The nation's economic growth is inseparable from financial inclusion efforts, namely expanding access to financial services to the community. The development of wider financial access can reduce welfare inequality and support post-pandemic economic recovery. OJK has set a financial inclusion target of 90% by 2024. Therefore, Bank Mandiri ensures the availability of access, products and financial services that are in accordance with the needs and abilities of the community.

In addition to bolstering the wholesale segment, Bank Mandiri also extended financial inclusion to underserved customer groups, namely:

Financial inclusion products and services are provided in simple, easy-to-understand forms, tailored to the needs of communities that have not yet been reached by financial services.

As one of the largest banks, Bank Mandiri recognises its important role in supporting a more responsible economic growth, including efforts to help realize a lower carbon emission economy. Bank Mandiri's commitment extends beyond the environmental aspect; it is also dedicated to continuously enhancing community empowerment and financial inclusion. This includes providing financing support to the MSME sector and socially oriented industries.

Wirausaha Muda Mandiri

The Wirausaha Muda Mandiri (WMM) program has nurtured 50,000 young Indonesian entrepreneurs over the past 15 years, beginning in 2007. WMM places its emphasis on business mentorship, networking, facilitating market access, and offering banking and capitalization services.

SUCCESS STORY WMM ALUMNI

Wirausaha Muda Mandiri transform and supported the progress of DUSDUKDUK. As one of the entrepreneurial space for young people to improve business skills, promote business, and expand networks.

Arif Susanto, Owner DUSDUKDUK

Being part of Wirausaha Muda Mandiri is one of the best decisions I've made in my life. I received many valuable learnings, such as education, which turned me from an amateur entrepreneur into a professional entrepreneur. When I became one of the WMM winners, I gained credibility in my business and connections with many young entrepreneurs from Sabang to Merauke.

Florentia Jeanne, Owner NoonaKu Signature

Find Out More about wMM bank Mandiri

Learn More

Mandiri Sahabatku

Mandiri Sahabatku is a financial literacy and entrepreneurship training program for Indonesian Migrant Workers (PMI). This program provides online and offline entrepreneurship workshops involving Indonesian Migrant Workers in 11 countries (namely Hong Kong, Japan, South Korea, Malaysia). As the number of Migrant Workers grows, Bank Mandiri offers micro/SME financing or the opportunity to become a Mandiri Branchless Agent Banking in Indonesia.

Rumah BUMN

Bank Mandiri, in collaboration with the Ministry of State-Owned Enterprises, is driving, empowering, and enhancing SMEs through financial literacy, digital marketing skills, and e-commerce promotion. Bank Mandiri has established 22 State-Owned Enterprises Houses (RB) spread across Indonesia, involving 13,814 SMEs (approximately 90% women) through digital marketing workshops. As of September 2022, more than 3,000 SMEs have registered on Top Indonesia E-Commerce, boosting their annual gross sales.

Bank Mandiri also promotes SME products through national and international exhibitions, such as the Indonesian Representative Office Abroad, the festival of Indonesian creative products in Malaysia, festival of Indonesia in South Korea, proud with Indonesia’s product, Dubai Expo 2020, London Coffee Festival 2021, Katumbiri Expo 2021, national discount festival, and RB entrepreneurship week.

Through the Rumah BUMN, Bank Mandiri has experienced an increase in the Social Return on Investment (SROI) over the last three years. The purpose of calculating SROI is to measure the benefits, effectiveness, and impact of the company's programs. Bank Mandiri's SROI reporting is conducted independently, considering the social value derived from CSR programs. The SROI value of the Rumah BUMN Surabaya grew by 19.6 times in 2021, surpassing the 2019 value of 12.65 times. The SROI value above represents that each invested Rupiah through Bank Mandiri's CSR fund can provide a social value of up to 19.6 Rupiah in the Rumah BUMN Surabaya.

Wiwit was a housewife who received entrepreneur training. After that, She has been processing water hyacinth waste into handicraft products (Bags, Sandals, Kitchen Utensils, and Chairs). After receiving digital marketing and participate in various exhibitions, her products increase up to 3 times and provided job opportunities for 4 surrounding villages (Kebraon, Wiyung, Bangkringan, and Lakarsantri)

Wiwit Wafianti, Owner Witrove

Find Out More About Rumah BUMN

Learn More

Rice Milling Unit

In order to achieve Sustainable Development Goal #1 (No Poverty), Bank Mandiri launched the Rice Milling Unit (RMU) as an Integrated Rice Processing Center in Pamarican and Kebumen Districts. Currently, the RMU can process 10 thousand tons of rice and contributes to an income increase for 11,000 farmers by Rp12.5 billion. Through the RMU program, Bank Mandiri has provided Mcro Business Loan (KUM) / People’s Business Credit (KUR) to 4 thousand farmers, becoming a national benchmark involving 14 farmer communities. The RMU program aligns with the Government's initiative to alleviate extreme poverty.

Through the Rice Milling Unit (RMU), Bank Mandiri has experienced an increase in the Social Return on Investment (SROI) over the last three years. The purpose of calculating SROI is to measure the benefits, effectiveness, and impact of the company's programs. Bank Mandiri's SROI reporting is conducted independently, considering the social value derived from CSR programs. The SROI value at the Pamarican Rice Milling Unit, West Java, grew by 2.69 times in 2021, higher than the 2019 value of 2.13 times. The above SROI value represents that everyone Rupiah invested through Bank Mandiri's CSR fund can provide a social value of up to 2.69 Rupiah at the Pamarican RMU in 2021.

Balkondes

"Balkondes" is a program initiated by Bank Mandiri aimed at rural areas to foster tourism business opportunities through the establishment of homestays, prolonging the length of stay for tourists by introducing new cultural performances in each village, increasing the economic income of rural communities, and generating employment opportunities for village residents. Bank Mandiri has the opportunity to enhance the community's economy through the development of Balkondes in Kenalan Village, Borobudur, Magelang.

Program Bapak Asuh

"Bapak Asuh" is a program that collaborates with expert partners in various fields of knowledge to serve

as mentoring guides for ex-migrant worker in starting and developing their businesses upon returning and settling in Indonesia.

Several Expert Partners in various disciplines include categories such as Beauty and Fashion, Culinary, Automotive,

as well as winners of the Wirausaha Muda Mandiri (WMM) program.

The educational program activities include:

- Establishing legalities for startup businesses.

- Financial literacy covering KUR (People's Business Credit), KUM (Micro Credit), and Livin' Merchant.

- Financial Management.

- Education towards Digitalization & Marketplace.

Mandiri Digipreneur Hub

Mandiri Digipreneur Hub is an incubation center established by Bank Mandiri for MSMEs.

Business owners are guided to be able to create or produce goods effectively and correctly. Not only that,

through Mandiri Digipreneur Hub, MSME players will also be taught how to marketing products, packaging, financial

planning, and developing their businesses.

Mandiri Digipreneur Hub is expected to become the primary choice location as a learning centre for exploring business opportunities, as well as access to financial literacy and capital venture.

Urban Fest Expo

The Urban Festival business is a program implemented by Bank Mandiri, serving as one of the platforms

supporting the development and welfare of SMEs across Indonesia to discover SMEs that are truly willing to grow substantially.

This program serves as a marketing support, transaction facilitator, connector, and promoter for startup businesses, enabling them to access capital for business expansion.

MANDIRI X POS EDUKASI KEUANGAN BERSAMA

Pos Edukasi Keuangan Bersama: Financial Inclusion for the Society

Amidst the increasingly complex dynamics of global finance, a solid understanding of financial management is key to effectively managing personal finances. Bank Mandiri, in collaboration with PT Pos Indonesia,

has initiated the “Pos Edukasi Keuangan Bersama” with a strong commitment to enhancing financial literacy through financial education modules for the community, particularly for micro, small, and medium enterprises (MSMEs/UMKM).

