Mandiri’s Human Capital Overview

Bank Mandiri's Human Capital division is dedicated to fostering a workforce capable of propelling growth, sustaining business excellence, and nurturing future leaders. This objective is achieved through expediting the fulfillment and enhancement of productivity, as well as by fostering the growth and fortifying the values of Bank Mandiri's AKHLAK and EVP among employees. The Human Capital division plays a vital role in supporting the company's strategic endeavors, crafting a purposeful employee experience, and actively participating in the cultivation of exceptional talent, ultimately contributing to the development of Indonesia's finest professionals.

Mandiri’s Employee Value Proposition (EVP)

Learn

Acquire/strengthen new knowledge, behaviors, skills, or different values

Synergize

Develop personally and professionally

Grow

Collaborate for the collective benefit in achieving the company's vision and mission

Contribute to Indonesia

Have contributions and shares, as well as provide meaning and benefits to Indonesia

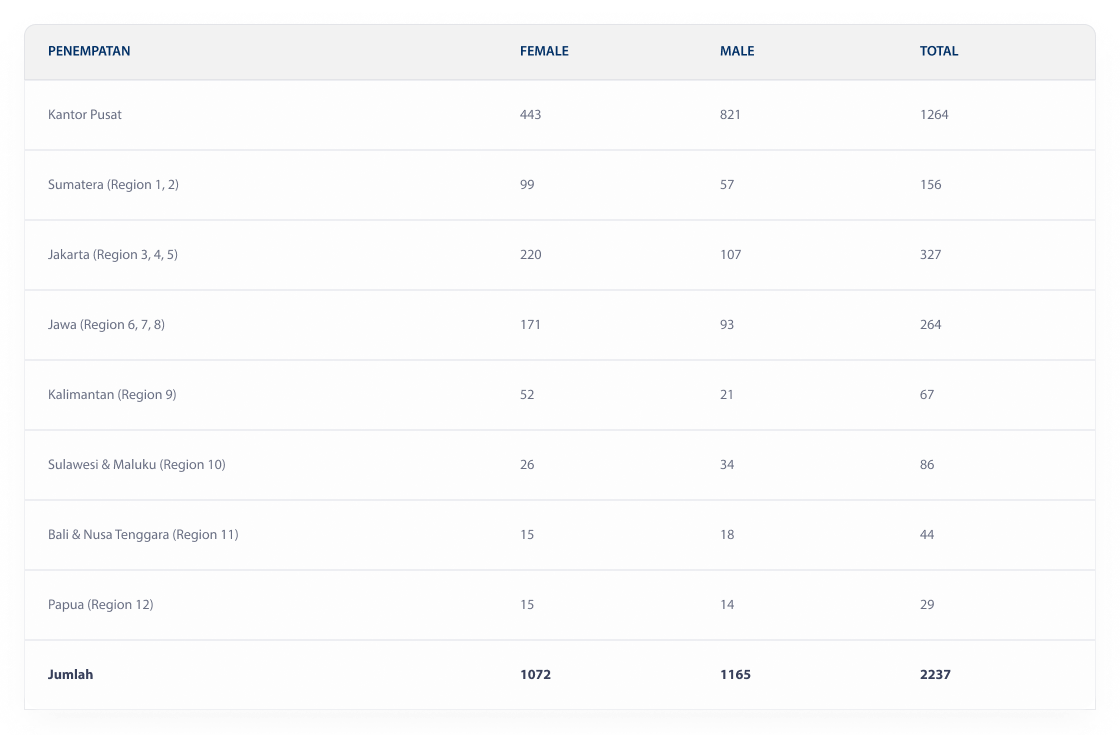

Bank Mandiri highly regards the creative contributions stemming from diverse personalities and cultural backgrounds. Every employee is encouraged to participate as a valuable member of an inclusive team. Bank Mandiri places significant importance on diversity, treating all employees equally and fairly, irrespective of their ethnic background, gender, educational background, religion, or any other distinguishing factor. This commitment to equality and diversity is ingrained from the inception of the recruitment process and is consistently upheld throughout the training and promotion systems. Furthermore, equal opportunities are extended through our recruitment policy, enabling all Indonesian residents to pursue a rewarding career with Bank Mandiri. It's noteworthy that our workforce comprises Indonesian citizens hailing from various regions.

