Social Portfolio

Category based on POJK no 51/2017

Bank Mandiri’s Commitment to Financial Inclusion

Bank Mandiri ensures the availability of access, products, and financial services tailored to the

community’s needs and capabilities, particularly for the underserved groups, unbanked (i.e., those

with no access to financial services) or underbanked (i.e., those who do not use financial services,

despite having access), such as:

At Bank Mandiri, we are committed to fostering financial inclusion so that individuals and businesses have access to useful and affordable financial products and services that meet their needs such as transactions, payments, savings, credit, and insurance, which are designed based on underserved clients’ needs and payment capacity and delivered in a responsible and sustainable way. We believe that access to financial services is essential for empowering individuals, small businesses, and communities, ensuring equal opportunities for economic participation and prosperity, as well as a key driver of economic growth and social development.

- Poor or low-income individuals

- Communities having difficulties in accessing banking services

- Persons with disabilities

- Migrant or informal workers

- Areas with limited access to formal financial networks due to geographical constraints (rural areas), dispersed populations, or low financial literacy.

- Marginalized and/or vulnerable groups, such as women, children, elderly people.

- Microbusinesses having difficulties in accessing capital or banking services.

At Bank Mandiri, we are committed to fostering financial inclusion so that individuals and businesses have access to useful and affordable financial products and services that meet their needs such as transactions, payments, savings, credit, and insurance, which are designed based on underserved clients’ needs and payment capacity and delivered in a responsible and sustainable way. We believe that access to financial services is essential for empowering individuals, small businesses, and communities, ensuring equal opportunities for economic participation and prosperity, as well as a key driver of economic growth and social development.

- Innovating and Expanding Financial Services for Underserved Groups

We continuously innovate and expand our range of financial services based on market research and direct feedback from clients. By understanding the needs of underserved groups, we design tailored solutions that enhance financial accessibility and usability. - Tailoring Delivery Methods to Clients’ Needs

We adapt our service delivery channels to the preferences and requirements of targeted groups, ensuring that financial solutions are easily accessible through digital platforms, agent banking, and community-based approaches. - Offering Non-Financial Support and Promoting Financial Well-Being

Beyond financial services, we provide financial literacy programs, business development training, and advisory services to support the financial well-being and sustainability of underserved individuals and businesses. - Preventing Over-Indebtedness

We establish responsible lending procedures to protect clients from excessive debt burdens. Through careful credit assessments and financial education, we ensure that targeted groups can borrow sustainably and avoid financial distress. - Implementing Accessible Complaint Mechanisms

We have put in place easily accessible and responsive complaint mechanisms to ensure that financial inclusion clients can report issues and receive prompt resolutions. These mechanisms uphold customer protection and service transparency. - Training Staff on Ethical Sales Practices

We train our employees to uphold the highest ethical standards, ensuring that aggressive sales techniques and disrespectful treatment of targeted groups are strictly prohibited. Our training programs emphasize responsible customer engagement and service integrity. - Engaging with External Partners

We collaborate with government agencies, non-profit organizations, and other stakeholders to expand financial inclusion efforts and develop a more inclusive finance market. - Dedicated Financial Inclusion Governance

To ensure accountability and strategic oversight, we have established a dedicated role or committee at the Board of Directors (BOD), executive management, or operational level to oversee financial inclusion initiatives and track progress.

Digital Innovation

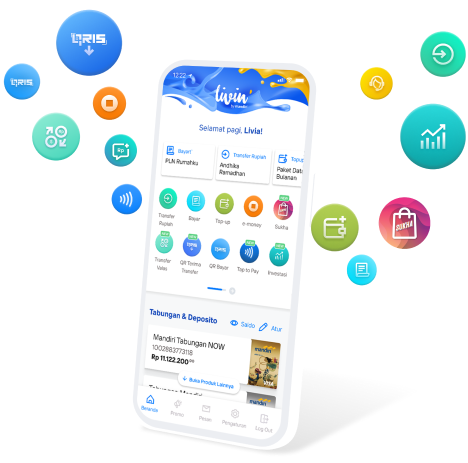

With more than 35 million customers, Bank Mandiri is

one of the retail banking players with a strong presence in the market. Through progressive

business transformation, Bank Mandiri has embarked on a digital journey, continuously

offering cutting-edge digital innovations to customers and business partners. Bank Mandiri

has launched the Super App Livin’ by Mandiri and the Super Platform KOPRA, both of which

have made significant contributions to the bank’s financial performance.

