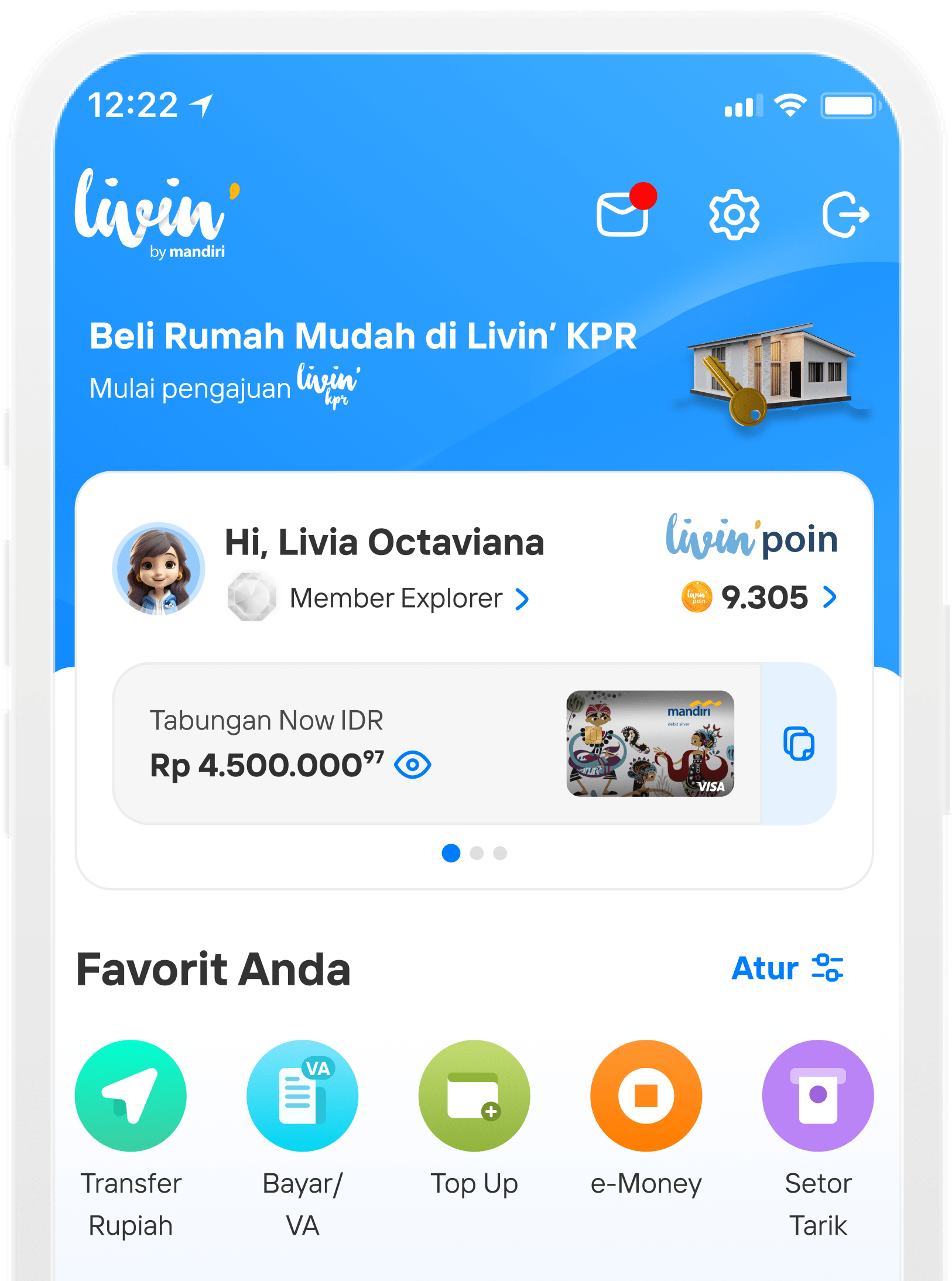

Cara Buka Deposito Mandiri di Livin' by Mandiri

Deposito Content

How to Open Deposit on Livin' by Mandiri

Discover the convenience of saving time deposits with attractive interest rates and other benefits.

Learn how to open Deposit here.

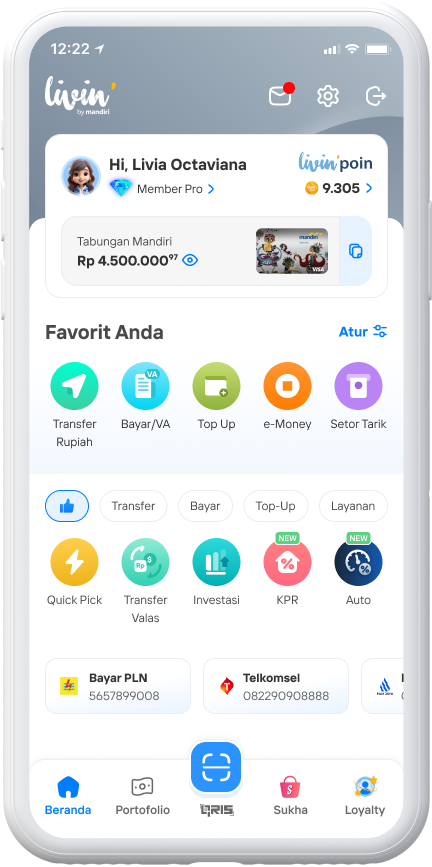

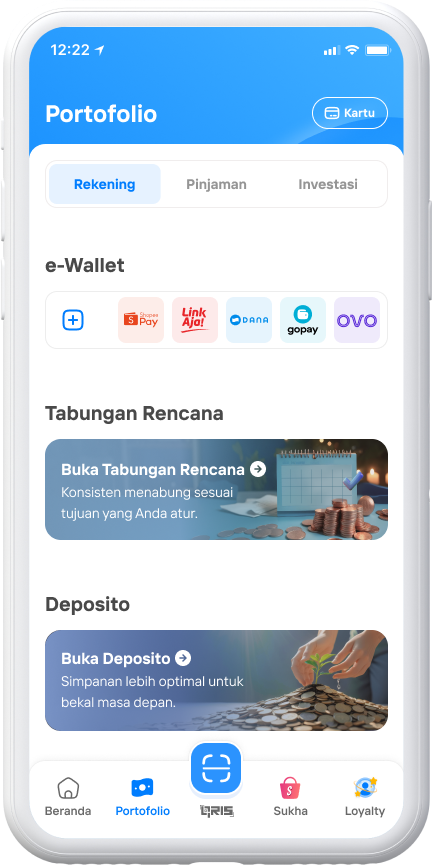

Select Portfolio

In the Deposit section then Select the Open Deposit Banner

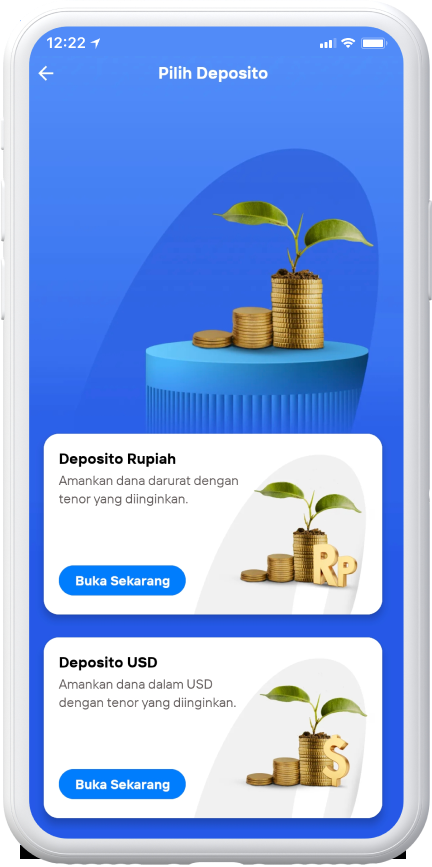

Select Rupiah/USD Time Deposit and click Open Now

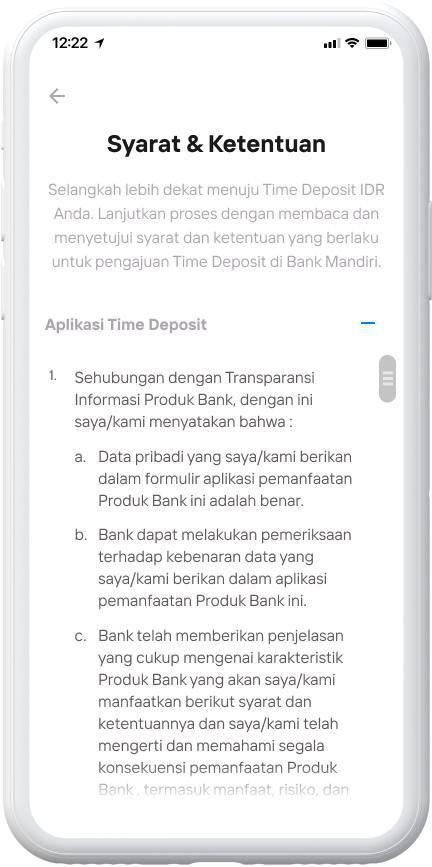

Agree to terms & conditions

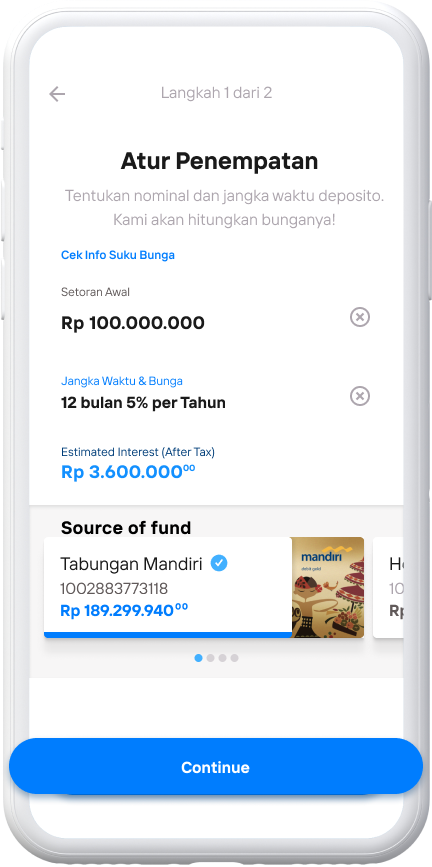

Set the deposit amount and term according to your needs, then click Continue.

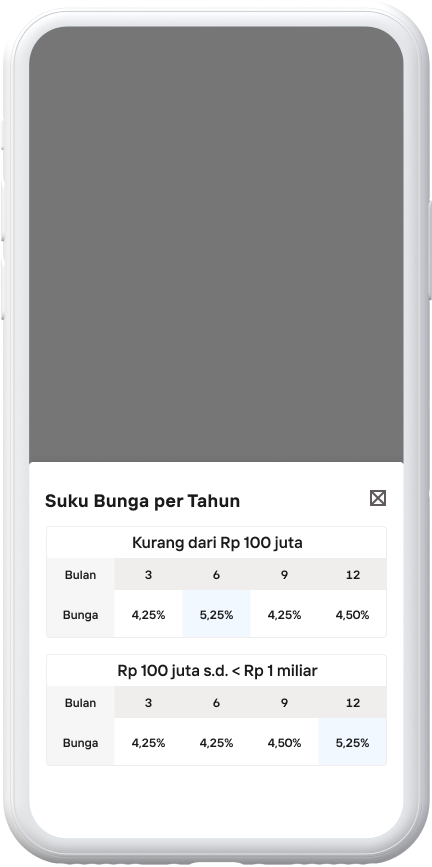

Check the interest rate offered

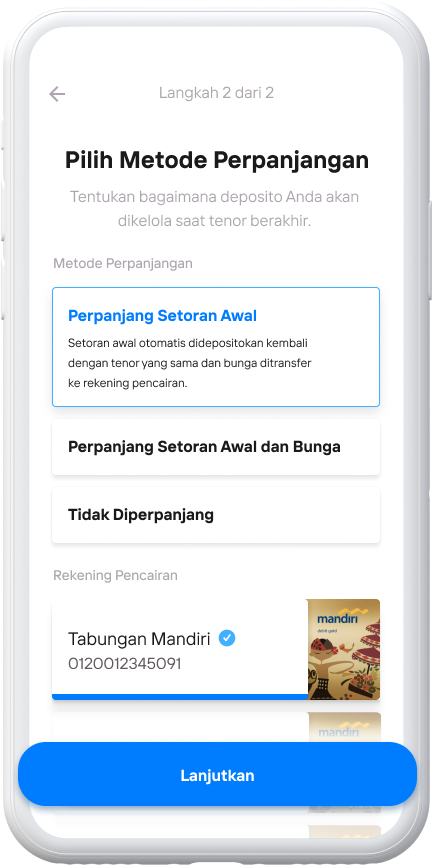

Select the renewal method for your desired deposit then click Continue.