Total Employee

Employee with disabilities

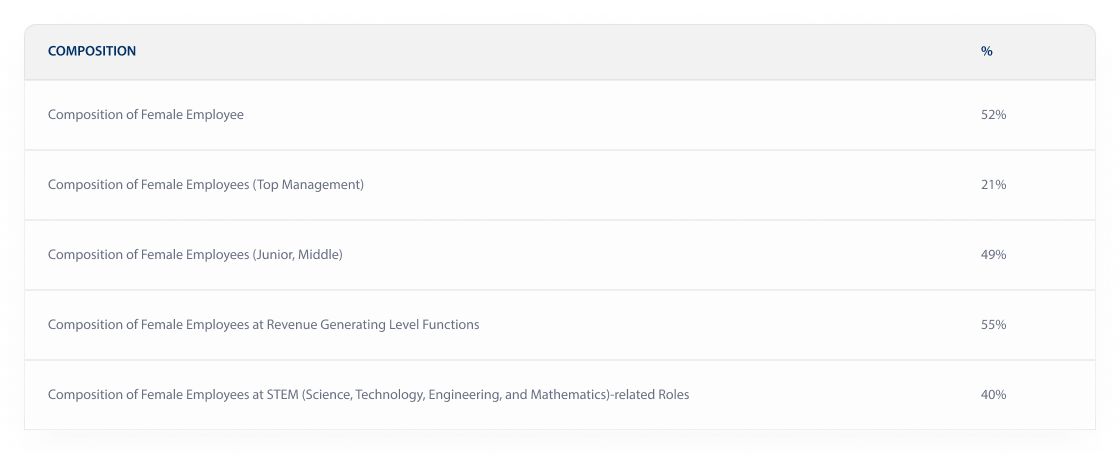

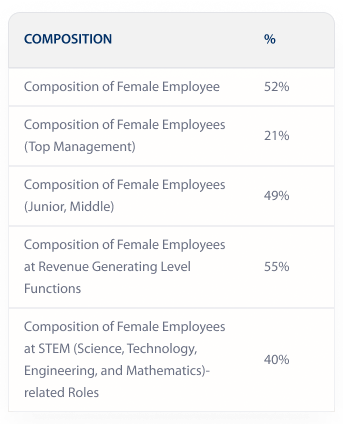

Gender equality composition

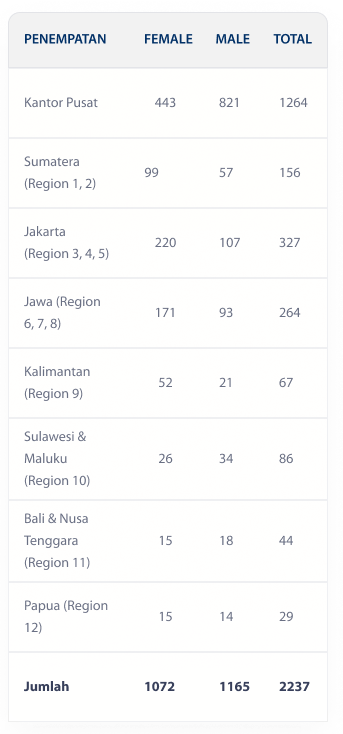

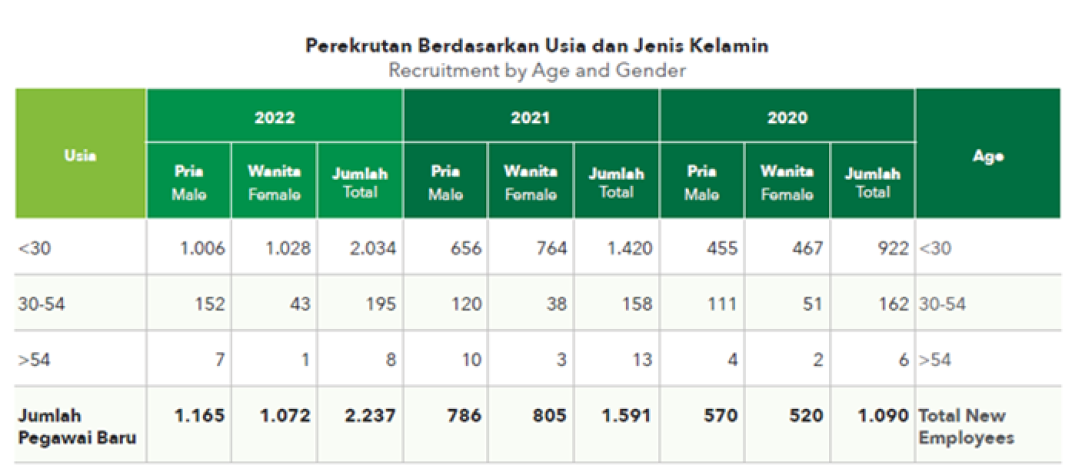

New employee composition by program & gender

New employee placement by age & gender

New employee placement by age & gender

Talent Pipeline Development Strategy

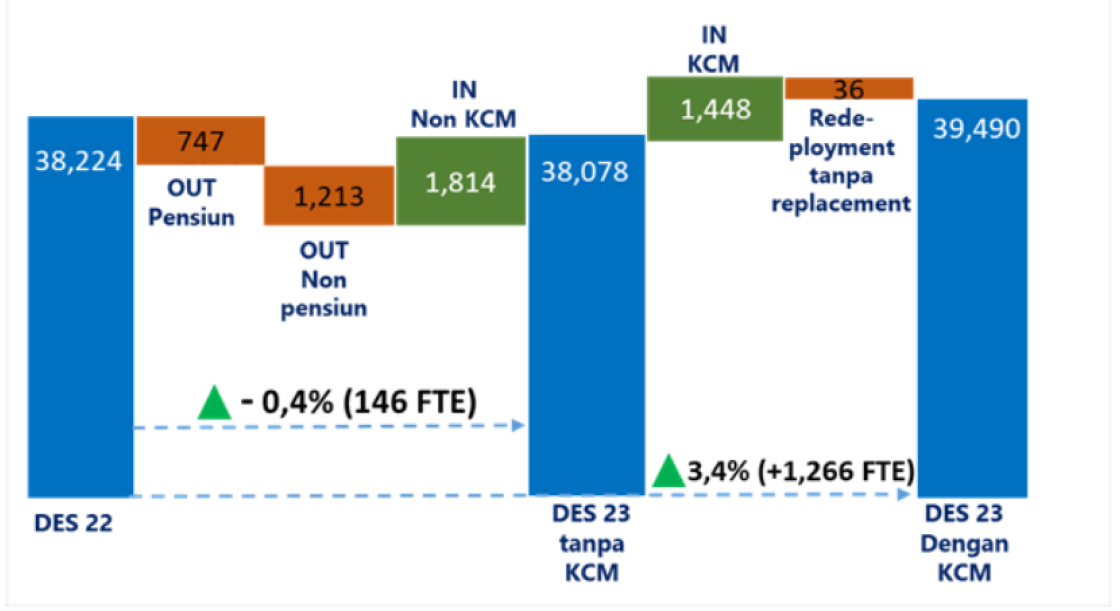

Headcount Forecast 2023

- Employee Baseline in 2022 is 38,224.

- Estimated OUT Employees for 1 Year:

- Retirement: 747 Employees

- Non-Retirement: 1,213 Employees

- Potential Redeployment Without Replacement: 36 Employees

- Estimated IN Employees:

- Fulfillment of Strengthening Functions in Wholesale, IT, Data Security Audit, ESG, and Selective Replacement of Retired and Resigned Employees totaling 1,814.

- Micro Branch Office (KCM) Conversion Initiative with a Headcount Requirement of 1,448.

- Bank Mandiri has a Projected Employee Forecast at EOY 2023 Without Considering the KCM Initiative of -0.4% YoY and Considering KCM +3.4% YoY.

Waterfall Headcount BMRI In-Out Flow 2023

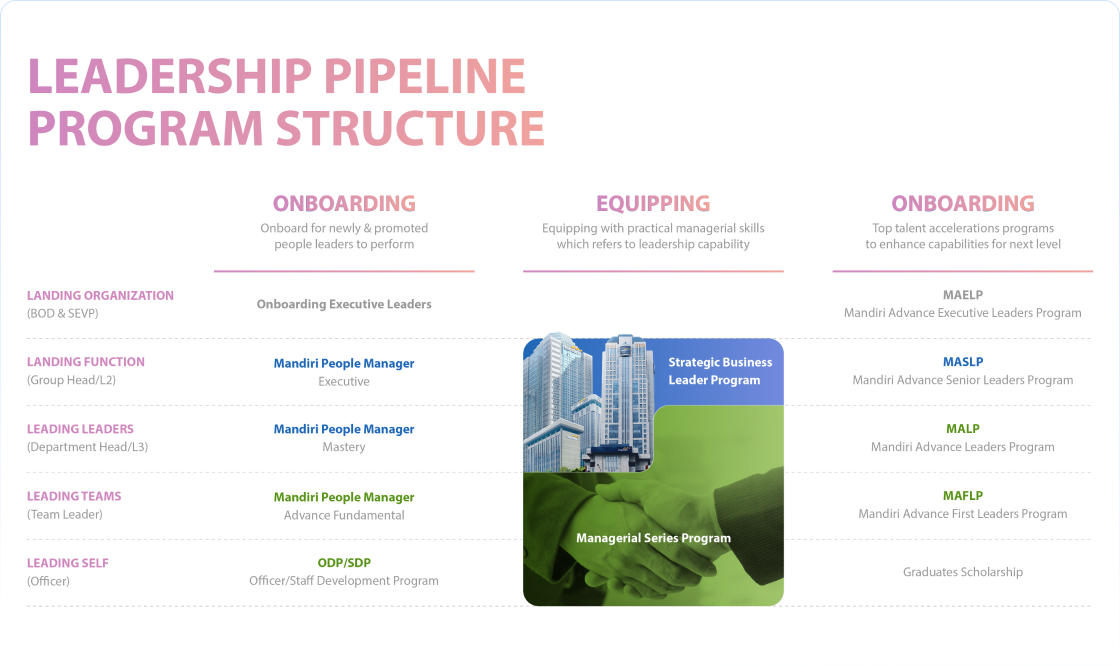

Bank Mandiri is actively equipping its workforce to tackle future challenges through a strategic talent pipeline development approach. This strategy is put into action through a comprehensive leadership development program designed for all employees to prepare the Bank Mandiri leadership pipeline. The program is organized into three phases, aligning seamlessly with both the core values of the Mandirian culture and the specific talent requirements that correspond to Mandirian career ladder.

Fase Onboarding

which is training aimed at new employees and employees who are rotated, promoted or who occupy new positions so as to prepare employees as leaders.

Fase Equipping

which is managerial skills training aimed at completing the leadership capability of employees in their current position.

Fase Developing

which is a top talent acceleration program to increase capability in preparing leaders to the next level. In terms of development programs, Bank Mandiri collaborates with educational institutions to accelerate talent readiness, which is tailored to Mandirian's needs based on job level.