Bank Mandiri is constantly striving to strengthen its digital banking application, focusing on the features offered, customer data security, and accessibility to expand the user base, particularly for individuals without access to or underserved by financial services. The bank’s digital banking aims to offer convenience for customers to conduct transactions and boost customer transaction volume.

During 2023 the Bank Mandiri has continuously implemented a digital banking roadmap refined according to customer needs. There are five parts The main points in the roadmap are:

Bank Mandiri is constantly striving to strengthen its digital banking application, focusing on the features offered, customer data security, and accessibility to expand the user base, particularly for individuals without access to or underserved by financial services. The bank’s digital banking aims to offer convenience for customers to conduct transactions and boost customer transaction volume.

During 2023 the Bank Mandiri has continuously implemented a digital banking roadmap refined according to customer needs. There are five parts The main points in the roadmap are:

- Leveling Up Digital Readiness, as a basis carrying out digital transformation, Bank Mandiri is focused improve the fundamental reliability of IT Systems, such as core banking improvement, business process re-engineering, provision of high performance infrastructure and so on;

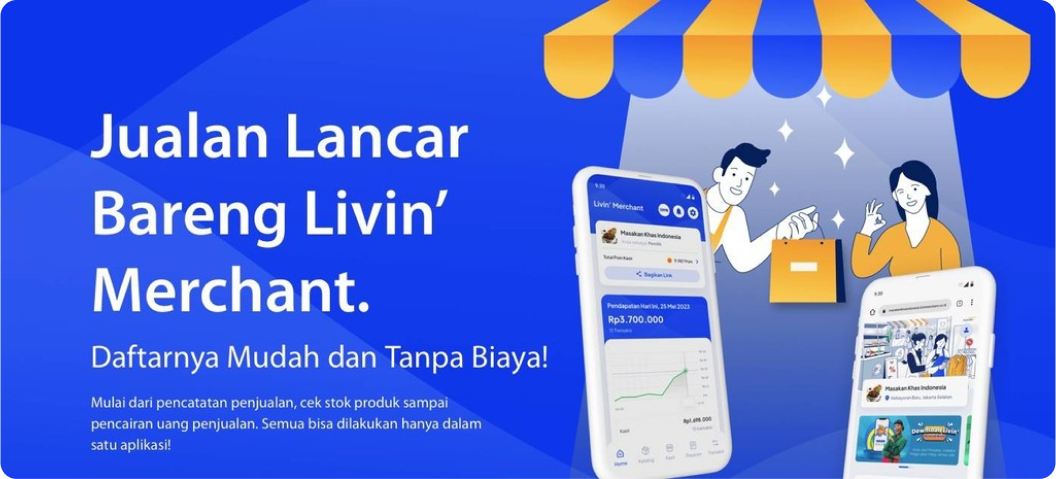

- Developing Digital Native, Bank Mandiri develops native digital service products through various innovations with customers as the focus of product development which is digital native so it can provide services end to end digital banking;

- Modernizing Distribution Channels, Bank Mandirimodernize digital channels to improve customer experience both in terms of User Interface (UI) and User Experience (UX), and can answer various questions customer needs. This was done by Bank Mandiri by continuing to develop Livin', Kopra, and Smart Branch.

- Digital Ecosystem Expansion, Bank Mandiri continues increasing collaboration with third parties or partners strategic in developing its digital ecosystem, as well expanding digital access and ecosystem for customers. So that customers can directly access products and Bank Mandiri services on other channels