Deposit Swap

Product - PS - Depositswap

Mandiri Deposit Swap

Mandiri Deposit Swap

- PRINCIPAL PROTECTED PRODUCT

Invested fund is securely protected, co there is no potential decrease nor lost losses. - POTENTIAL FIXED AND HIGHER YIELDS

Potential yields are higher than conventional foreign exchange savings products. Yields obtained depend on the number of days within the cap and bottom as determined by the reference exchange rate chosen by the customer. - TRANSACTION TENOR

Tenors are 1,3,6 and 12 months, 24 months or according to the deposit period. May not be redeemed before due. - Currency Choice

Investment funds is in Non-IDR currencies such as USD, SGD. - FEES AND TAXES

- Duty stamp charfe for Bills and Agreements

- Tax will be calculated based on the difference between the final investment yield (in Initial Currency) and the initial placement amount (in Initial Currency)

- Mandiri Deposit Swap Agreement (term is effective for 2 years).

- Structured Product Customer Questionnaire Form (valid for 2 years).

- Product Highlight (each transaction), contains the detailed information concerning product features.

- Term Sheet (each transaction), contains the detailed information on customer's MDS transaction.

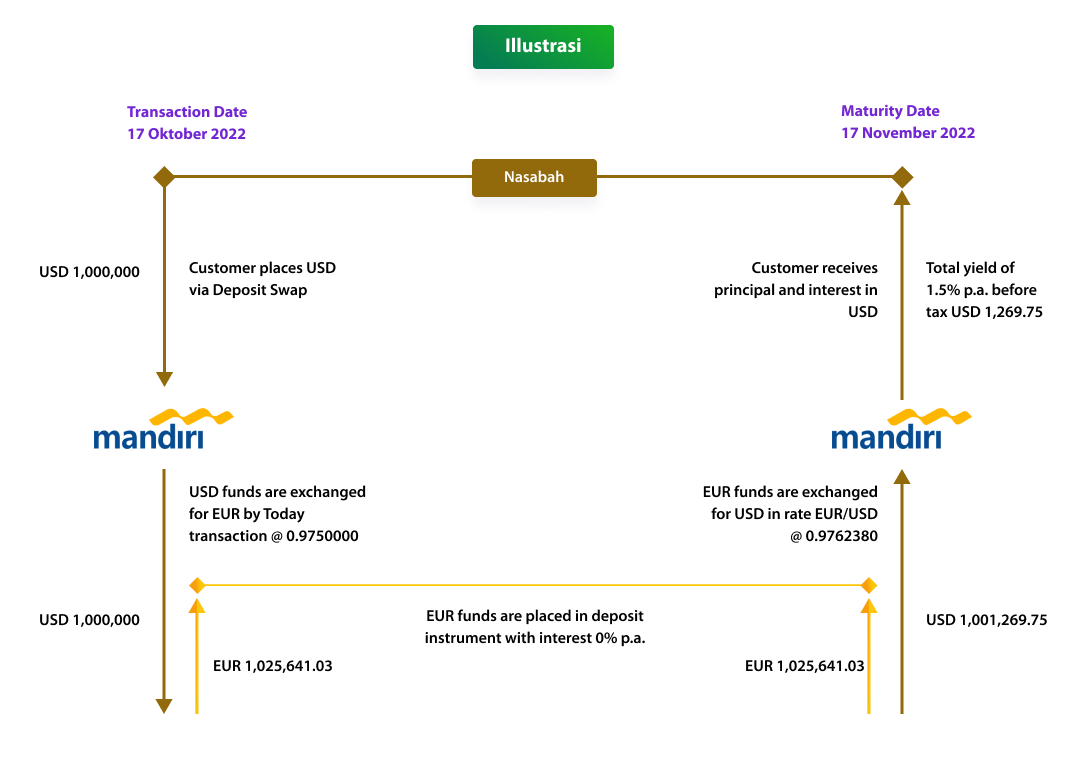

| Initial investment funds | USD 1,000,000 |

| Savings product | Deposit |

| Deposit palcement currency | EUR |

| Initial Conversion exchange rate | 1.0440000 |

| Final Conversion exchage rate | 1.0448910 |

| Deposit Tenor | 1 (one) Month |

| Transaction Date | 17 Oktober 2022 |

| Maturity Date | 17 November 2022 |

| Total Days | 31 hari |

| EUR Deposit Interest rate | 0% p.a. before tax |

| Total Returns Gained | 1% p.a. before tax |