Kredit Pemilikan Rumah Bersubsidi

Kredit Subsidi New

KPR Bersubsidi Bank Mandiri

Government Subsidized Mortgage

Get your first house with various ease and benefit from government subsidized mortgage program.

Mandiri KPR Sejahtera FLPP

KPR Sejahtera FLPP is a mortgage program with various ease and benefit for defined income people from the government managed by BP Tapera and distributed through Bank Mandiri.

Benefits

- Interest Rate start from 5% fixed until the end of credit period;

- Long tenor credit up to 20 years;

- Mild down payment start from 1%;

- Free collateral PPN fee;

- A down payment subsidy from government Subsidi Bantuan Uang Muka (SBUM):

| Province | SBUM |

|---|---|

| Non Papua and West Papua | Rp4 Million |

| Papua and West Papua | Rp10 Million |

What’s the risk of a Mortgage?

Several risks that could happen for Mandiri KPR:

- Changing Economics and politics situation risk

- Liquidity risk

- 3rd party default risk

- Changing laws and regulations risk

- Force Majore risk (natural disasters/extraordinary events)

- Other risks stated on the Syarat-Syarat Umum Perjanjian Kredit Konsumtif (SUKK)

Terms and Conditions

- Indonesian citizenship (WNI) and live in Indonesia.

- Min. age of 21 years or have been married, max. age of 55 years at the end of credit.

- TNI/POLRI conditions:

- Min. age of 18 years

- 3 months minimum of work experience since the date of employement letter, can use income letter from the institute/agencies.

- Both the applicant and spouse do not yet own a house and have never received a home ownership subsidy program.

- Permanent employee with 3 months of min. work experience or contract employee with min. 2 years of work experience.

- Have a total income per month of:

Province Minimum Maximum Single Married* Zone 1

Jawa (kecuali Jakarta, Bogor, Depok, Tangerang, Bekasi) Sumatera, Nusa Tenggara Timur, dan Nusa Tenggara Barat.Rp2 Million Rp8,5 Million Rp10 Million Zone 2

Kalimantan, Sulawesi, Kepulauan Bangka Belitung, Kepualauan Riau, Maluku, Maluku Utara, Bali.Rp9 Million Rp11 Million Zone 3

Papua, Papua Barat, Papua Tengah, Papua Selatan, Papua Pegunungan, dan Papua Barat Daya.Rp10,5 Million Rp12 Million Zone 4

Jakarta, Bogor, Depok, Tangerang, Bekasi.Rp12 Million Rp14 Million * a total of income both applicant and spouse

- Collateral type of house built by developer registered in Kementerian Perumahan dan Kawasan Permukiman (Kemen PKP) that has a specification defined by the government.

Collateral criteria for KPR Sejahtera FLPP

- Collateral type of house built by developer registered in Kementerian Perumahan dan Kawasan Permukiman (Kemen PKP) with the maximum price defined by the government.

- Further information of residential project list, visit SiKumbang website.

- Maximum price for the subsidized house in year of 2025:

No Region Max. Price 2025 1. Jawa (except Jabodetabek) dan Sumatera (except Kep. Riau, Bangka Belitung, dan Kep. Mentawai) Rp162 Million 2. Sulawesi, Bangka Belitung, Kep. Mentawai, dan Kep. Riau (except Kep. Anambas) Rp168 Million 3. Kalimantan (except Kabupaten Murung Raya dan Kabupaten Mahakam Ulu) Rp177 Million 4. Jabodetabek, Kep. Anambas, Kabupaten Murung Raya, Kabupaten Mahakam Ulu, Maluku, Maluku Utara, Bali, dan Nusa Tenggara Rp181 Million 5. Papua dan Papua Barat Rp234 Million Further info of residential project list, visit SiKumbang website https://sikumbang.tapera.go.id/

Document requirements

| No | Document requirements |

|---|---|

| 1. | Application document with a picture of applicant and spouse |

| 2. | Copy of KTP applicant and spouse registered in Dukcapil |

| 3. | Copy of Kartu Keluarga registered in Dukcapil |

| 4. | Copy of Married/Divorced Certificate (whom married/divorced) or Letter of information not yet married from Kelurahan (if not yet married) |

| 5. | Copy of NPWP |

| 6. | Latest salary slip or income letter from the company |

| 7. | Employement Letter |

| 8. | Copy of Surat Pemberitahuan (SPT) Tahunan Pajak Penghasilan (PPh) orang pribadi |

| 9. | Copy of checking account/savings from 3 months ago |

| 10. | Letter of Surat Penawaran Rumah (SPR) from Developer |

| 11. | Letter of Surat Pernyataan Pemohon KPR Bersubsidi signed by applicant and spouse |

| 12. | Letter of Surat Permohonan Subsidi Bantuan Uang Muka. |

Fees

- Provisional fee 0,50%

- Admin fee Rp500,000 .

