Mandiri EDC

EDC New

EDC Mandiri

It's time to enjoy the convenience of receiving payments by connecting bank accounts and transferring funds in real time using EDC Mandiri.

Terms and Conditions Merchant

Features and Benefits of Mandiri EDC

Card Transactions

Accept payment via all types of debit/credit cards

Contactless

It features contactless payment acceptance using either cards, mobile phones, or smartwatches.

Bill Payment

Equipped with payment features for Credit, Electricity Tokens and other billers)

All Day Transaction

Can accept payment transactions until 23:59 WIB every day

DCC (Dynamic Currency Converter)

A currency conversion service that is performed dynamically at the time of transaction.

Transaction acceptance

QRIS

One QR code to accept payments from all mobile banking and e-wallets

Acceptance of Alipay wallet transactions

Acceptance of Alipay wallet transactions from tourists

EDC Registration Document Requirements

For more information :

Please contact Call Mandiri at 14000 or visit the nearest Bank Mandiri branch office.

- Bank Mandiri Customer

- Identity Card (KTP)

- Taxpayer Identification Number (NPWP)

- Have identity as a business owner (KTP, NPWP, SIUP and Deed of Establishment)

FAQ EDC

Risk and Fees

- Please always keep the EDC machine in good condition. If the machine is damaged or lost due to the Merchant's negligence and/or willfulness, then it is the Merchant's responsibility.

- Merchants may not move the EDC machine from the business location that has been registered with the Bank.

- Please always keep sensitive or private data/information confidential. If the Merchant's data is leaked due to the Merchant's negligence and/or intentionality, then it is the responsibility of the Merchant.

| MDR Kartu debit / NPG | ||

| Lini Bisnis Merchant | On Us | Off Us |

| Reguler | 0.15% | 1% |

| Pendidikan | 0.15% | 0.75% |

| SPBU | 0.15% | 0.50% |

| P2G/G2P/Donasi | 0% | 0% |

| MDR QRIS | ||

| Lini Bisnis Merchant | On Us & Off Us | |

| Reguler Usaha Mikro (UMI) Omzet maks 2M/tahun |

• 0% (nominal transaksi ≤ 100 Ribu) • 0,3% (nominal > 100 Ribu) |

|

| Reguler • Usaha Kecil (UKE) • Usaha Menengah (UME) • Usaha Besar (UBE) |

0.70% | |

| Pendidikan | 0.60% | |

| BLU/PSO/SPBU | 0.40% | |

| P2G/G2P/Donasi | 0.00% | |

Note: transaksi dapat dilakukan dengan Scan kode QRIS melalui aplikasi Livin' by Mandiri maupun aplikasi lainnya di mesin EDC

| MDR Kartu Kredit* | ||

| Jenis Kartu pembayaran | On Us & Off Us | |

| VISA | 1.80% | |

| Mastercard | 1.80% | |

| JCB | 1.80% | |

| CUP (Union Pay) | 1.80% | |

Note: transaksi dapat dilakukan dengan cara Tap to Pay (tap kartu/device di mesin EDC) maupun Dip (insert kartu di mesin EDC)

| MDR Prepaid (kartu e-money) | ||

| Lini Bisnis Merchant | On Us | |

| Reguler | 0.50% | |

| P2G/G2P/Donasi | 0.00% | |

| MDR Alipay | ||

| Lini Bisnis Merchant | Alipay | |

| Reguler | 0.70% | |

| Keterangan: | ||||||

| On Us = transaksi yang dilakukan menggunakan kartu/layanan Mandiri di EDC Mandiri | ||||||

| Off Us = transaksi yang dilakukan menggunakan kartu/layanan selain Mandiri di EDC Mandiri | ||||||

| *untuk pengajuan MDR CC special rate, dapat menghubungi mandiricare@bankmandiri.co.id |

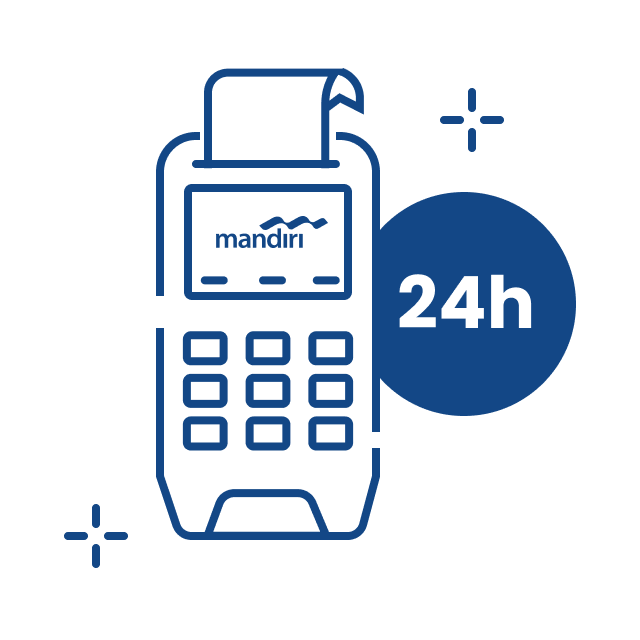

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang