- Bank Mandiri has reaffirmed its commitment to implementing Sustainable Finance and achieving NZE targets through the ESG Guiding Principle document established under No. RMPC/051/2023 dated December 13, 2023. This document serves as a comprehensive framework outlining the vision, commitment, and strategy for integrating ESG aspects and sustainable finance into every business and operational activity of the Bank.Download Document

- In the first pillar, Bank Mandiri emphasizes sustainable banking activities to lead Indonesia's transition towards a low-carbon economy by integrating ESG aspects into all bank activities, including managing risk and business aspects through the development of sustainable financial products/services.In the second pillar, in support of achieving Net Zero Emissions in Operations by 2030, Bank Mandiri ensures the integration of ESG principles into the bank's operational activities, including managing environmentally friendly operational aspects and the bank's social relationships with employees and customers.In the third pillar, Bank Mandiri expands its commitment to sustainability by refining activities beyond core banking and operations through strengthening the bank's role in financial inclusion and social and environmental responsibility, aligning with the goal of Catalyzing Multiple Growth for Social Impact to Achieve SDGs.

- Bank Mandiri has established a long-term transformation strategy, with a specific focus on the bank’s sustainability strategy for the next 10 years. This strategy is regularly overseen by the Transformation Committee.

- Analyzing the risks and opportunities of climate change to prepare Bank Mandiri’s strategy in facing climate change risks.

- Developing a Sustainable Finance Action Plan (SFAP) based on the mapping of the implementation of ESG aspects and Sustainable Finance at Bank Mandiri for the next five years.

- Developing Sustainable Finance products in both wholesale and retail segments, such as sustainable financing, sustainable bonds, ESG-based investments, eco-friendly cards, and others.

- Establishing an ESG Desk focused on providing financing services such as green loans, sustainability-linked loans, transition loans to help customers transition to a low-carbon economy.

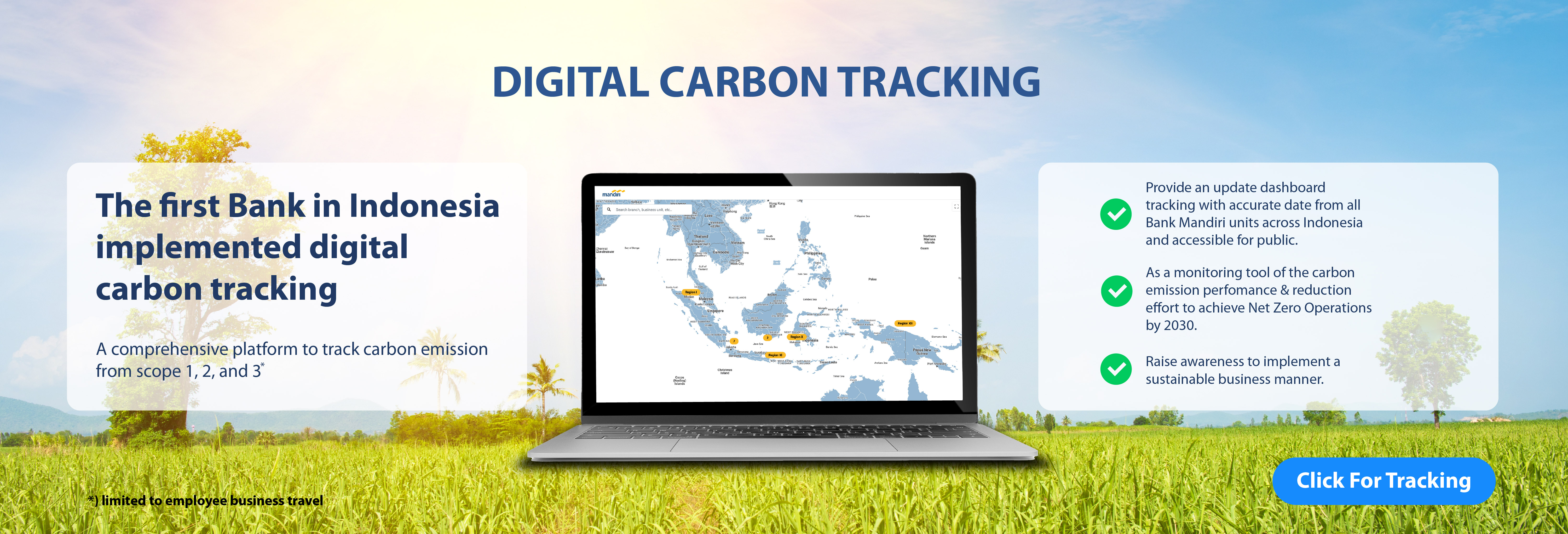

- Developing digitalization in Bank Mandiri’s core business, such as Livin’, Kopra, Smart Branch, and Digital Carbon Tracking to support the achievement of Net Zero Emission (NZE) in Operations by 2030.

- The Contributor Work Unit, consisting of Business Units, Risk Management, Support, and all Regional Offices, actively implements ESG strategies and initiatives in all business and operational activities in line with the framework, vision, and commitments of Bank Mandiri’s ESG.

Task Force on

Climate-related Financial Disclosures (TCFD)

Bank Mandiri and Commitment to Sustainable Finance: Embracing Responsible and Sustainable Governance, Strategy, Risk Management, Metrics and Targets.