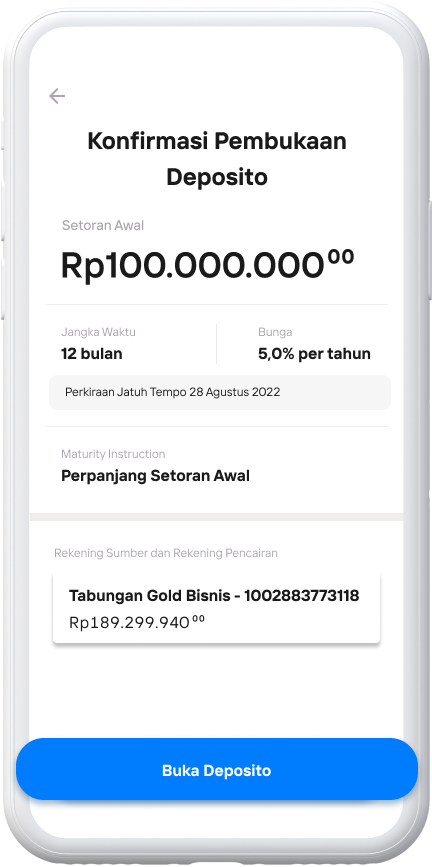

Review the deposit opening details and then tap

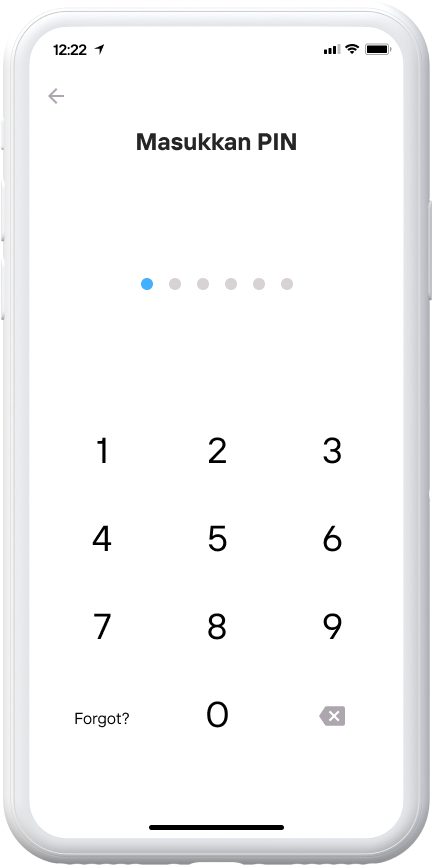

Enter your Livin' PIN

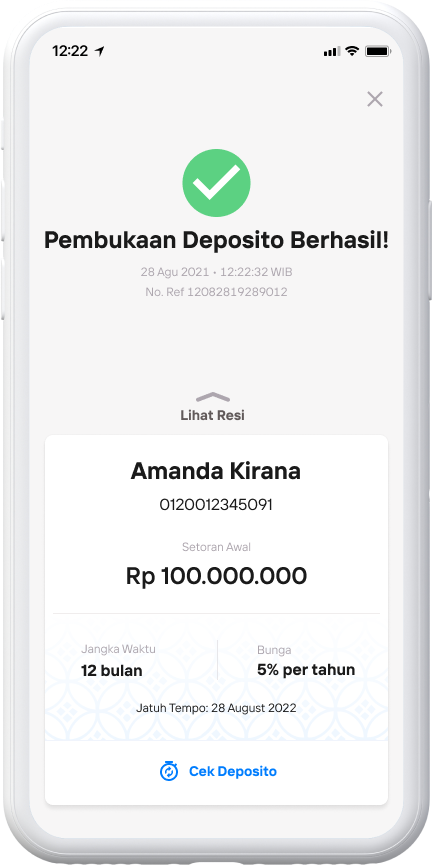

Wait for the notification to appear Deposit Opening Successful!