Signature Program

Akademi Retail Banking

- Cluster Business Leader Training Program

- Regional Strategic Business Leader Program

- Peningkatan Kompetensi SME

- Optimalisasi RMU

- Business Sales Leader

- Bisnis Ekosistem

Akademi Wholesale Banking

- Structured Finance

- Structured Treasury

- Structured Trade

- Wholesale Sales Management Program

- BCapital Market & Investment Banking

Akademi Digital Banking & IT

- Digital Literacy

- Digital Innovation

- Digital Banking School

- IT School

- Business Sales LeaderBackend & Front End Developer Bootcamp

Akademi Risk Manajemen

- ODP Risk School

- FAL & CLB

- Audit Talk Series

- Forum APU PPT

- Cybercrime dalam Praktik Perbankan

Akademi Human Capital & Finance

- HC School Foundation Program

- Sertifikasi Competency Based Interview (CBI)

- Competency Management

- Customer Profitability Analysis (CPA)

- Change Management

- Think Like A Strategy Consultant

Akademi Operation

- Operation Management

- Banking Operation School

- Pendidikan Dasar Penilai Properti (PDP 1 & 2 )

- Rapid Improvement

- Effective Complaint Handling & Service Recovery

Departemen Leadership & Menejerial

- Top Talent Development Program (MASLP, MALP, MAFLP, Women Leadership Program)

- Strategic Business Leader untuk L3 (Kantor Pusat)

- Program Beasiswa Pasca Sarjana Luar Negeri

- ODP/SDP

- Mandiri People Manager

Number of education/training by employee status

Regular performance appraisals and feedback processes

- 1. Aspirations and performance achievement feedback

- 2. Agree on expectations

- 3. Identify strengths and development areas

- 4. Develop a development plan.

Through development dialogues with their superiors, employees can also establish individual KPIs or set work targets and agree on action plans. In the middle of the year, through development dialogues, employees can also conduct mid-reviews or adjust individual KPIs, during which Employees and Employee Managers have the opportunity to adjust work targets, discuss performance progress and follow-ups, obstacles and solutions, as well as discuss aspirations and development plans for the current year.

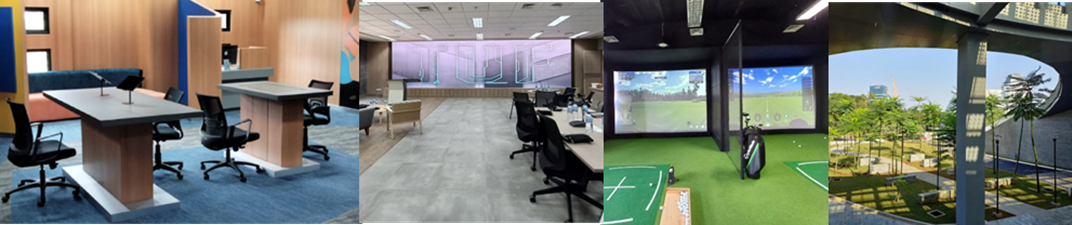

Wijayakusuma Campus as House of Competence

Facilities

- 16 Classrooms with digital equipment

- 21 Virtual Studio

- 31 Smart Branch Simulator

- 42 Bay Virtual Golf

- 5Outdoor Amphitheater

- 6Indoor Cafeteria with Putt Golf

- 7Executive Lounge with Café

- 810 Unit Electric Indoor Transporter

- 92 Unit Shuttle Bus

More Information about Wijayakusuma Campus

Go to LinkThe employee turnover rate in the banking industry is quite high, at 15-20% per year. As such, Bank Mandiri's employee turnover rate can be considered very good, at around 4.82%, which is much lower than the turnover rate in the banking industry. Bank Mandiri has made various efforts to improve employee retention, one of which is by creating a comfortable work atmosphere: super happy and super productive, to increase employee engagement.

Employee engagement index

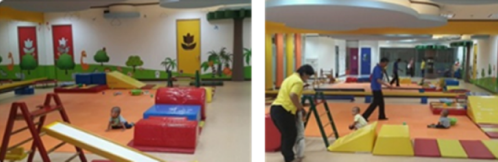

Complete and comfortable office facilities not only boost employee productivity but also play a crucial role in retaining top talent. At Bank Mandiri, we prioritize creating a positive working environment by providing various facilities and infrastructure specifically designed for our employees, including:

- 1Facilitating the development of hobbies, arts, health and sports.

