Livin' Paylater - Cara Aktivasi dan Menggunakan

Head Paylater r17

Paylater in Livin' by Mandiri

Discover all the convenience of financial transactions in Livin' and learn how to use it here.

How to Activate Paylater on Livin' by Mandiri

Instructions for UseHow to Use Paylater on Livin' by Mandiri

Instructions for UseHow to Check Livin' Paylater Transaction

Instructions for UseHow to Check Livin' Paylater Billing Details

Instructions for UseRisks:

- Credit Default Risk

The use of Livin Paylater must be accompanied by routine payments according to the due date of the Livin Paylater bill, so that customers can avoid the risk of credit default. - Customer Data Security

Livin Paylater users must protect their personal data to avoid the risk of unauthorized use of their Livin Paylater account by irresponsible parties.

Frequently Asked Questions (FAQs)

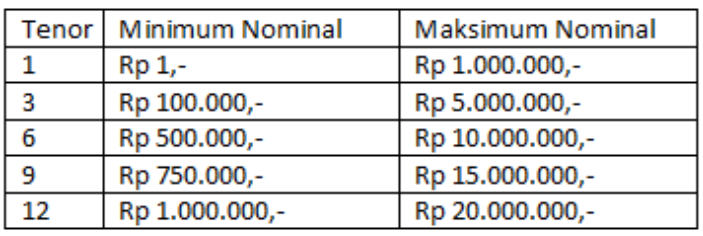

Livin' Paylater is a loan facility provided by Bank Mandiri for transaction payments using QR and Virtual Account (VA) at all merchants, as well as payment for items at Livin' Sukha merchants. This service uses the 'buy now, pay later' concept with a choice of payment terms of 1, 3, 6, 9, or 12 months.

- Can be used for transactions up to a maximum of IDR 20 million.

- Installment period from 1 month to 12 months.

- Approval of applications is relatively fast.

- Can be used for QR and Virtual Account (VA) transactions at all merchants and item payments at Livin Sukha merchants via the Livin' by Mandiri application.

- Bill payments are made by auto debit according to the transaction due date.

- Loan interest rates 1.5% flat per month

- Admin fee start from 0% per transaction.

- Admin fee and loan interest rates may change at any time.

- Late payment charged starting from 4% per month of the outstanding bill.

- Indonesian citizens.

- Individual customers who have an active account at Bank Mandiri.

- Minimum age 18 years and maximum 65 years.

- Have a NIK that has been registered as an e-KTP

- Submission of Livin' Paylater is done online via the Livin' by Mandiri application.

- Notification of the results of the Livin' Paylater application will be sent via the Livin' by Mandiri application and registered email.

Maximum limit up to IDR 20 million.

Can change at any time following the Livin' transaction conditions.

Livin' Paylater can be used at all merchants that support QRIS via the QRIS menu, as well as for payments using the Virtual Account Number (VA Number) via the Pay/VA menu in the Livin' by Mandiri application.

Livin' Paylater uses a multiple billing concept, where the payment due date for each transaction is 1 month after the transaction date. For example, if a transaction is carried out on July 12 2023 with a tenor of 3 months, then the maturity dates are August 12, September 12 and October 12 2023. Especially for transactions carried out on the 30th or 31st, the maturity date will be adjusted to the last date. in the following month.

Livin' Paylater payments are made by auto debit according to the transaction due date. You just need to ensure the availability of funds in your account.

Early repayment is currently not possible.

- • You will be charged a late fee of 4% of the outstanding amount.

- • Your Livin’ Paylater account will be temporarily blocked.

- • Your debit account will be blocked according to the amount of the outstanding bill.

If you feel that you have not carried out the transaction, report it immediately via Mandiri Call 14000.

- If there are transactions that are not approved repeatedly, first check the availability of limits and the status of your Livin' Paylater account via the Livin' application.

- If the limit is still available and your Livin' Paylater account is still active, immediately report transaction problems via Mandiri Call 14000.

Account blocking or closing can be done with the following steps:

- Click the "Portfolio" button on the main screen of the Livin’ application.

- Click the "Loans" button on the portfolio page.

- Click the "Livin’ Paylater" button on the loan page.

- Click the screw/gear icon in the right corner of the Livin’ Paylater page.

- Click the "Temporarily Block" button if you want to temporarily stop using Livin’ Paylater funding sources for QR or VA payments.

- Click the "Close Livin’ Paylater" button if you have no active transactions and want to close the Livin’ Paylater credit facility.

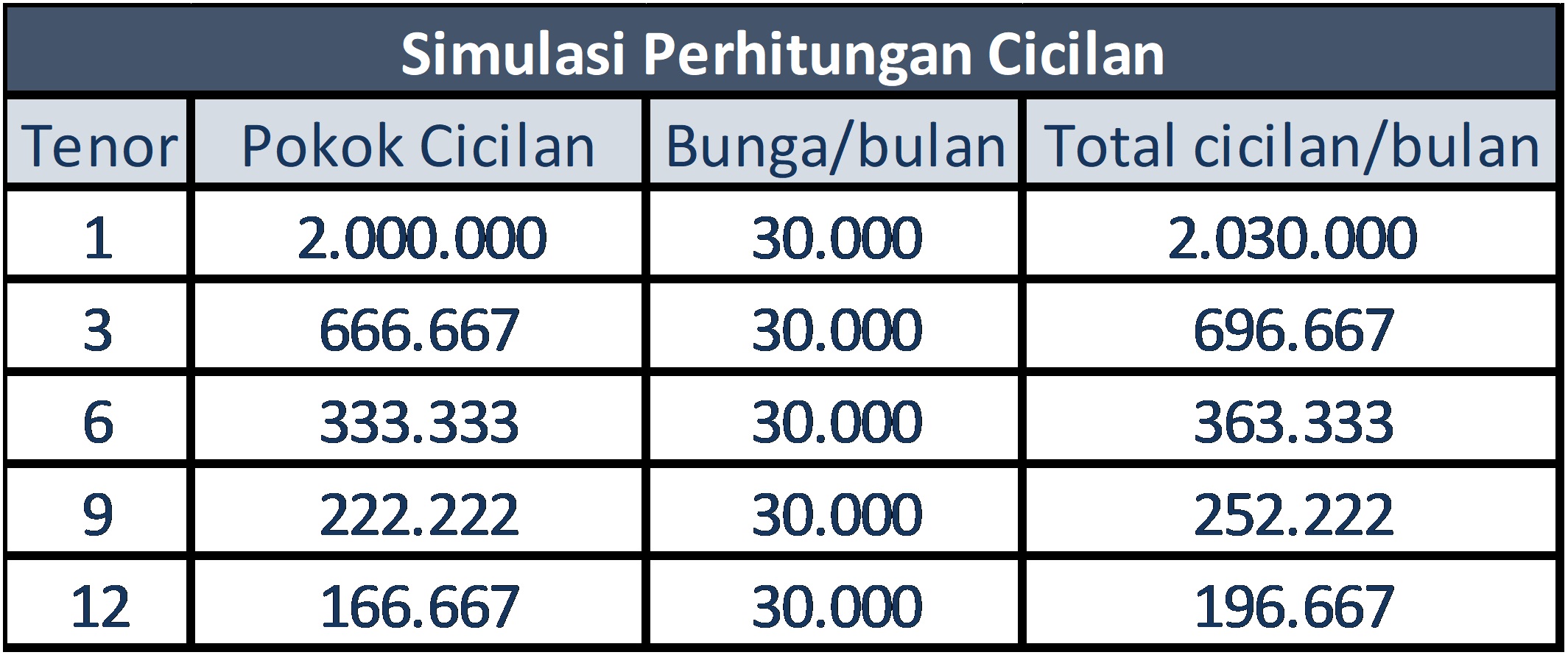

- Example of interest installments with a transaction nominal of IDR 2,000,000.

- Example of calculating a 3 month tenor (nominal installments per month).

- Nominal per month =

(transaction nominal/installment tenor) + (1.5% interest from transaction nominal)

= (IDR 2,000,000/3) +(1.5% x IDR 2,000,000)

= IDR 666,667 + IDR 30,000

= IDR 696,667 - Total to be paid = (monthly principal installments + monthly interest) x installment tenor + (administration fee 0% of transaction nominal).

= (Rp. 696,667) x 3 + (0% x Rp. 2,000,000)

= IDR 2,090,001 + IDR 0

= IDR 2,090,001

*The fees charged may change according to applicable provisions.

Mandiri call 14000