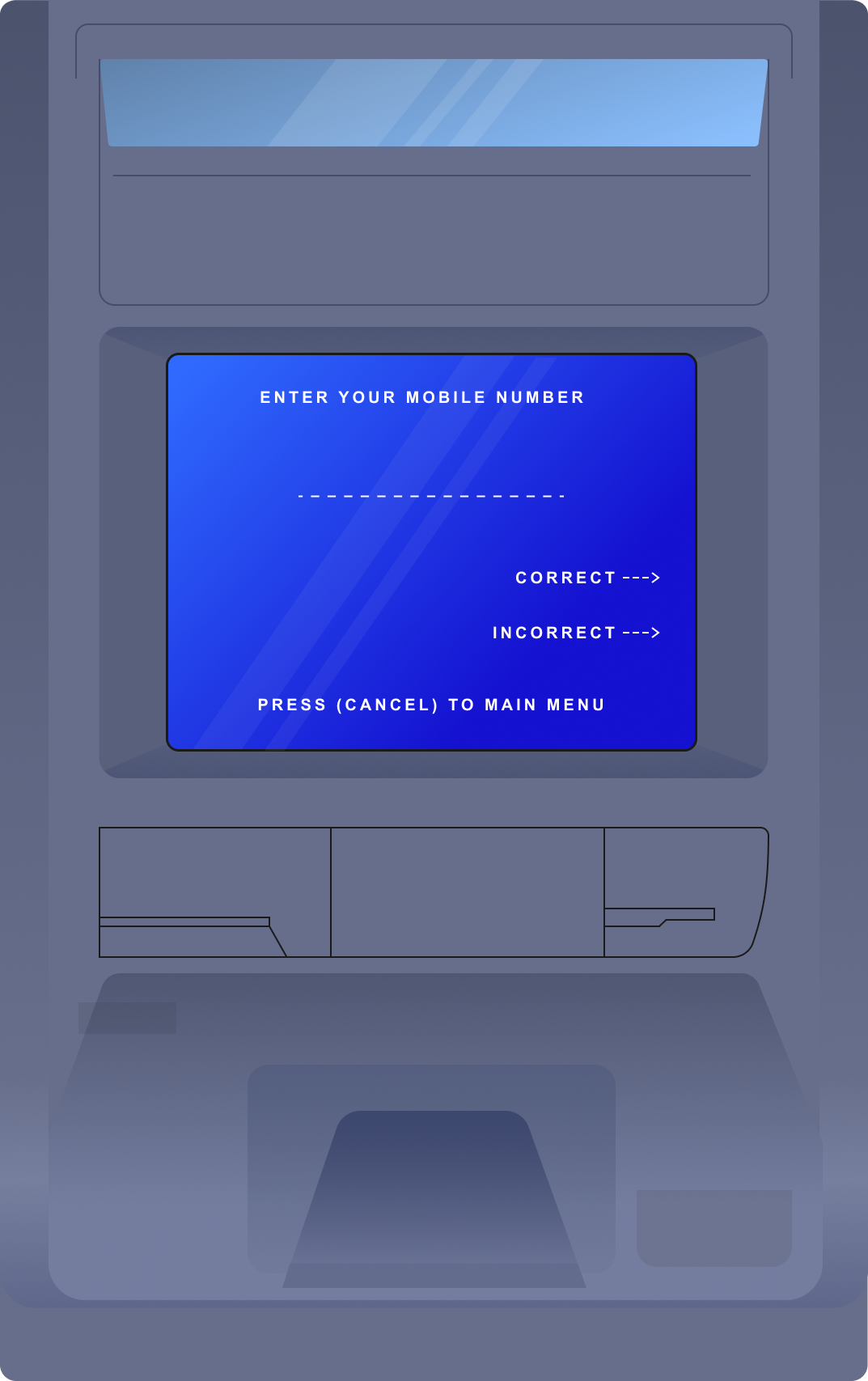

Press Enter by pressing the green button at the bottom right of the keypad

Select the Livin’ by Mandiri menu

Select the Cardless Cash Withdrawal menu

Enter your phone number registered with the Livin’ by Mandiri app, then press “Correct”

Enter the 6-digit token number created in the Livin’ by Mandiri app, then press “Correct”

Take and count your money after the process is complete. Press “Yes” if you want to make another withdrawal

To create a new token number, go back to the Livin’ by Mandiri app and enter the new 6-digit token number

FAQ - TARTUN CARDLESS

Frequently Asked Questions (FAQs)

Cardless Withdrawal is a feature that provides cash withdrawal services at Bank Mandiri ATM machines without a debit card for Bank Mandiri customers using the Livin' by Mandiri application. Cash withdrawal transactions can be made using the mobile number registered in Livin' by Mandiri and the cardless withdrawal token that the customer has previously created via the Livin' by Mandiri application.

The cardless withdrawal token that the customer has created will be active for 1 hour. Cash withdrawal tokens cannot be used again after 1 hour since the token was created.

Cardless withdrawal transactions are limited to the limit of IDR 5,000,000 (five million rupiah) per day.

Cardless withdrawal transactions are limited to the limit of IDR 1,000,000 (one million rupiah) per transaction.

Yes. Customers can create up to 5 active cardless withdrawal tokens at the same time. There is no limit on the number of tokens created per day.

After making a cash withdrawal with the first token, the Customer can press the "Yes" button to make a cardless cash withdrawal transaction again at the ATM and insert the next token

The minimum nominal cash withdrawal amount is IDR. 100,000 (one hundred thousand rupiah) with the largest denomination that can be purchased by the ATM machine used by the Customer.

There are no additional fees charged to customers who make cardless wtihdrawal at the Bank Mandiri ATM machine.

Information regarding the code that has been successfully generated will appear in the inbox at New Livin' by Mandiri and list of active tokens in the Cardless menu inside Livin’ by Mandiri app.

Accounts that can be the source of withdrawal funds is a Rupiah Mandiri individual savings account or checking account that are currently on active status.

Risiko yang The risks inherent in cardless withdrawal transactions include:

- Data security risks:

The risk of providing cellphone numbers and/or cardless withdrawal tokens to untrusted parties, resulting in false transactions by irresponsible parties. - Risk of transaction failure:

Risk of transaction failure if the customer makes transactions more than the daily limit, does not have sufficient balance, or uses the wrong cellphone number and cardless withdrawal token. - Risks of cardless withdrawal tokens expired:

Risk of cardless withdrawal tokens expire which causes the tokens that the customer has previously created can no longer be used for transactions because they exceed the predetermined active token time limit. - Risk of System Failure:

There is a risk of connection problems or maintenance, causing token creation activities and/or cardless withdrawal transactions to fail.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang