Cara Transfer Valas di Livin' by Mandiri dengan Mudah

Content - Transfer VALAS

How to Transfer Forex at Livin' by Mandiri.

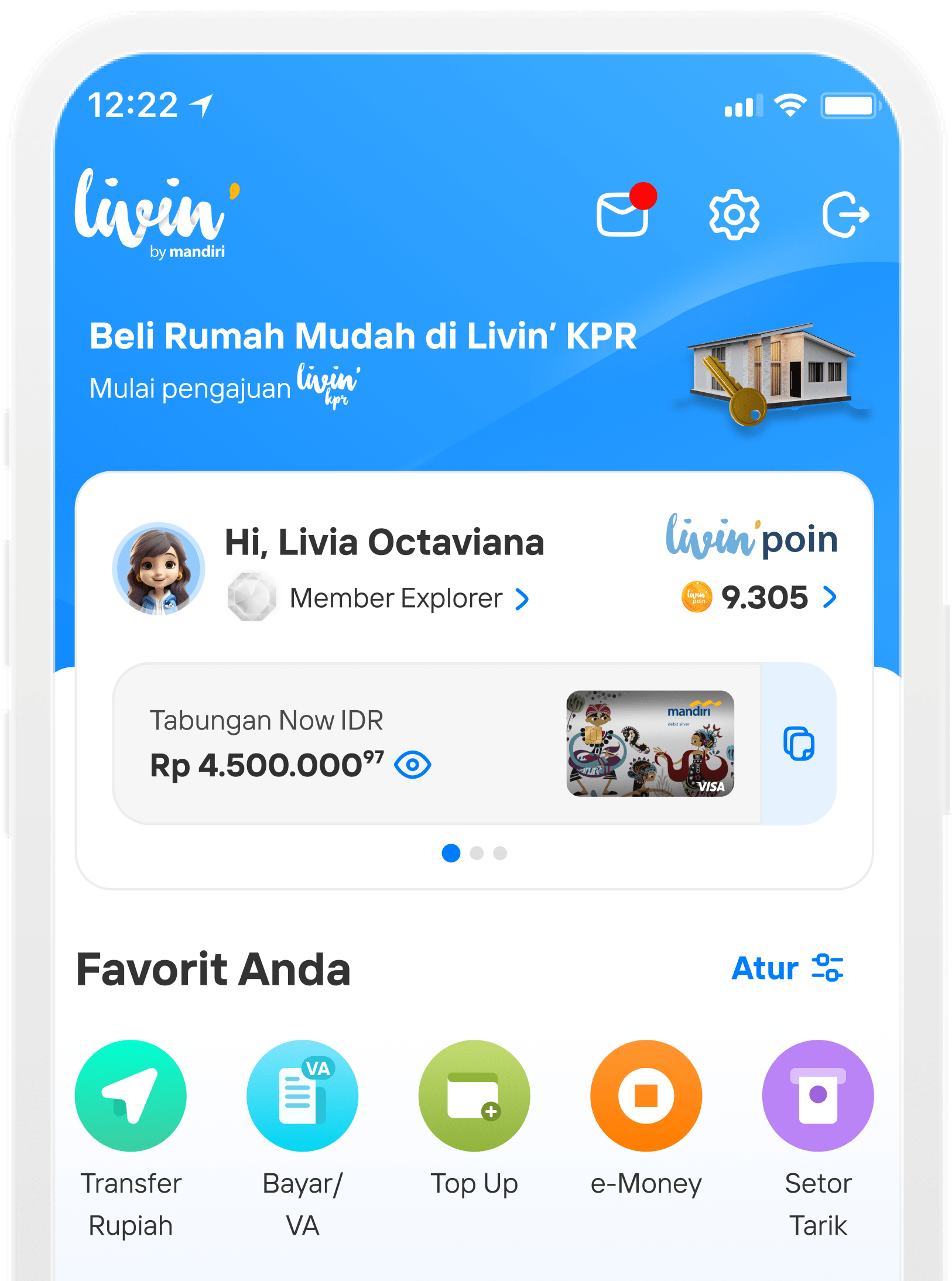

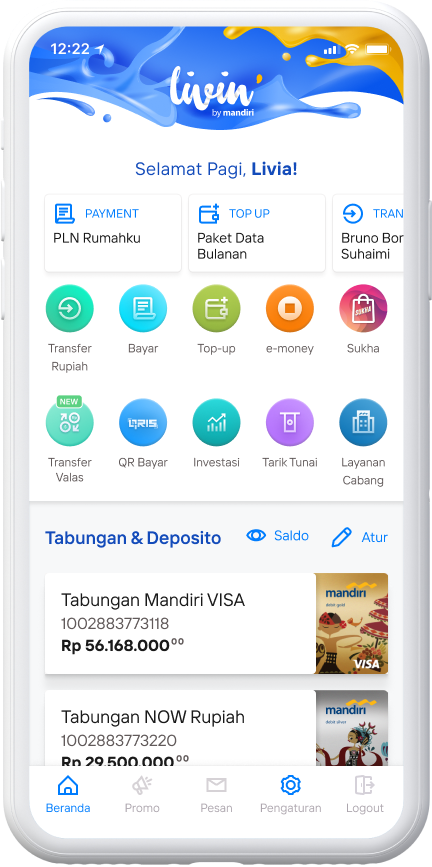

Download Now! Discover all the convenience of financial transactions in Livin'. And learn how to use it here.

How to Transfer Valas

Select the menu Transfer Forex

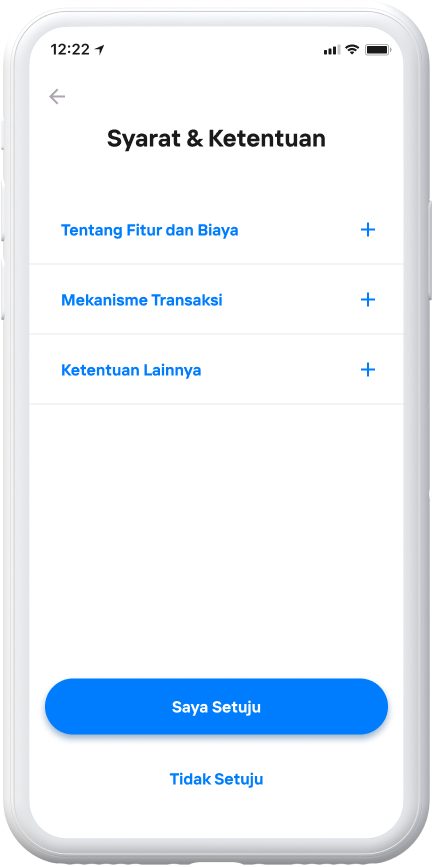

Select I Agree

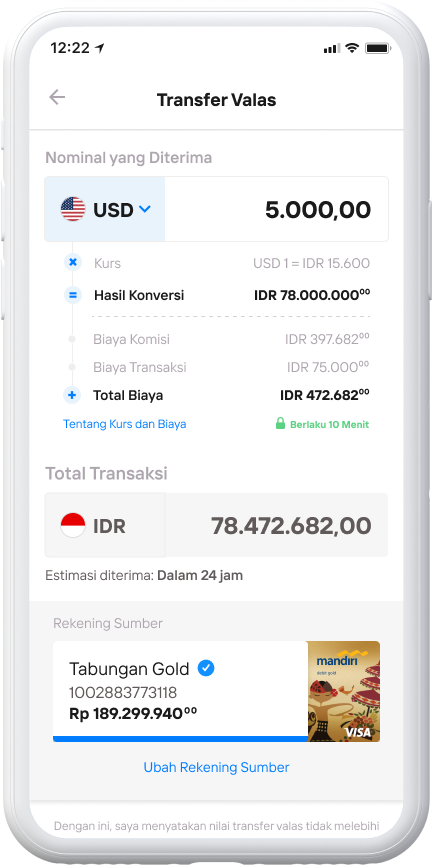

Enter the transfer amount and select Continue.

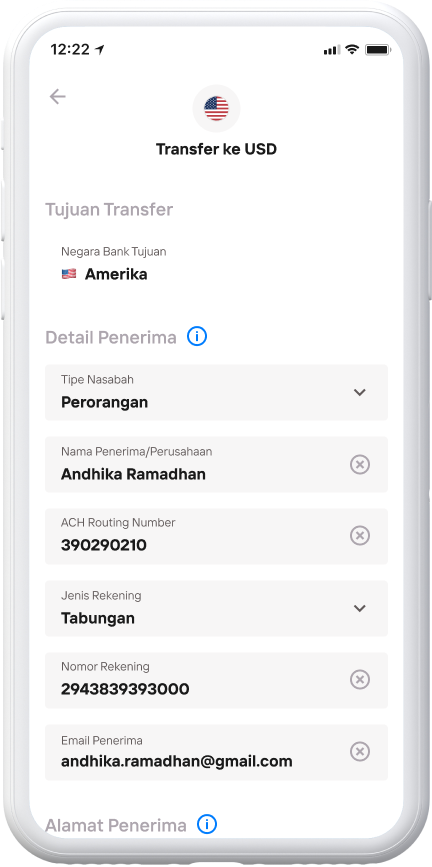

Complete the transfer recipient data, then select Continue.

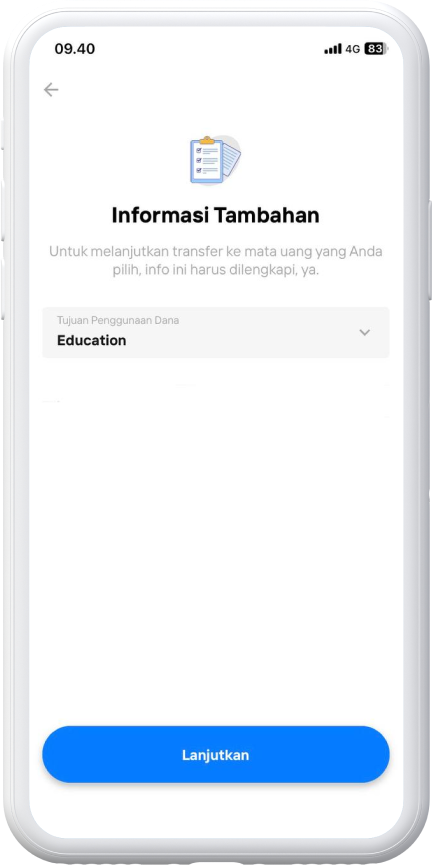

Complete the intended use of funds, then select Continue.

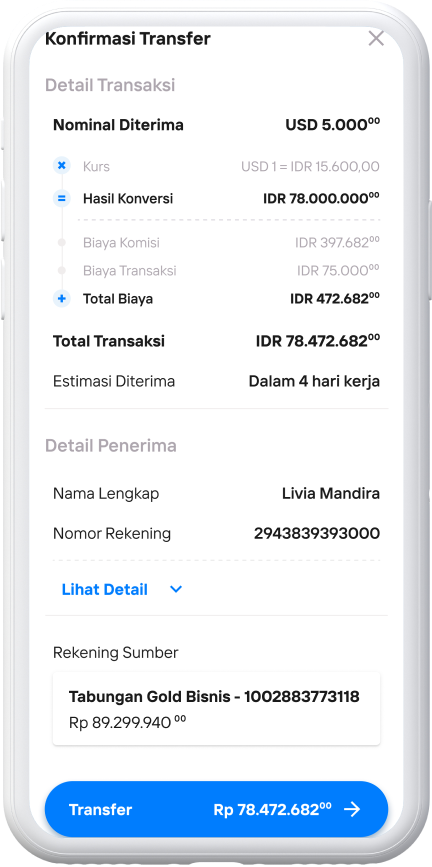

Confirm the transaction data then select Transfer

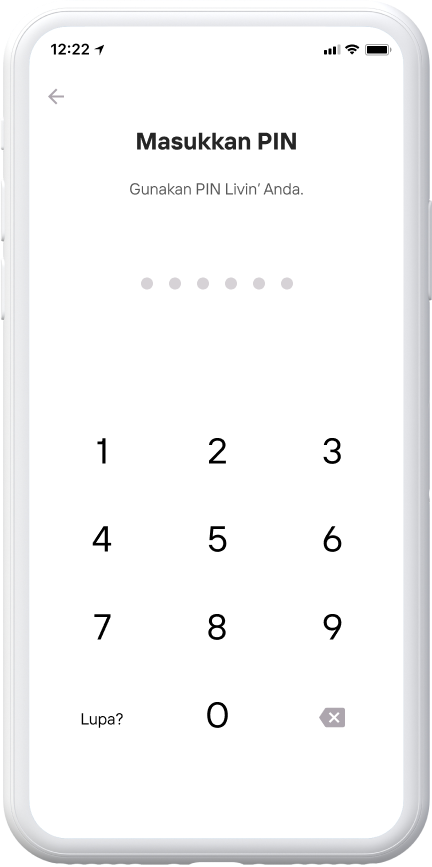

Enter Livin'PIN

The forex transfer request is successfully sent, to view the transaction status click Check Transfer Status.