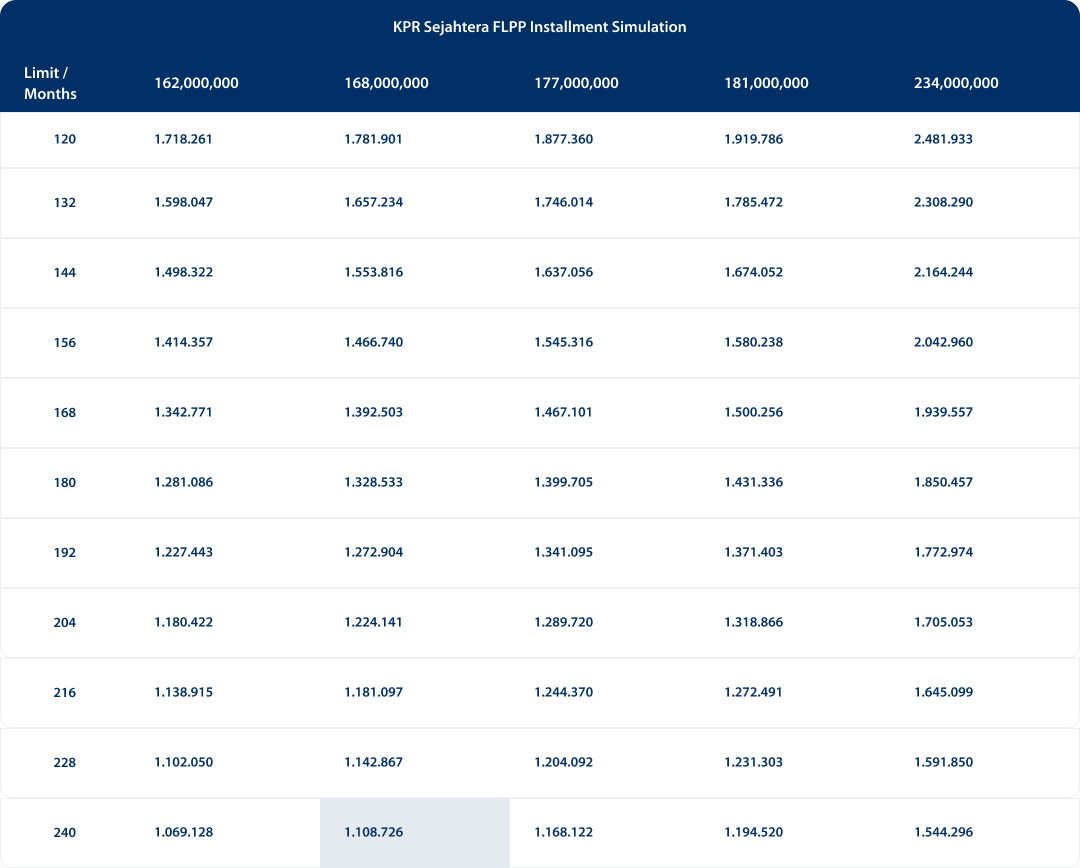

KPR Sejahtera FLPP Simulation

| Limit | Rp. 168.000.000,00 |

| Tenor | 240 Months (20 Years) |

| Interest Rate/ Year | 5% |

| Monthly Installment | Rp. 1.108.726 |

Program Periode

This KPR FLPP program period is valid until the application deadline of 31 December 2025.

KPR Sejahtera FLPP Application

Contact the nearest Bank Mandiri branches to ask for KPR Sejahtera FLPP application and do a registration process from SiKasep application:

- Download SiKasep application from Google Playstore (currently SiKasep only available in Android platform)

- Make sure GPS/Location is active during the application process using SiKasep.