In addition to the educational modules, this platform also serves as a gateway for the community to access bank products such as

account opening Tabungan Now, Tabungan Rencana & Multicurrency, MSME's Loan (KUR/KUM Product).

This initiative is Bank Mandiri's commitment to financial inclusivity, not only functioning as a financial institution but also as a partner in building comprehensive financial well-being within society.

For more information, please visit

https://pos-pintar.digitaldesa.id/web/instansi/bank-mandiri

Financial inclusion exerts a favorable influence on a nation's economic landscape. In this context, Bank Mandiri is committed to advancing economic development through the implementation of Corporate Social and Environmental Responsibility initiatives that directly address the community's requirements. The Productive Micro strategy is designed to optimize ecosystem-aligned acquisitions by digitizing operational channels across the Bank Mandiri organization.

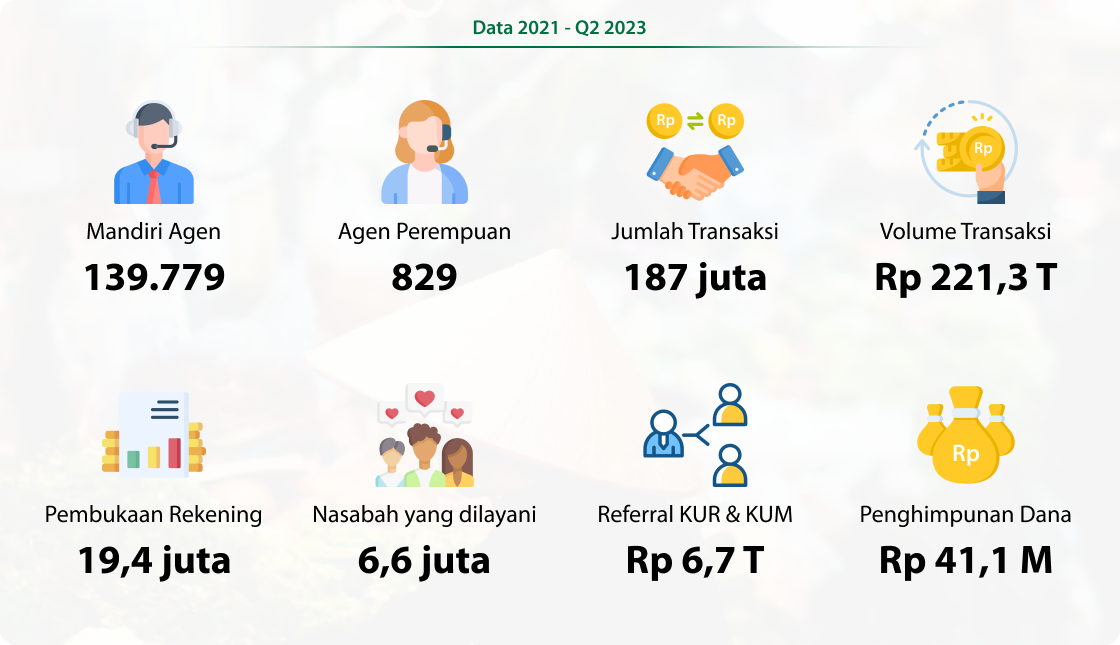

Mandiri Agen

Bank Mandiri's strategy in expanding financial inclusion, especially for people who are not reachable by formal financial institutions, is by providing Branchless Banking agents or, in OJK terms, Laku Pandai. Bank Mandiri has implemented the Laku Pandai program nationally since 2016, referring to OJK Regulation No.19/POJK.03/2014 and OJK Circular Letter No.6/SEOJK.03/2015. Their duties are prioritized to handle low-populated areas, such as outskirts and rural areas.

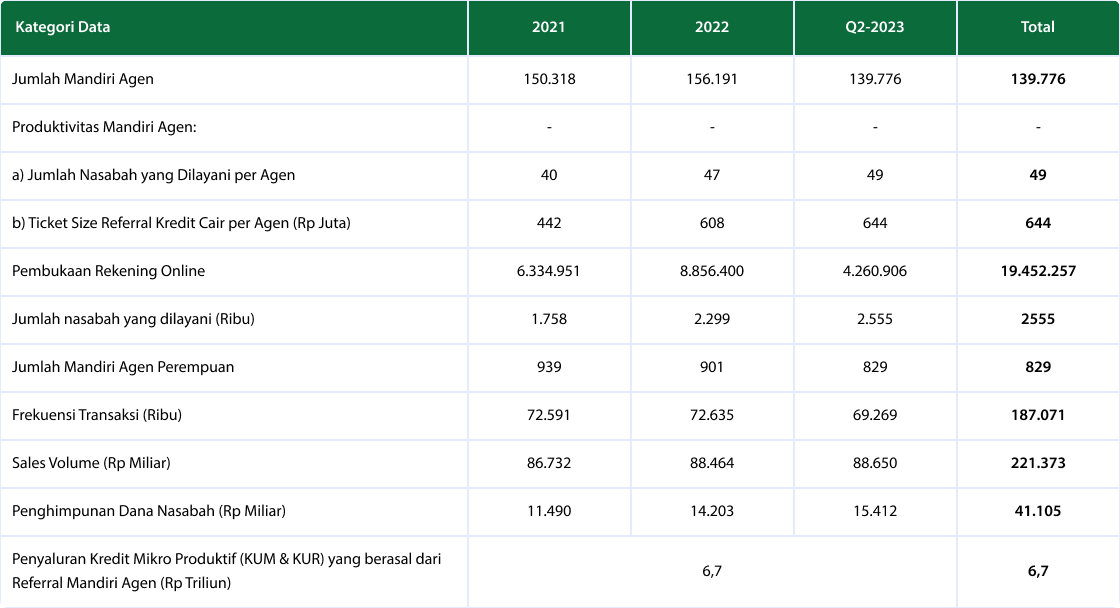

To bolster branchless banking services, Bank Mandiri has been steadily supplying Mini ATMs by EDC to Mandiri Agents. Our extensive network of 139,776 branchless banking agents operates across all provinces in Indonesia, providing nationwide coverage. Productivity among Mandiri Agents continues to increase, with a growing number of community served and larger credit referral ticket sizes per agent. Our Mandiri Agent initiative exemplifies Bank Mandiri's dedication to connecting society with banking services. Furthermore, as of the second quarter of 2023, Mandiri Agen proudly include 829 female agents, further contributing to financial inclusion in our society.

The Mandiri Agen played a vital role within the community by serving as a distribution channel for government subsidized loans (Kredit Usaha Rakyat (KUR)). Bank Mandiri with close collaboration with the Ministry of State Owned Enterprises (SOE) and the Department of Social Services to delegate Mandiri Agent for distributing social assistance, including:

Kredit Usaha Rakyat

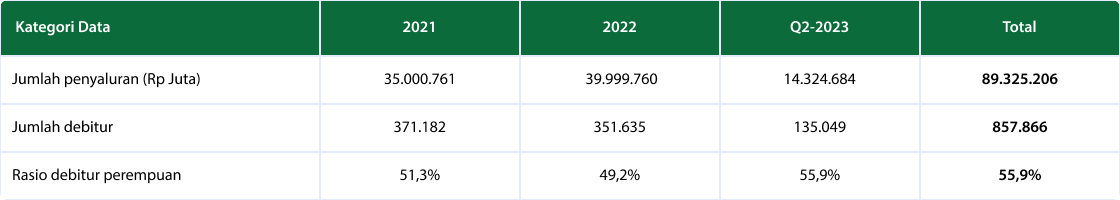

KUR (People's Business Credit) is part of the government's program to expand access to financing for SMEs. It is provided to productive and eligible business groups that are suitable to receive loans but lack additional collateral or have insufficient collateral.

Mandiri has distributed KUR to approximately 2.4 million people. The distribution of KUR/KUM aims to enhance the competitiveness of micro-entrepreneurs, drive economic growth, create employment opportunities, and alleviate poverty. In the agricultural sector, Bank Mandiri engages in synergies involving stakeholders such as Wholesale debtors to optimize the value chain and build the agribusiness ecosystem. For example, in the Dompu and Sumbawa Regencies, Bank Mandiri collaborates with PT Seger Agro Nusantara (SAN) as the off-taker, the Coordinating Ministry for Economic Affairs of the Republic of Indonesia as the supervisor of the KUR product, the Ministry of Agriculture, and local authorities. The government finances corn farmers and develops the ecosystem. This collaboration offers certainty in the purchase of corn harvested by farmers from PT SAN, the provision of agricultural products such as seeds, fertilizers supported by Mandiri Agen (branchless banking), and ease of payment in the form of a bullet payment. Currently, 700 partner farmers of PT SAN have participated in Bank Mandiri's KUR financing program. In the future, Bank Mandiri will continue to increase financing to more farmers, especially through collaboration with wholesale debtors and continuing initiatives to promote financing in the production sector.

Testimonoal of KUR Argiculture Bank Mandiri

With the presence of Bank Mandiri KUR, especially the agriculture program in collaboration with PT SAN, farmers can sell their harvest easily. PT SAN as the off taker of corn harvest guarantees the purchase of harvest with pre-agreed prices and prevents farmers from selling with low prices.

Iwan, Corn Farmer

Since I joined the Bank Mandiri KUR Agriculture program, I could maintain my cornfield better and maximize the harvest better than the previous year. I am so grateful that Bank Mandiri and KUR have facilitated farmers' needs such as seeds, fertilizer, pesticides and enabled farmers to maintain the crops better.

Edi Man, Corn Farmer

Find Out More about KUR Program

Learn More

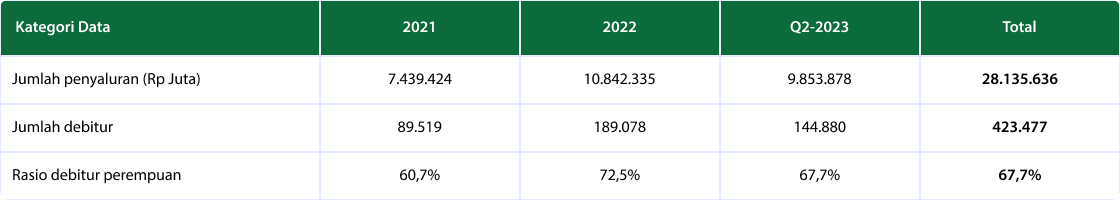

Kredit Usaha Mikro

The "Kredit Usaha Mikro" (Micro Productive Loan) is extended to financially productive businesses with requirements such as investment or working capital, within a range of Rp 10 million to Rp 500 million. This assistance is directed towards micro-entrepreneurs who exhibit feasibility but have not yet met the criteria for traditional banking services. Kredit Usaha Mikro distribution has reached. Up to the second quarter of 2023, a total of IDR 28,135,636 has been disbursed through the Kredit Usaha Mikro program, benefiting a diverse pool of 42,477 debtors. Notably, the distribution of Kredit Usaha Mikro (KUM) underscores the substantial participation of women, accounting for a significant 67.7% of the total number of debtors.

Livin` Merchant by mandiri

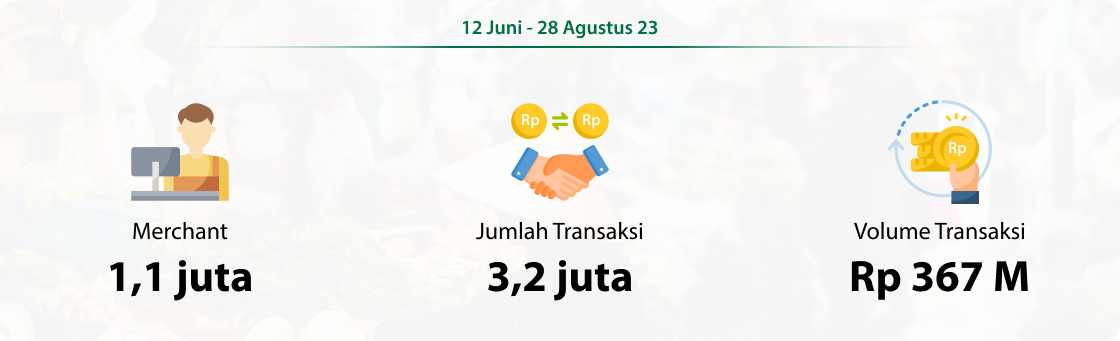

The Livin' Merchant application is designed to assist entrepreneurs throughout the sales value chain. It covers tasks such as recording sales, monitoring product stock, and facilitating sales transactions—all within a single application. Livin' Merchant facilitates offline and online sales processes. The straightforward registration and user-friendly interface of Livin' Merchant aim to make it accessible for business operators, supporting Bank Mandiri and its commitment to promoting financial inclusion.

Kopra By Mandiri

Bank Mandiri remains committed to fostering sustainability through digitalization, introducing a range of digital products such as Livin' for consumers and Kopra for wholesale clients. Kopra's Digital Super Platform provides a comprehensive suite of financial services, enabling customers to fulfill all their business requirements through a single access point, promoting long-term business sustainability. Since its launch in October 2021, Kopra has consistently seen an increase in both transaction frequency and value, with a remarkable 95% of Bank Mandiri's business clients registered as Kopra users. Kopra introduces various innovative features to empower both society and businesses, including three distinct variants: Kopra Portal, Kopra Host to Host, and Kopra Partnership.

Tabungan Simpanan Pelajar

Tabungan Simpanan Pelajar (SimPel) has been introduced with the aim of nurturing a savings culture right from a young age within the framework of financial education and inclusion. For parents and educational institutions, SimPel serves as a catalyst for financial education and instills a savings ethos in students. SimPel Savings aligns with the savings initiative initiated by Otoritas Jasa Keuangan (OJK), designed to enhance financial inclusion among Indonesian students. The adoption of SimPel Savings represents a significant stride towards promoting sustainability by imparting the value of savings early in life.

Waste to Energy

As a form of our commitment, Bank Mandiri is actively managing climate change risk. We carry out CSR “Waste To Energy” in collaboration with Ecoranger who is an alumni of WMM in 2020. Through the optimization of the Maggot Black Soldier Fly (BSF) to decompose organic waste into compost and biogas production of livestock waste as an energy source. Together with the ecoranger team until December 2022, we have started operational carbon emissions of 200 Tons of CO2e from the processing of 215,5 tons of waste (measurement is carried out by Greeneration). Some of the activities we carried out during this period included:

Some of the activities we carried out during this period included: Biogas optimization training for Maggot, Construction of 5 Biogas Houses, "Beach Clean Up" at Pulau Merah Beach, Cemara Pancer Conservation Beach and Mustika Beach, and carrying out Eco Ranger Academy involving students and customers.

#MANDIRIPILAHSAMPAH

Due to the high rate of waste production in Indonesia and low public awareness in waste management, Bank Mandiri presents the #MandiriPilahSampah program. This program was launched in collaboration with Nara Synergi with the aim of developing Waste Banks in 10 locations in the Mampang Prapatan and Kebon Baru villages, South Jakarta. The main objective of the #MandiriPilahSampah Programme is to create a sustainable Waste Bank system by involving the inclusion and active participation of the community, managing organic and non-organic waste into products with economic value, and becoming a forum for community collaboration in the spirit of mutual cooperation. As of February 2023, the Bank Sampah has served 1,044 customers with total sales of inorganic waste reaching Rp231,821,298. The Bank Sampah programme not only helps reduce waste piles, but also provides customers with the opportunity to exchange their deposited waste for cash and daily necessities.