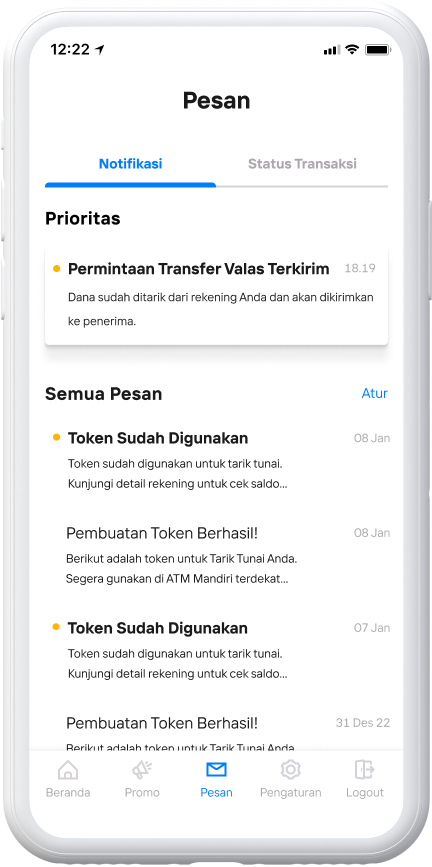

Transaction status can be checked periodically through the Message menu.

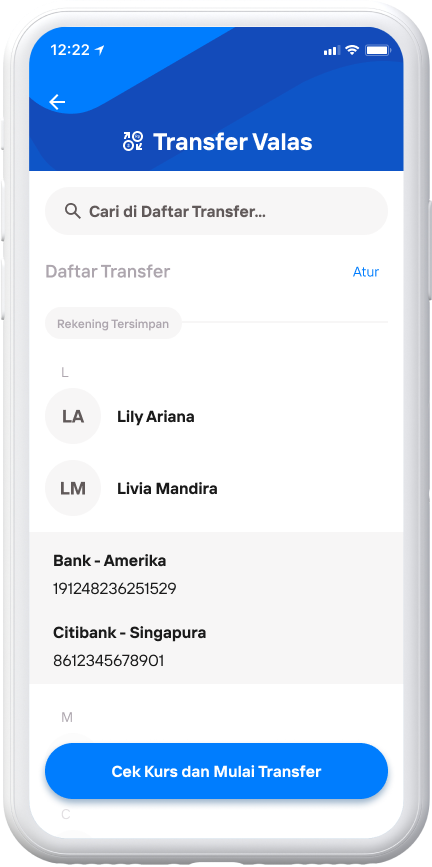

The recipient's account is automatically saved in the Transfer Register.

Risks:

- Risk of non-compliant transactions:

Risk of errors in inputting benefficiary / recipient data, so that funds fail to be sent or sent to the wrong recipient. - Risk of system failure:

Risk of connection disruption or system maintenance causing forex transfer transactions to fail. - Risk of failed transfer:

The risk of failed transfer occurs if the customer makes forex transfer transactions exceeding the daily limit or single transaction limit, or does not have sufficient balance.

FAQ - Transfer VALAS

Frequently Asked Questions (FAQs)

The Foreign Exchange Transfer feature in Livin' by Mandiri is a foreign exchange transaction feature for sending funds to overseas banks via the non-SWIFT method.

Forex transfers via non-SWIFT method can be done 24/7 through Livin' by Mandiri with forwarding of funds within minutes and funds received by the destination customer are not deducted by any fees (ull amount guarantee). any fees (ull amount guarantee).

Meanwhile, foreign exchange transfers via the SWIFT method can only be made during Bank Mandiri Branch Office operating hours with the imposition of the following fee components:

- OUR: the cost is charged to the sender

- BEN: costs are charged to the recipient

Customers can make transactions from IDR and foreign currencies to 9 destination currencies and a total of 28 destination countries as follows:

- USD: Amerika Serikat

- GBP: Inggris Raya

- EUR: Austria, Belgia, Belanda, Cyprus, Estonia, Finlandia, Perancis, Jerman, Yunani, Irlandia, Italia, Latvia, Lithuania, Luxembourg, Malta, Monako, Portugal, Slovakia, Slovenia, Spanyol

- SGD: Singapura

- AUD: Australia

- CAD: Kanada

- HKD: Hongkong

- INR: India

- THB: Thailand

- CNY: China

There are 2 components of transaction fees for Forex Transfers at Livin' by Mandiri:

- Commission Fees: will be calculated based on the amount and time of the sending customer's transaction. This fee is floating (subject to change) according to the nominal and transaction time of the sending customer.

- Transaction Fee: Free of charge until July 31 2024, then IDR 75,000 or the equivalent of USD 5 per transaction. This fee is a flat (fixed) fee charged per transaction to the sending customer

Yes. The exchange rate used for Forex Transfer transactions at Livin' by Mandiri is the current, more competitive rate.

No, it doesn't. Livin' by Mandiri's Forex Transfer feature allows customers to send funds to overseas banks 24/7 without limitation of transaction operating hours.

Funds from Forex Transfer transactions in Livin' by Mandiri can be forwarded to the destination customer in minutes, hours or days, depending on the choice of destination currency and the delivery time of the customer's transaction in the destination country.

Yes. The FX Transfer feature in Livin' by Mandiri is transparent by displaying the estimated time of funds forwarding on the FX Transfer main screen, after the transaction amount info is inputted by the sending customer.

All Livin' by Mandiri customers who have individual retail savings and current accounts in the following 10 currencies:

- IDR

- USD

- EUR

- SGD

- AUD

- GBP

- HKD

- CNY

- JPY

- CHF

- THB

- MYR

- SAR

The Foreign Currency Transfer service at Livin'by Mandiri can now be used for customers who need to send funds to bank accounts or e-wallets abroad.

Currently, FX Transfer service through non-SWIFT method can only be enjoyed at Livin' by Mandiri channel. Meanwhile, foreign exchange transaction services at Branch Offices can be enjoyed by customers through the SWIFT method.

Customers who wish to make Foreign Exchange Transfers other than the 9 destination currencies (USD, GBP, EUR, SGD, AUD, CAD, HKD, INR, THB and CNY), can visit the nearest Bank Mandiri Branch Office and make foreign exchange transfers using the SWIFT method.

Currently, the Forex Transfer service at Livin'by Mandiri can accommodate needs transactions to fellow Bank Mandiri destinations and overseas destination banks

Currently, the Forex Transfer service at Livin' by Mandiri is only available for fund transfers to the local currency of the destination country. For customers who have forex transaction needs to non-local currency of the destination country (e.g. transfer to Singapore to USD account destination) can use forex transfer services via SWIFT method at the nearest Bank Mandiri Branch Office.

Yes, there are transaction limit conditions as follows:

- Minimum transaction limits: USD 5 equivalent

- Maximum daily transaction limit: USD 25.000 equivalent

- Maximum monthly transaction limit USD 100.000 equivalent secara akumulatif per orang (jika transaksi dari sumber dana valuta IDR)

Customers can conduct forex transfer transactions at the Branch Office by bringing the underlying documents needed for the transaction.

Currently, the Forex Transfer service at Livin' by Mandiri can only be used for monthly transaction nominal of USD 100,00 equivalent without underlying documents. For transaction needs above USD 100,000 equivalent with underlying documents can only be done through the SWIFT method at the nearest Bank Mandiri Branch Office.

Yes. Customers can track the status of their FX Transfer transactions in Livin' by Mandiri with the following steps:

- Klik Menu Inbox atau Pesan di Livin’ by Mandiri.

- Select the details of the FX Transfer transaction that has been transacted in the Priority section.

In addition, customers will also be sent a Push Notification when there is a change in the status of a successful or failed transaction.

- Transfer Request Sent: funds have been withdrawn from the sending customer's account and will be sent to the destination customer.

- Forex Transfer Processed Successfully: the funds have arrived at the destination bank and are being forwarded to the recipient's account.

- Unsuccessful Forex Transfers: The transaction cannot be forwarded because (a) there is a discrepancy in the recipient's details, or (b) the recipient's account is inactive, or (c) the customer is indicated in the sanction screening list in Indonesia and the destination country.

Yes. Customer funds will be returned to the source account with the following conditions:

- Customer funds will be refunded using the prevailing exchange rate at the time of the refund date with a return SLA of no later than 7 working days.

- If the sending or receiving customer is indicated in the Anti-Money Laundering and Prevention of Financing of Terrorism (AML/CFT) and/or sanction list checks, the Bank has the right to cancel the transaction. transaction or request additional supporting documents to the sending customer to be submitted to the authority.

Yes. The recipient will be notified of the fund transfer from Bank Mandiri through the e-mail that has been inputted by the sending customer during the FX Transfer transaction process at Livin' by Mandiri.

Yes. The recipient details required for transactions to 10 currencies for Forex Transfers in Livin' are dynamic according to the transfer requirements of each destination country's local currency.

- Receiver type (Bisnis/Perorangan)

- Recipient name

- ACH Routing Number (9-digit identifier of the recipient's bank account within the United States)

- Account type (Giro/Tabungan)

- Account number

- Alamat penerima (negara tujuan, kota, kode pos, nomor bangunan/rumah)

- Recipient email

- Receiver type (Bisnis/Perorangan)

- Recipient name

- UK Sort Code 6-digit identifier of the beneficiary's bank account in the United Kingdom

- Account number

- Recipient email

- Recipient type (Business/Individual)

- Recipient name

- IBAN (14-digit identifier of the recipient's existing bank account in EU countries)

- Account number

- Recipient email

- Receiver type (Business/Individual)

- Recipient name

- Bank name

- Account number

- Recipient email

- Receiver type (Business/Individual)

- Recipient name

- BSB code (6-digit number consisting of: bank, country, and branch number in Australia)

- Account number

- Recipient's address (Country, City, Destination Address)

- Recipient email

- Receiver type (Business/Individual)

- Recipient name

- Account Type (Current Account/Savings Account)

- Email or mobile phone number of the recipient

- Interac Security Question & Answer

- Recipient's address (Country, City, Destination Address, Building Number)

- Recipient emails

- Receiver type (Business/Individual)

- Recipient name

- Hong Kong Clearing Code(6-digit number consisting of 3 digits Bank Code and 3 digits Branch Code)

- Account type (current account/savings account)

- Account number

- Recipient email

- Receiver type (Business/Individual)

- Recipient name

- Routing Code IFSC(11-digit number consisting of the number: bank, and branch in India)

- Account number

- Recipient email

- Receiver type (Business/Individual)

- Recipient name

- Thailand Bank Code(3-digit angka yang merepresentasikan bank di Thailand)

- Account number

- Recipient email

- Recipient name

- Alipay ID

- ecipient email

For the Purpose of Use Funds field, the following options are available: Personal, Family, Education, Training, Goods, Travel, Property, Service, Loan, Investment, Medical, Other Users can choose according to their transaction purposes

Yes. There is a local government requirement for CAD currency. Canadian local government regulations stipulate that the recipient must answer the security question correctly according to the security answer inputted by the sending customer. If the recipient does not answer the security question with the appropriate security answer, or within 30 days the recipient does not answer the security answer, the transaction will be automatically cancelled and refunded according to the applicable SLA (Service Level Agreement) provisions.

The writing of the recipient's name is adjusted to the name registered in the account. If the recipient's name only consists of one word, the sender can rephrase the first name as the last name.

If customers experience problems with the source of funds account not appearing, first make sure the source account is active.

If customers experience problems with the 'Save to List' button not appearing, this is because:

- The recipient's data will be autosaved into the 'Saved List' after a successful overseas Forex Transfer.

- The data entered by the customer in relation to the recipient's details will be saved and will auto prefill the fields when the customer performs the transaction again by selecting from the 'Saved List'.

- If the customer makes a forex transfer with the same name, but the destination account is different, then the 'Saved List' will show two different accounts for the same name.

Customers must re-verify (provisioning) to change the transaction PIN in order to return to transactions.

The terms and conditions of Overseas Forex Transfer through Livin' by Mandiri can be accessed through the following link https://bmri.id/livintncvalasln

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang