Livin' Auto

AUTOLOAN 2024

Get the best offer for your loan application

Learn MoreLooking for a car?

We've Got it All

Run the loan simulation.

It's easy!

Cara Mudah Daftar Livin' Merchant

Tambah Produk

Cara menerima pesanan via Kasir

Mulai Belanja Online

Pengaturan Akun

Menerima Pesanan Online

FAQ Autoload

Frequently Asked Questions (FAQs)

Livin' Auto is a feature in the Livin' by Mandiri application that provides end-to-end financing services for vehicle purchases to Bank Mandiri customers through credit applications processed by financing institutions in collaboration with Bank Mandiri. Through Livin' Auto, customers can enjoy various features, including a wide selection of vehicles, credit simulation, easy application process, and attractive offers, all integrated in one application.

Livin' Auto provides many benefits to customers, namely:

- Special interest rate for customers

- Short and easy application process, as it is integrated with the customer database in the Livin' by Mandiri app

- Fast processing

- Seamless Payment

- Complete features that make it easy for customers to apply for vehicle purchases end-to-end from vehicle selection, payment, to tracking the status of the application in real time anywhere and anytime.

Details of the features contained in Livin' Auto are as follows:

- Indicative Limit

The maximum limit that can be given based on the bank's internal assessment which is not binding. The final limit can be obtained after the customer applies for credit and is processed by the bank's partner financing institution. - Explore

VehiclesCustomers can obtain complete information regarding the vehicle to be purchased, both exterior and interior of the vehicle, including specifications. - Vehicle Recommendations

Customers can see vehicle options that are in accordance with the desired limit and budget. - Loan Simulation

This feature helps customers to be able to calculate the vehicle price instalment simulation based on the amount of down payment, insurance and tenor chosen. - Financing Application

Customers can apply for vehicle purchase financing through Livin' Auto online in an easy and fast way, which is divided into 2 stages, namely:

a. Simulation

b. Filling in personal data information - Track Application Status

Customers can monitor the latest updates on their financing application in the Livin' by Mandiri application directly. This feature helps the process of applying for financing through Livin' Auto to be more transparent to customers without the need to manually ask the Bank officer.

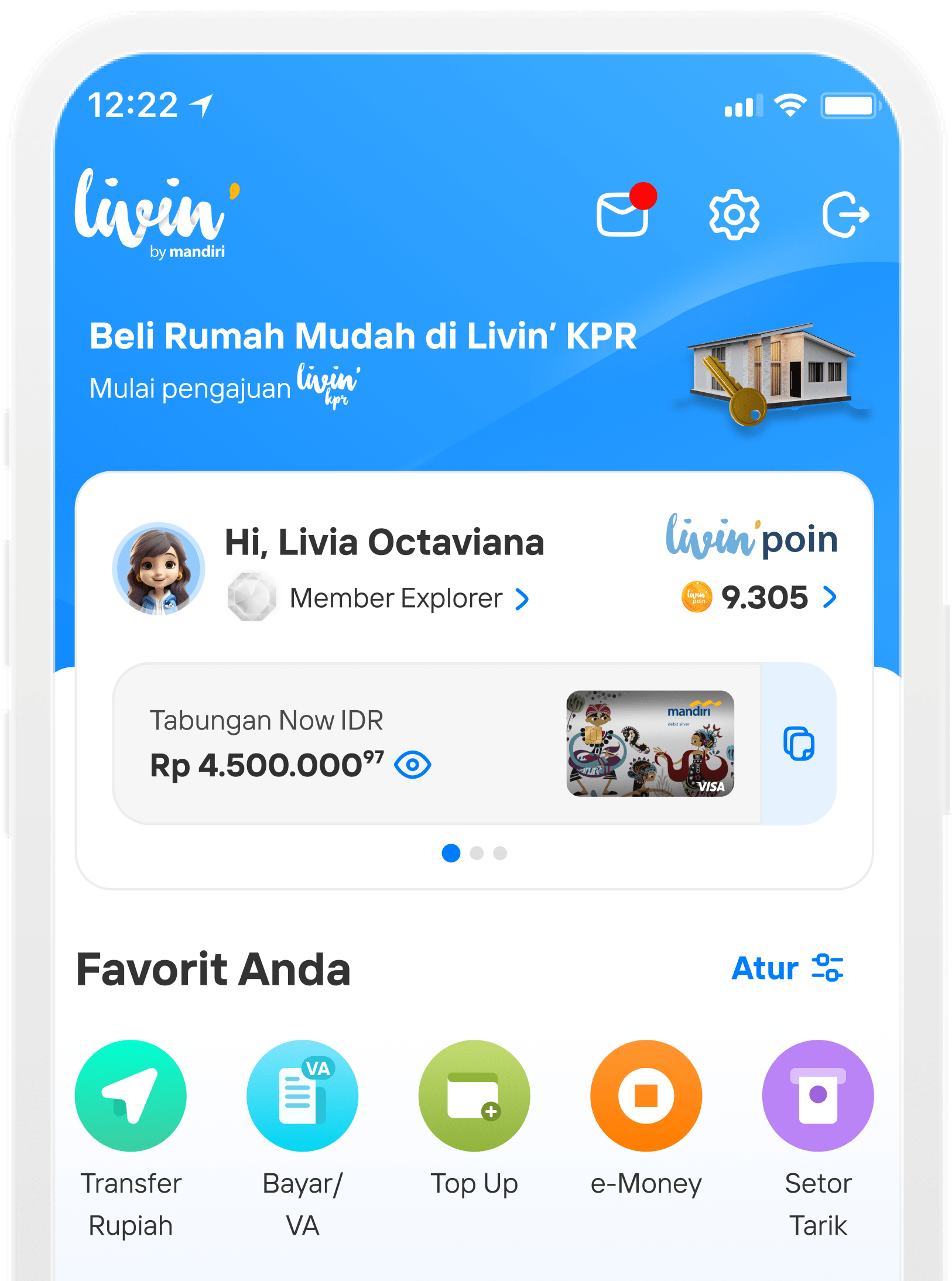

Customers can access Livin' Auto on the Livin' by Mandiri app via:

- Livin' Auto Menu

- Livin' Auto widget

- Livin' promo page

Currently, applications for vehicle financing through Livin' by Mandiri are specifically for applications for financing the purchase of new non-commercial vehicles at selected dealers.

Currently, used vehicle financing is not yet possible through Livin' Auto.

The maximum limit for vehicle financing applications is IDR 5 billion.

The minimum age at the time of credit application is 21 years old or married and the maximum age is 60 years old at the time of credit

is paid off. For Bank Mandiri Priority/Private customers, the maximum age limit is 65 years old at the time of

credit repayment.

Minimum 1 year and maximum 5 years. The maximum tenor is also based on the upper limit of retirement age (60

years) for regular customers and 65 years for priority/private customers whichever is shorter.

Submission of Financing through the New Livin' by Mandiri Application cannot be done on a joint income basis.

Booking fee that must be prepared by the customer for purchase is determined by the tiering price of the unit to be purchased

- Car price up to IDR 800 million, booking fee IDR 5 million

- Car price > IDR 800 million, booking fee IDR10 million

- For Lexus brand cars, booking fee of IDRc50 million

The TDP that can be paid to obtain financing from Mandiri's partner financing institutions is a minimum of 10% and a maximum of 50% of the on-the-road vehicle price.

The application process for vehicles with indent status refers to the same vehicle financing application as the ready vehicle.

-

Interest rates for new passenger cars, viz:

Tenor (Years) Interest Rate

Flat p.aInterest Rate

Effective p.a1 1,99% 4,32% 2 2,55% 5,24% 3 2,45% 4,93% 4 3,75% 7,34% 5 4,55% 8,68% *The interest rate is effective 31 January 2025

**Interest rates are subject to change at any time - Free of provision fees

- Cashback worth IDR 2.6 million for the first 52 liquid debtors on car financing

- e-money worth IDR 500,000 for the first 52 liquid debtors on car financing

-

Maroon 5 tickets for 22 first liquid debtors on car financing

The customer will be informed that the financing application was successfully submitted and the customer can track it through the Application Status Details in Livin' Auto.

- - Whastapp MONA (MUF Online Assistant): 082111824010

- - MUFCall: 1500824 (Monday - Friday: 08:00 to 15:00 WIB & Saturday: 08:00 to 12:00 WIB)

- - MUFMail : mufcare@muf.co.id (Monday - Friday: 08:00 to 15:00 WIB & Saturday: 08:00 to 12:00 WIB)

- - Website : www.muf.co.id

- - MUF Branch Office: Operating Hours Monday - Friday: 08:00 to 15:00 & Saturday: 08:00 to 12:00 local time.

2) Contact Mandiri Tunas Finance

- - Care Centre 1500059 (Monday to Friday at 08.00 to 17.00 WIB)

- - email : customer.care@mtf.co.id (Monday to Friday at 08.00 to 17.00 WIB)

Booking fee refund conditions are in accordance with the provisions of each dealer registered with Livin' Auto which can be read on the following page:bmri.id/livinautorefundbookingfee

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang