Kredit Investasi

New Kredit Investasi

Investment Loan

Mandiri Investment Loan is a loan facility provided to finance capital goods needs in the context of rehabilitation, modernization, expansion, establishment of new projects and/or special needs related to investment.

Benefit :

Providing financing solutions for capital goods that meet business needs.

Loan Features :

- Loan limit over IDR 500 million to IDR 25 billion.

- The loan is given in Rupiah and foreign currency.

- Disburse all at once or gradually according to the intended use.

- Interest and principal are paid monthly on period/date as the Bank determines. The interest rate is floating and effective.

- The term is adjusted to the effective age of the financed object, a maximum of 10 years and can be extended.

- The collateral is the financed object.

Loan requirements :

1. Conditions for applying:

- Individual Business Customers:

- Indonesian Citizen

- Legally competent

- Business Entity Customers

Based on relevant legal provisions, customers who are legal business entities.

2. To apply for financing, the documents required include:

| Documents | Individual Business Customers | Business Entity Customers |

|---|---|---|

| Application Form | ✓ | ✓ |

| Copy of KTP of Applicant & Husband/Wife | ✓ | - |

| Copy of Marriage/Divorce Certificate (for those who are married/divorced) | ✓ | - |

| Copy of savings/current account statement for at least the last 6 months | ✓ | ✓ |

| Copy of NPWP | ✓ | ✓ |

| Copy of business permits (such as SIUP, SITU, TDP/NIB etc.) | ✓ | ✓ |

| Copy of the Deed of Establishment of the Company and the Deed of Amendment | - | ✓ |

| Copy of KTP of all company management and shareholders | - | ✓ |

| Copy of collateral ownership documents (such as SHM/SHGB/SHMSRS etc.) | ✓ | ✓ |

Other documents will be adjusted during facility processing.

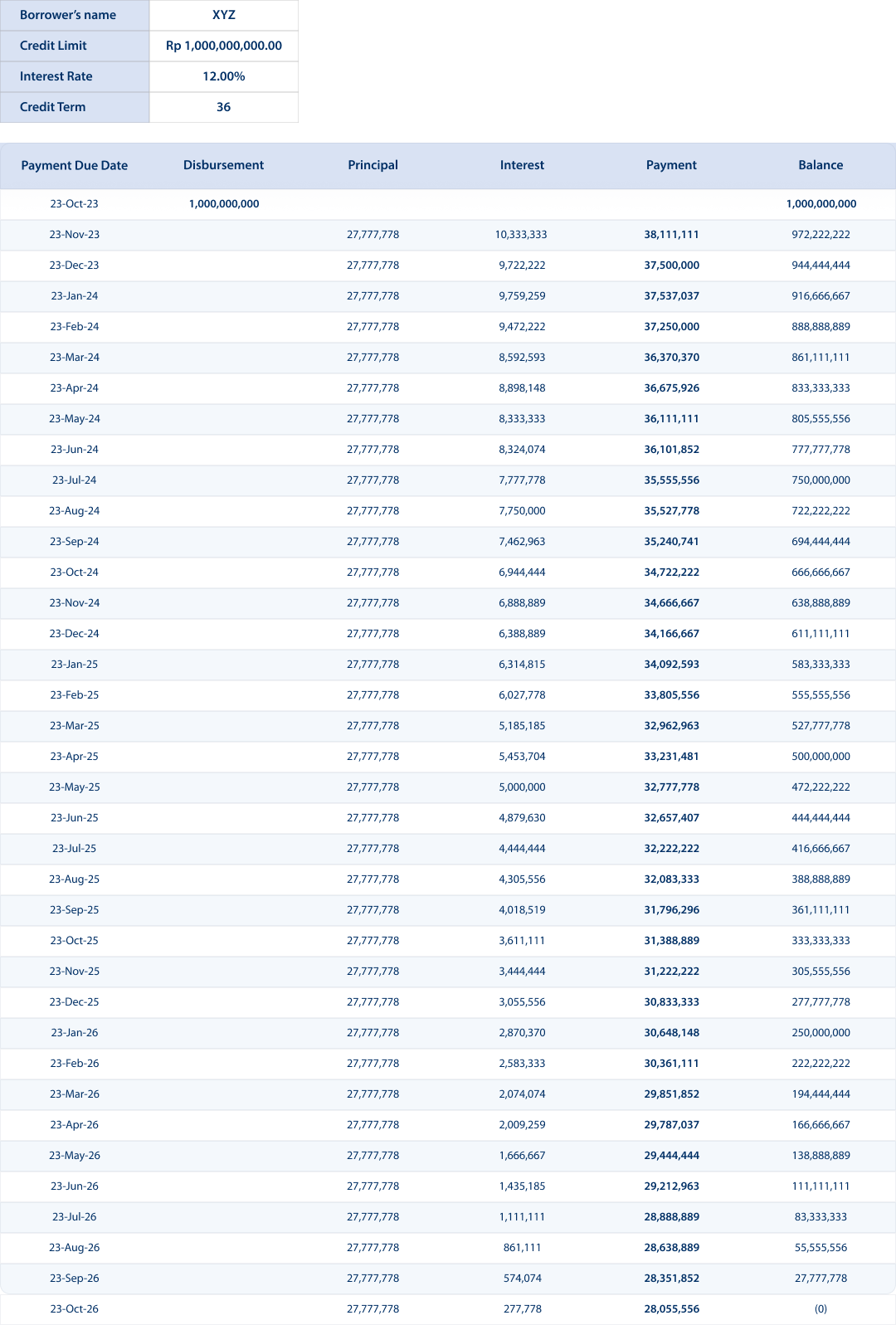

Loan Simulation:

- Investment Loan

- Loan Limit: IDR 1,000,000,000.00

- Term: 36 months

- Interest Rate: 12% effective p.a

The estimated interest and principal that must be paid each month is (according to the table)

The credit details above are a simulation with prorate principal payments every month.

Loan Risk:

Loan risks that may occur include:

- Changes in interest rates based on the Bank's considerations or Regulatory provisions

- Changes in exchange rates (if the credit currency is in foreign currency)

Estimated Loan Costs:

Estimated credit costs in providing credit include:

- Provision Fees

- Administration Fees

- Collateral Binding Fees

- Collateral Insurance Fees

- Collateral Appraisal Fee

For further information and applications for Working Capital Credit, you can submit it via the nearest Bank Mandiri branch or Mandiri Call 14000