Kredit Modal Kerja

New Kredit Modal Kerja

Working Capital Loan

Mandiri Working Capital Loan is a loan facility in Rupiah and Foreign Currencies provided to finance working capital needs such as inventory / receivables / projects.

Working capital loan is divided into 2, namely Revolving and Non-Revolving Working Capital Loan

Benefit:

Providing financing solutions for working capital needs aligned with business requirements.

Loan Features :

1. Revolving Working Capital Loan

- Loan limit over IDR 500 million to IDR 25 billion.

- The loan is given in Rupiah and foreign currency.

- Primary collateral is financed inventory and/or receivables. Additional collateral can be land or land and buildings.

- Disbursement is carried out at any time as needed.

- Credit facilities repayment, principal reduction or loan principal payment can be completed at any time during the credit period.

- Interest payments are completed every period/date as the Bank determines. The interest rate is floating and effective.

- The maximum term is one year and can be extended.

2. Non-Revolving Working Capital Loan

- Loan limit over IDR 500 million to IDR 25 billion.

- The loan is given in Rupiah and foreign currency.

- Primary collateral is financed inventory and/or receivables. Additional collateral can be land or land and buildings.

- Disbursement is done all at once.

- Loan principal payments are paid in installments every certain period as the Bank determines or made all at once when the facility matures.

- Interest payments are made every period/date as the Bank determines.

- The maximum term is five years and cannot be extended.

Loan requirements :

1. Conditions for applying:

- Individual Business Customers:

- Indonesian Citizen

- Legally competent

- Business Entity Customers

Based on relevant legal provisions, customers who are legal business entities.

2. To apply for financing, the documents required include:

| Documents | Individual Business Customers | Business Entity Customers |

|---|---|---|

| Application Form | ✓ | ✓ |

| Copy of KTP of Applicant & Husband/Wife | ✓ | - |

| Copy of Marriage/Divorce Certificate (for those who are married/divorced) | ✓ | - |

| Copy of savings/current account statement for at least the last 6 months | ✓ | ✓ |

| Copy of NPWP | ✓ | ✓ |

| Copy of business permits (such as SIUP, SITU, TDP/NIB etc.) | ✓ | ✓ |

| Copy of the Deed of Establishment of the Company and the Deed of Amendment | - | ✓ |

| Copy of KTP of all company management and shareholders | - | ✓ |

| Copy of collateral ownership documents (such as SHM/SHGB/SHMSRS etc.) | ✓ | ✓ |

Other documents will be adjusted during facility processing.

Simulation of Interest Loan Payment:

- Revolving Working Capital Loan

- Loan: IDR 1,000,000,000.00

- Term: 12 months

- Interest Rate: 12% effective p.a

The estimated interest that must be paid every month is :

| Disbursement date | Billing date | Average Balance | Interest rate | Estimated Loan Interest payment |

|---|---|---|---|---|

| 23/10/2023 | 23/11/2023 | 1,000,000,000 | 12% | 10,333,333 |

*) The interest calculation provided above is merely a simulation or estimation and subject to change

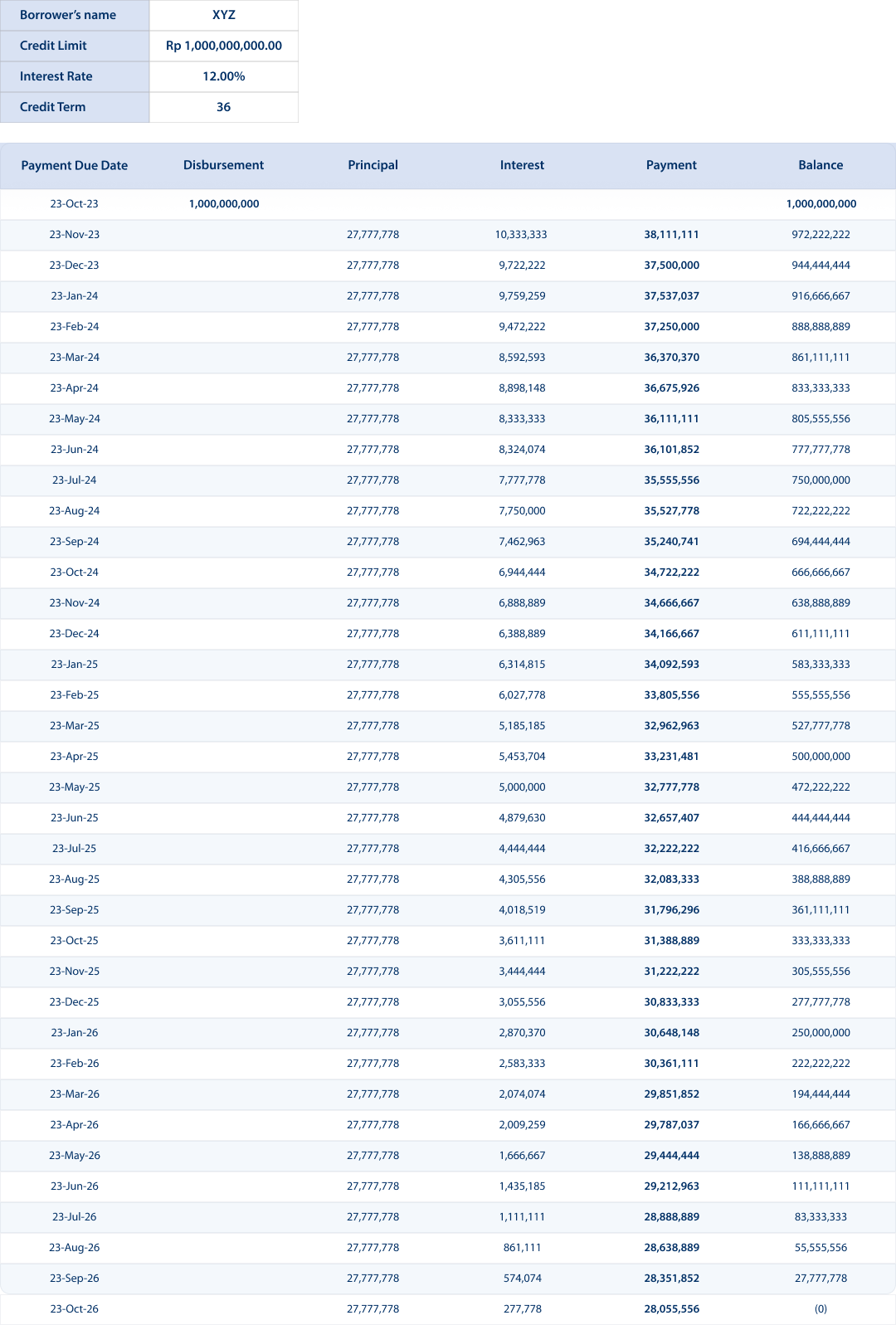

Installment Calculation Simulation:

- Facilities: Non-Revolving Working Capital Credit

- Loan: IDR 1,000,000,000.00

- Term: 36 months

- Interest Rate: 12% effective p.a

The estimated interest and principal that must be paid each month is (according to the table)

The credit details above are a simulation with prorate principal payments every month and subject to change

Loan Risk:

Loan risks that may occur include:

- Changes in interest rates based on the Bank's considerations or Regulatory provisions

- Changes in exchange rates (if the credit currency is in foreign currency)

Estimated Loan Costs:

Estimated credit costs in providing credit include:

- Provision Fees

- Administration Fees

- Collateral Binding Fees

- Collateral Insurance Fees

- Collateral Appraisal Fee

For further information and applications for Working Capital Credit, you can submit it via the nearest Bank Mandiri branch or Mandiri Call 14000