Risk

-

Customer deposits are not included in the Deposit Insurance Guarantee Program of the Lembaga Penjamin Simpanan (LPS), if:

- The total amount of the Customer's deposit balance exceeds (equivalent to) IDR 2 (two) Billion at one bank, both for single accounts and joint accounts.

- The interest rate that the customer gets exceeds the maximum interest rate of the LPS guarantee.

-

Fluctuations in savings interest rates can occur following market developments.

-

The customer must maintain confidential data (debit card number, card validity period, CVC / CVV, pin, username, password, OTP, date of birth, mother's name), misuse of confidential data by unauthorized parties is the sole responsibility of the customer.

-

The Customer is obliged to provide information and/or data in accordance with the actual conditions and the consequences if the Customer does not submit the actual information and/or data are the Customer's sole responsibility.

Simulation

|

Nominal |

Tenor |

Suku Bunga per Tahun |

Nominal Suku Bunga Bulanan (sebelum dipotong pajak)* |

Nominal Suku Bunga Bulanan (setelah dipotong pajak)** |

|

Rp10.000.000,- |

1 bulan |

2,25% |

Rp18.493,15 |

Rp14.794,52 |

*) Asumsi jumlah hari adalah 30 hari

**) Besar Pajak Penghasilan (PPh) adalah 20%

Keterangan

-

- Bunga deposito dikreditkan pada saat jatuh tempo

-

- Dalam hal terdapat perubahan suku bunga, maka akan berpengaruh pada nominal bunga yang diterima nasabah

Details information for Mandiri Deposito click this link

Deposito FAQ

Frequently Asked Questions (FAQs)

The Deposit feature in Livin' by Mandiri can be used to open, maintain, withdraw and close deposits.

- Customer accessed the feature before the cut off at 22.00 hours

- There is an active Savings/Giro Account that can be used as a Source of Funds Account

- Have a Savings / Current Account with the currency in accordance with the deposit you want to open

Minimum opening IDR is IDR 1,000,000 and USD is USD 1,000.

Yes, IDR100,000 for Rupiah Deposit and USD1 for USD Deposit.

Customers will get the same Deposit rate as when opening until maturity.

There are 3 due instructions, namely:

- Non ARO/Not Extended: The principal amount of the Deposit and the interest amount are disbursed to the Customer's Savings/Current Account.

- ARO Principal / Extended Principal Deposit: the principal will be extended according to the tenor chosen at the beginning of the opening and the nominal interest is disbursed to the Customer's Savings / Current Account

- ARO Principal & Interest: The interest amount of the deposit is added to the principal amount of the deposit and both are extended according to the tenor chosen at the time of opening.

The disbursement account is an account in the name of the Customer that will be used as a disbursement destination when the Deposit matures.

Yes, with a penalty of 0.5% of the Deposit Amount. Interest on cancelled deposits will not be paid by the Bank.

Customers can change the Deposit alias by going to the Account Details page, then select Edit.

1 and 3 months.

You can't. This is because the physical bilyet received by the customer when opening the Deposit at the branch must also be submitted during disbursement.

Customers can change the disbursement instruction through the deposit account details screen. Changes can be made a maximum of H-1 at 22.00 WIB before the maturity date.

Customers can change the disbursement account in the deposit account details. New Livin' by Mandiri will display all accounts that are eligible for disbursement. Changes can be made up to H-1 at 22.00 WIB before the due date.

Deposits with ARO Principal & Interest type are not disbursed at maturity except by manual disbursement. The Disbursement Account is re-displayed if the Deposit is withdrawn or changed to another disbursement instruction.

This menu is provided if the disbursement of Non-extended / NON ARO Deposits fails to be automatically disbursed due to a problematic Disbursement Account, for example due to closure. Customers can make manual disbursements without being charged a penalty as long as they have an eligible Savings/Giro Account.

Because in the Maturity month, the same date as the opening date of the Customer Deposit does not exist.

No, Customers can make disbursements even if the due date is on a holiday or red date.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang