KPR Mandiri Multiguna

KPR Mandiri Multiguna New

KPR Multiguna Bank Mandiri

Mandiri Multiguna

Mandiri KPR Multiguna (Refinancing)

Longer Tenor, Limit up to 10 Billion and Competitive Rate

Mandiri KPR Multiguna

Mandiri KPR Multiguna is a credit program that can be used for various needs with the collateral guarantee of house/apartment/ruko/rukan, including for

- New Booking Cash Credit facility that can be obtain by using the property certificate as collateral guarantee.

- Take Over Taking over a similar or not similar credit facility from the origin bank with the ease of process and benefits of interest rate back to fix period.

- Top Up An additional credit limit from the current running (existing) Mandiri KPR Multiguna.

Mandiri KPR Multiguna Benefits

- Competitive rate

- Bigger credit limit

Maximum Rp 10.000.000.000 (ten billion rupiah) for Employee and Professional, max. Rp 2.000.000.000 (two billion rupiah) for Self Employed

- Longer credit tenor

Up to 10 years for Employee and Professional; 7 years for Self Employed.

What’s the risk of a Mortgage?

Several risks that could happen for Mandiri KPR:

- Changing Economics and politics risk situation

- Liquidity risk

- 3rd party default risk

- Changing laws and regulations risk

- Force Majore risk (natural disasters/extraordinary events)

- Other risks stated on the Syarat-Syarat Umum Perjanjian Kredit Konsumtif (SUKK)

Mandiri KPR Multiguna Rates

Further info about current mortgage interest rates, visit bmri.id/kprbungaspesial

Terms and Conditions

- Indonesian citizenship (WNI) and live in Indonesia

- A minimum age of 21 years and when the credit ends a maximum of 55 years for employees; or maximum 60 years for professionals/entrepreneurs

- Employee conditions:

- Employee

- Permanent employee

- 3 months min. work experience

- Minimum income of IDR 5,000,000 (five million rupiah) per month.

- Contract employee conditions:

- Minimum position: manager/supervisor or as professional

- Minimum 5 years work experience

- Professional or Self Employed conditions

- Min. 2 years occurrence of experience (proved by business/practice license)

- Have NPWP or SPT Tahunan PPh orang pribadi according to current law and regulation

- Minimum income Rp 6.000.000 (six million rupiah) per month

- A property that can be use as collateral guarantee

- Employee

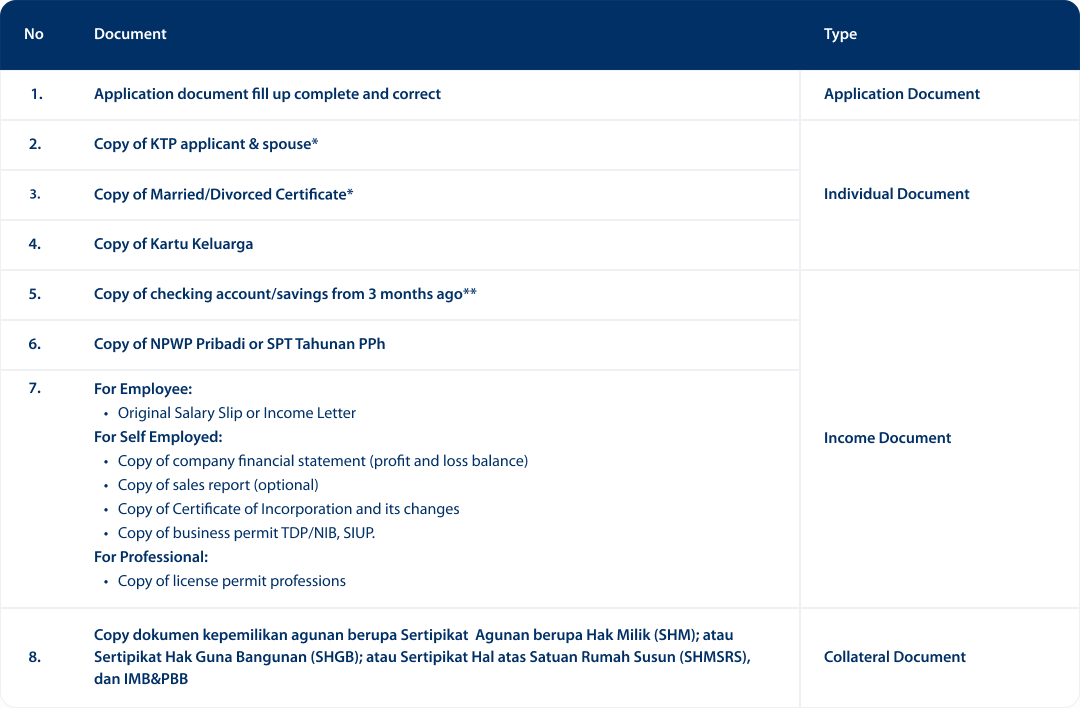

Document requirements for Mandiri KPR Multiguna

* : Only attached if applicant is married/divorced

** : Not needed if applicant is Bank Mandiri payroll employee

Installment Simulation

| Limit | Rp. 100.000.000,00 |

| Tenor | 144 months |

| Rate | 7.75% Fix 3 Years |

| Monthly installment | Rp. 1.068.792 |

Program Period

This KPR Multiguna program period is valid until the application deadline of 31 December 2025.

Contact Us

Further information contact the nearest Consumer Loans Area or contact Mandiri Customer Care 14000

Solusi beragam kebutuhan dengan agunan hunianSaatnya penuhi kebutuhan, saatnya mandiri.