- 2Providing training, seminars and education for employees.

- 3Providing Mandiri Club Fitness Center.

- 4Facilitating sports clubs or communities for employees, such as basketball, badminton, bicycle, running and other clubs.

- 5Providing health clinic facilities, complete with equipment and medical personnel who are ready to serve.

- 6Providing a childcare facility called Mandiri Daycare, so employees do not have to worry about their children while working.

Mandiri Club

In creating a spirit of passion outside of business, Mandiri Club serves to facilitate and organize non-business communication between bank staff through spiritual/religious activities, sports, arts, and social welfare.

Activities:

- 3 Areas of Spirituality

- 7 Arts & Culture

- 2 Social Fields

- 24 Sports

- 12 Region

Health Facility for Employee

Mental Health Facility

In supporting occupational health, in this case the mental health of each employee, Bank Mandiri provides Psychologist services that can be utilized by each employee. Ease of access for each employee to this facility is also a priority for Bank Mandiri so that this facility can be accessed through an online application.

Family Friendly Workplace

Occupational Health & Safety Policy and Program

To ensure the achievement of OHS objectives, Bank Mandiri established an Occupational Health and Safety Committee (P2K3) which is authorized on the basis of the Decree of the DKI Jakarta Provincial Manpower and Transmigration Office, No. 2337 of 2018: 2337 of 2018.

The committee's duties include collecting and managing data on OHS, reporting quarterly to the Manpower and Transmigration Office, and conducting health education and campaigns.

OHS Program:

- 1. Periodic inspection of active fire equipment in each building.

- 2. Standardize specifications, placement of building safety devices, evacuation route instructions, assembly points and evacuation routes.

- 3. Communicate emergency information to employees, guests, and the Building Emergency Response Team.

- 4. Emergency response readiness training.

- 5. Disaster emergency evacuation simulation.

Terkait kesehatan pegawai, Bank Mandiri menyediakan: Fasilitas kesehatan untuk pegawai dan anggota keluarga yang disediakan pemerintah serta dengan Asuransi Kesehatan Mandiri Inhealth (Jaminan Rawat Inap, rawat jalan, rawat bersalin, rawat gigi, general check-up, kacamata, dan jaminan kesehatan khusus) Jaminan sosial tenaga kerja dan perlindungan sosial Jaminan kesehatan masa purna bakti/pensiun dari Bank Mandiri Klinik kesehatan di lingkungan unit kerja Proteksi jiwa berupa asuransi bagi pegawai dan keluarga pegawai yang bekerjasama dengan Asuransi Jiwa Mandiri Inhealth

Employee Stock Ownership Program (ESOP) dan Management Stock Ownership Program (MSOP)

As an extension of the previously distributed Employee Stock Ownership Program (ESOP) and Management Stock Ownership Program (MSOP), Bank Mandiri implemented a comparable program from 2015 to 2023 for its employees and management, featuring predetermined grant and vesting requirements.

The Management Stock Ownership Program (MSOP) takes the form of Long Term Incentive (LTI) shares, granted to the Board of Directors and Non-Independent Board of Commissioners. This is aimed at motivating them to enhance future performance and to reward their efforts in sustaining and/or enhancing the long-term value of the shares. LTI shares were granted from 2022 to 2023, with each vesting period lasting three years.

Bank Mandiri also has an Employee Stock Ownership Program (ESOP) to enhance the sense of belonging and motivate employees to make long-term contributions. ESOP is granted to all job grades and levels that meet the criteria approved by management, including individual performance, talent classification, and employee track record. From 2015 to 2023, Bank Mandiri distributed a total of 88,203,800 shares with vesting periods ranging from three to five years.

Bank Mandiri will implement a similar stock ownership program for employees and management in the following years.

To facilitate Digital Transformation and its impact on ESG performance, Human Capital Group has implemented specific strategies aimed at enhancing Digital Capability for employees and other similar personnel through various programs:

Mandirian Jadi Digital

Digital competency improvement program for employees, so that they can contribute to Bank Mandiri's digital transformation.

40 vol.Webinars Mandirian Siap Jadi Digital

19.836Mandirian Attendees

My Learn by human capital

A digital platform used by Bank Mandiri employees to conduct training, self-development, and process feedback.

My Digital Academy

Early Hiring and Development Program to attract the Best Digital Talent from university students by developing technical skills and providing scholarships and golden tickets to join Bank Mandiri.

15.272student participations

302selected bootcamp participants

Strategic Workforce Program

Strategies for preparing the number of human resources, human resource skills, and strengthening digital culture & mindset to support strategies, New Business & Operating Models as a result of digital transformation to increase productivity.

3.841Mandirian Upskilled for Smart Branch

302Mandirian Upskilled for Digital Operations

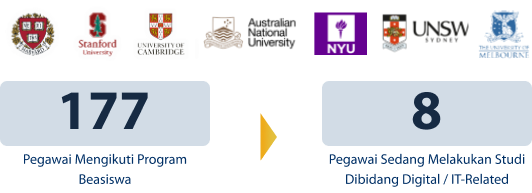

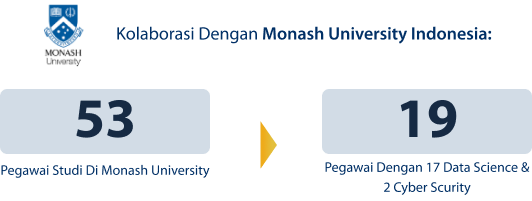

Bank Master's Degree Scholarship

Master's degree education to support the improvement of Digital Capability focusing on enhancing Digital Skills, through 2 Programs:

Mandiri Executive Scholarship for Postgraduate

Mandiri International Scholarship

At Bank Mandiri, Srikandi Mandiri is here as a community for our female Mandirians. A place where all women can connect, share, and find support at every stage of their lives through a range of engaging activities.

- 1Physical Wellbeing Program

- 2Mental Health Program

- 3Fun Program

- 4Respectful Workplace Policy Awareness

- 5Woman Leadership Program

Woman Leadership Program

This program is designed to empower and elevate the top millennial female talent within Bank Mandiri to the next level. The Women Leadership Program focuses on developing both personal and professional skills to address the unique challenges uniquelly faced by women.

Workshops

Sharing & discussions with C-Level Woman Leaders

Mentoring

In-depth mentoring (in groups of 5) with C-Level Women Leaders

Inspiring Devt Coaching

In-depth coaching (in group of 5) development plan (career & personal)

