Dual Currency Investment

Product - PS - Dual Currency Investment

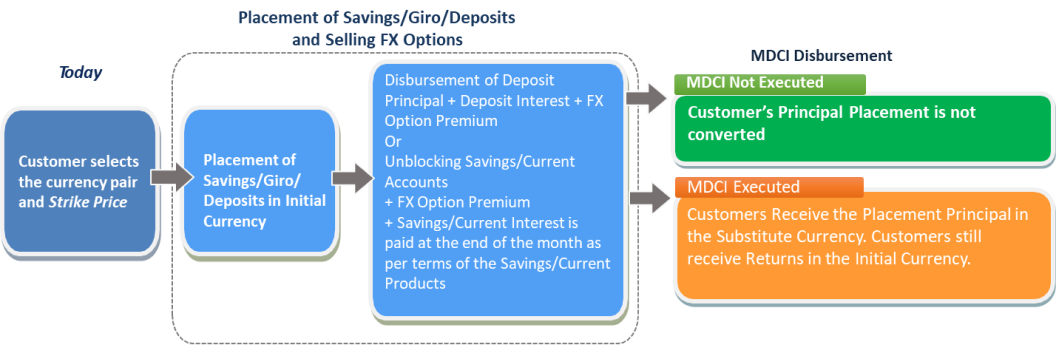

Mandiri Dual Currency Investment

Mandiri Dual Currency Investment

- NON-PRINCIPAL PROTECTED PRODUCT

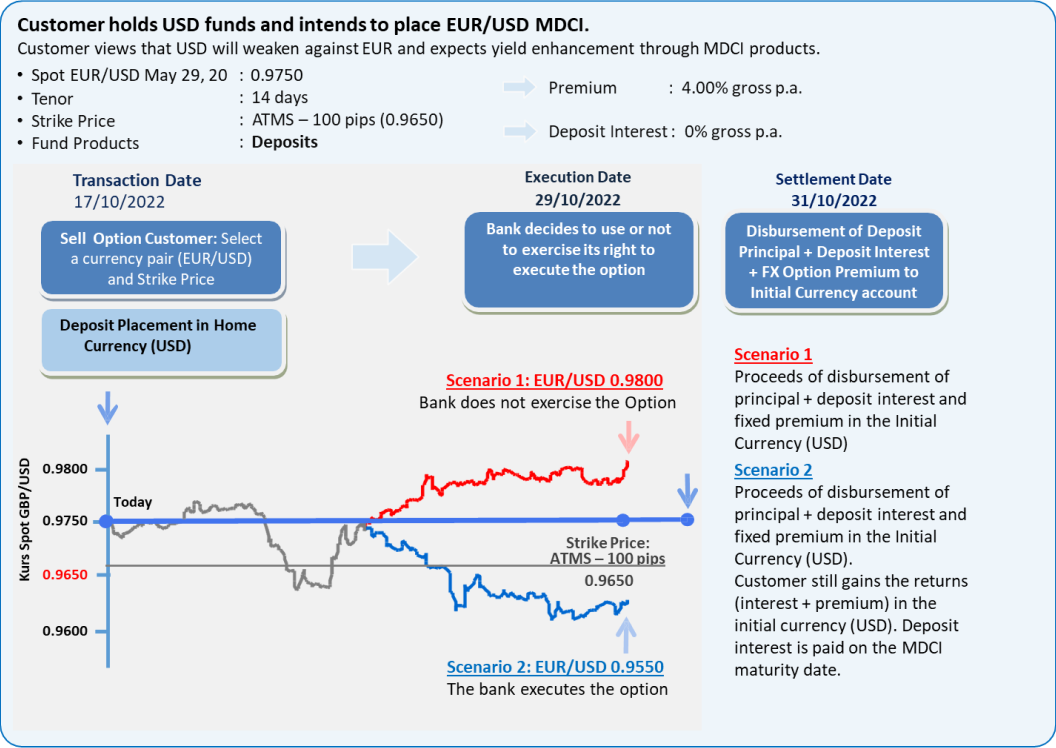

Placement funds are not protected. There is the potential for funds to be converted into other currencies if market movements do not match the customer's view. - POTENTIAL HIGH RETURNS

Potential returns are higher than conventional savings products obtained from fund product interest and FX OPTION premiums. - TRANSACTION TENOR

The investment period is 14 days with savings products, and 1 month with Deposit products. Cannot be redemed before due. - CURRENCY CHOICE

Investment placement funds are in Non-IDR currencies such as USD, EUR, GBP, AUD, JPY, and SGD. - FEES AND TAXES

- Stamp fees for Bills and Agreements

- Tax will be calculated on Deposit Interest and FX Option Premiums

- Mandiri Dual Currency Investment Agreement (effective term for 1 year)

- Structured Product Customer Questionnaire Form (valid 1 year)

- Product Highlight (each transaction), contains detailed information on product features

- Term Sheet (each transaction), contains detailed customer MDCI transaction information