QRIS

QRIS ID/ENG

Enjoy the benefits and convenience with Bank Mandiri QRIS.

Make it easy to accept transactions using QR codes from all QR-based applications in Indonesia for the convenience of your business.

Benefits of Becoming a QRIS Mandiri Merchant

Our products with

Static QRIS

QR codes that can be printed on stickers, tentcards, lanyards to facilitate a variety of different payment transactions

Our products with

Dynamic QRIS

QR Code yang di-generate melalui menu QRIS pada mesin EDC atau POS anda, dan hanya bisa digunakan untuk satu kali transaksi

QRIS Transaction Fees and Limits

A. Cost

Regular Merchant

| Business Type | Details | MDR |

|---|---|---|

| Micro Business | Transaction Nominal ≤ 500,000 (less than or equal to five hundred thousand rupiah) | 0.0% |

| Transaction Nominal > 500,000 (more than five hundred thousand rupiah) | 0.3% | |

| Small, Medium, and Large Enterprises | 0.7% |

Speciality Merchants

| Business Type | MDR |

|---|---|

| Education | 0.6% |

| SPBU | 0.4% |

| Public Service Agency, Public Service Obligation | 0.0% |

| Government to People (Contoh: Bansos) | 0.0% |

| People to Government (Contoh: Pajak dan Donasi Sosial) | 0.0% |

B. Transaction Limit

The nominal for each QRIS transaction is limited to a maximum of IDR 10,000,000 (ten million rupiah) per transaction in accordance with PADG provisions.

FAQ ID/ENG

Frequently Asked Questions (FAQs)

Merchant benefits:

With the integration of QR codes into one QRIS for all, the transaction process becomes more effective and efficient so that it can cut queue time.

Benefits for consumers:

Consumers can be more flexible in choosing payment applications with QR codes when making transactions. Imagine, consumers who were previously faced with QR codes from various application providers before making a payment transaction, are now only faced with one QR code, namely QRIS, which is certainly much more flexible!

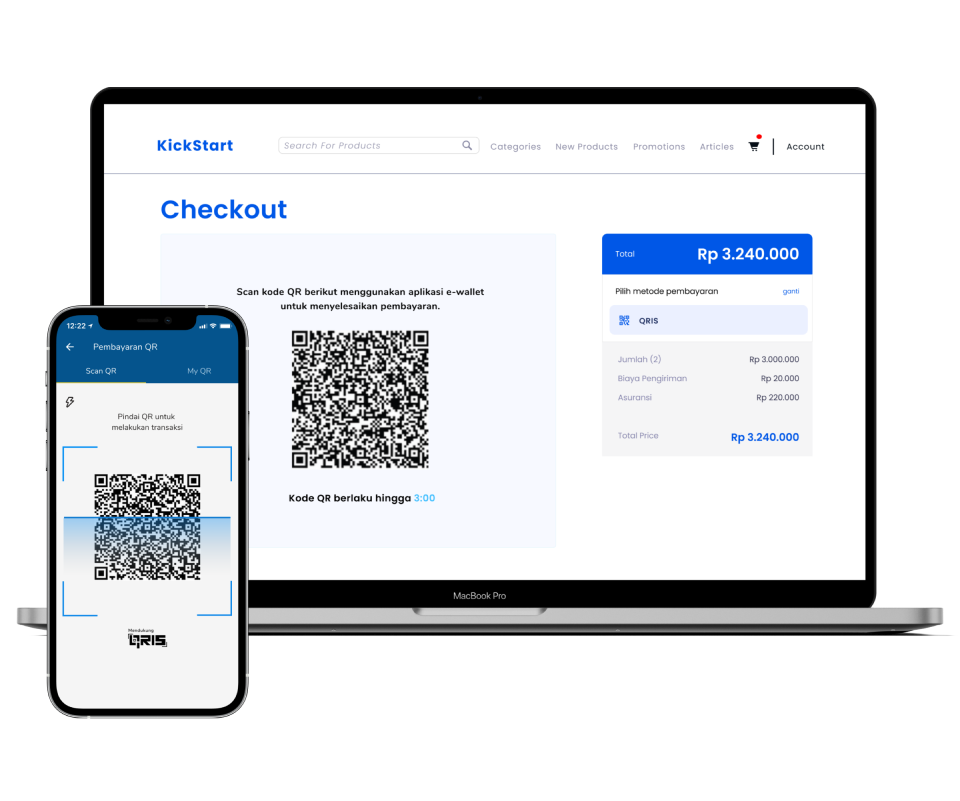

Merchant Presented Mode (MPM)

A payment method where the Merchant's QRIS will be scanned by the consumer using Livin' by Mandiri or other payment apps, how:- Open Livin' by Mandiri

- Pilih QR Pay

- Scan the merchant's QRIS

- Enter Livin' Pin

- Receive notification of successful payment

Customer Presented Mode (CPM)

A payment method where consumers generate QRIS through Livin' by Mandiri or other payment applications to be scanned by POS or Merchant Scanner, how:- Open Livin' by Mandiri

- Select QR Pay, then select Show QR

- Enter Livin' Pin

- Appear QR and point at Merchant POS/ Scanner

- Receive notification of successful payment

- QRIS as an alternative to receiving non-cash payments from the Livin' by Mandiri application and various other banking and / or fintech applications.

- Transactions are automatically recorded and the transaction history can be recapitulated.

- Decrease the risk of loss due to giving the wrong change or receiving payment with counterfeit money.

| Merchant Type | Category | % MDR |

|---|---|---|

| Reguler | Regular Micro Business (UMI) | 0.3% |

| Small Business (UKE), Medium Business (UME) and Large Business (UBE) | 0.7% | |

| Special | Education | 0.6% |

| Public Fuel Filling Stations (SPBU), Public Service Agency (BLU), Public Service Obligation (PSO) | 0.4% | |

| Government to People (G2P) such as Social Assistance (Bansos), People to Government (P2G) including taxes, passports, and social donations (non-profit) | 0% |

All types of digital payment methods have risks, including payments using QRIS, which are divided into QRIS payments through merchants and payments using the Livin' by Mandiri application with the QR Payment feature.

The risks associated with QRIS at merchants include:

- Risk of Inappropriate Transactions:

- The risk of the QR which is to be paid is a fake QR, not belonging to the merchant where the transaction is taking place. Therefore, it is necessary to ensure that the QR code matches the name of the merchant where the customer is making the payment transaction.

- Risk of QR payments using QR codes sent by fraudulent entities, leading to the funds paid by the customer being directed into the account of the fraudster.

- Risk of data security:

The potential risk of compromising personal data by scanning QR codes from unreliable or insecure sources, leading to possible privacy violations through irresponsible parties. -

Risk of System Failure:

The risk of connection disruptions or system maintenance leading to payment transaction failures. - Risk of Payment Failure:

The risk of payment failure occurs when a customer attempts a payment transaction exceeding the daily limit, the per-transaction limit, or when there are insufficient funds available in the account.

For individual customers

For individual customers