Fun Wellbeing Activities

Short class to improve engagement & well-being

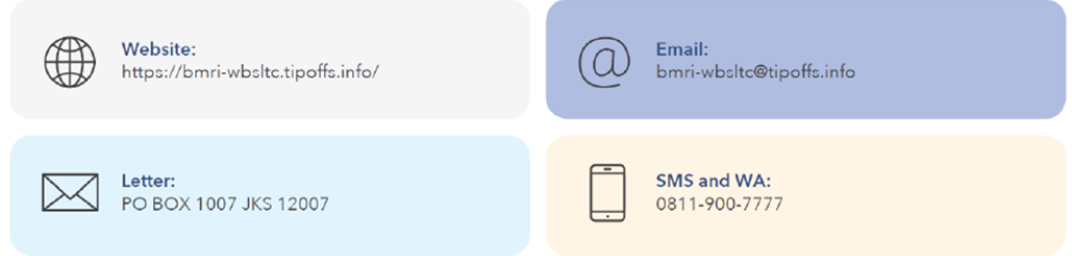

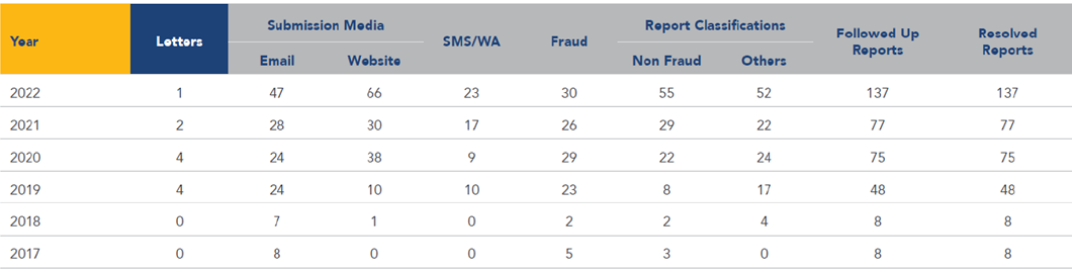

To maintain and improve the

reputation

of the Bank and in line with the second pillar of the Anti-Fraud Strategy (SAF), the

detection pillar, risk control facilities and systems are needed and carried out through

the

Whistleblowing System (WBS) mechanism. Bank Mandiri has provided a reporting facility

for

complaints of violations called Whistleblowing System – Letter to CEO (WBS-LTC). WBS-LTC

aims to detect acts of fraud or indications of fraud, encourage awareness and concern

for

all employees and improve the company’s reputation to stakeholders.

The management of WBSLTC reports acceptance and administration is carried out by an

independent third party to provide a safe-environment that encourages employees and

stakeholders to report acts of fraud or indications of fraud. The types of fraud

reported

include fraud, deception, embezzlement of assets, leakage of information, banking

crimes,

corruption crimes, and other actions that can be equated with fraud in accordance with

the

provisions of laws and regulations, as well as actions that categorized as breaches of

employee disciplinary regulation of Bank Mandiri. In addition to reporting acts of fraud

or

indications of fraud, WBS-LTC can also be used to report non-fraud violations such as

violations of norms and ethics (code of conduct).

The management of Whistleblowing System – Letter to CEO engages the independent third party, which aims, among others, to :

- 1Be Independent and professional.

- 2Minimize the risk of conflict of interest.

- 3Provide a sense of security for the whistleblower.

- 4Increase stakeholder trust in Whistleblowing System – Letter to CEO management. Awareness

- 5The whistleblower can monitor the status of the follow-up to the Whistleblowing System – Letter to CEO report being submitted.

Whistleblowing System – Letter to CEO

Confidentiality of Whistleblowers

As Bank Mandiri’s commitment to maintaining the confidentiality of reporting data, the Bank provides :

- Guarantee on the confidentiality of the whistleblower identity.

- Guarantee for the confidentiality of the contents of the report submitted by the whistleblower.

Protection for Whistleblowers

Protection of Employees who submit reports containing information related to disciplinary violations and breaches of applicable stipulations/regulations, as long as the information submitted by the Employee is true, according to the facts and does not constitute a false report including no involvement of the whistleblower.Types of Violations that can be Reported

1. Fraud, which consists of:- Fraud

- Deceptions

- Embezzlement of Assets

- Leak of Information

- Banking Crimes

- Corruption Crimes

- Other actions that can be equated with fraud in accordance with the laws and regulations, as well as actions that are categorized as breaches to the employee disciplinary regulation of Bank Mandiri.

2. Non-fraud, including violations of external and internal rules, including norms and ethics (code of conduct), with examples such as :

- Abuse of authority and/or position

- Actions that can degrade the reputation and/or good name of the Bank

- Immoral acts inside and outside the Bank

- Abuse

- Discrimination, sexual harassment, violence and bullying in the workplace

- Drug use

- Engage in prohibited community activities

- Violations of ethics, include the use of social media

Letter to CEO Mechanism

Handling Results

More Information about Grievance Mechanism

Go to Link