As part of our commitment to sustainability, Bank Mandiri has established two strategic initiatives in financing and banking products,

becoming the first national bank to introduce the Sustainable Finance Framework (SFF) and the Transition Finance Framework (TFF).

The SFF serves as a strategic policy framework to support financing for green and social activities, aligning with both national and global sustainability agendas.

S&P Global Ratings, as a Second Party Opinion provider, has assessed Bank Mandiri’s SFF as aligned with global sustainability standards and principles, including

the Green Loan Principles and Social Loan Principles issued by the Loan Market Association (LMA), as well as the Green Bond Principles, Social Bond Principles, and

Sustainability Bond Guidelines issued by the International Capital Market Association (ICMA).

Meanwhile, the TFF is designed to expand financing coverage for transition-related activities, providing financial support to sectors that are not yet fully

environmentally friendly but have concrete plans and commitments to significantly reduce carbon emissions in the short to medium term.

Both frameworks are dynamic in nature and will be periodically reviewed and expanded as needed to amend and/or add additional eligible activities and/or criteria to meet any applicable regulatory requirements.

Download Sustainable Finance Framework

Download Transition Finance Framework

In addition to the evaluation criteria, we have specific policies and/or Standard Operating Procedures (SOPs) to ensure sustainable practices in our business processes, Approved by Board of Directors (BoD)

Bank Mandiri is committed to not financing businesses that engage in the following activities (Exclusion List):

- Environmentally Adverse Projects

- Illegal Logging Operations

- Peatland-related Financing

- Gambling Industries

- Pornographic content & Human Right Violations

- Prohibit Drugs and Narcotics

- Projects that could harm the environment and protected areas, such as UNESCO World Heritage Sites

- Sectors prohibited by laws and regulations.

Bank Mandiri mandates that clients have ESG-related requirement, such as:

- Environmental impact assessment (AMDAL):

- Environmental Management Effort and Environmental Monitoring Effort (UKL-UPL)

- Public Disclosure Program for Environmental Compliance (PROPER)

- other criteria in accordance with applicable laws and regulations.

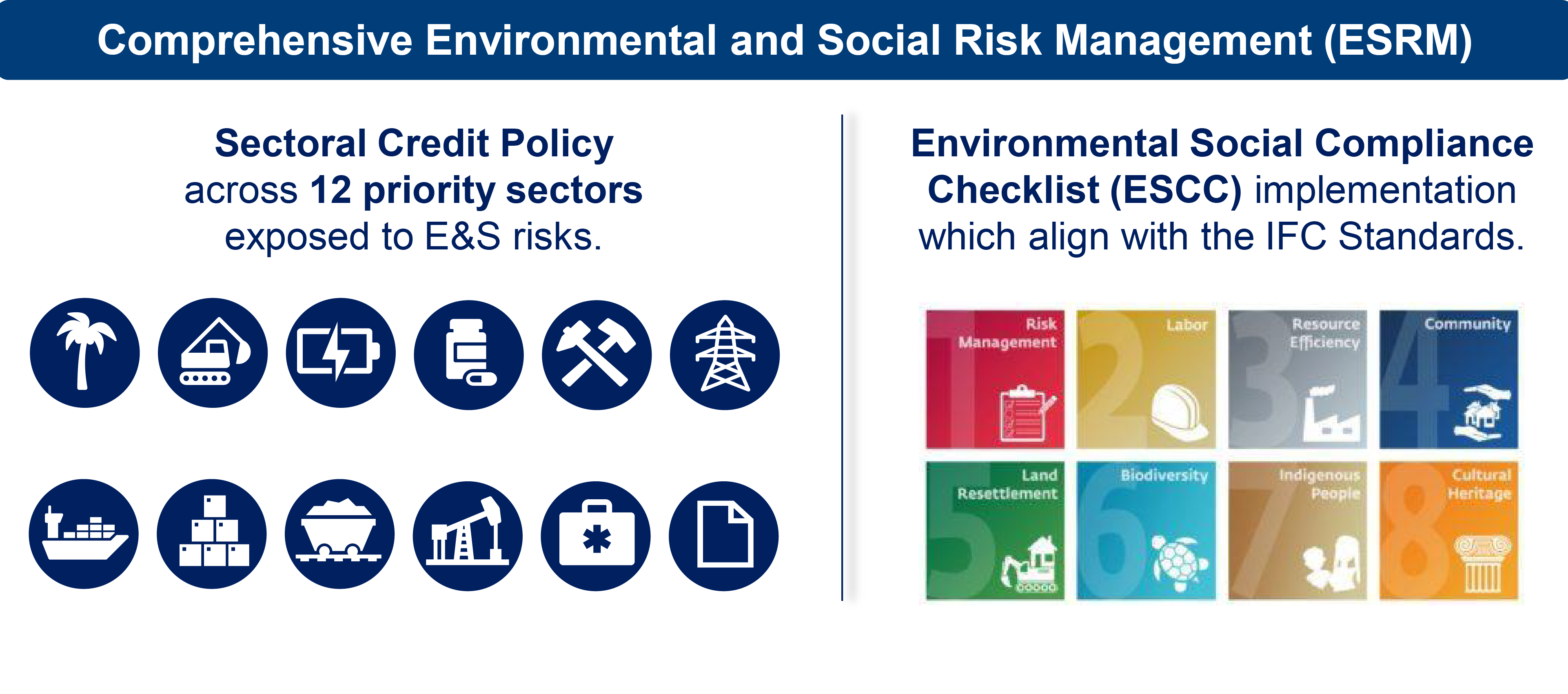

In addition to developing

sectoral credit policies, Bank Mandiri also implements Environment Social Risk Management (ESRM)

through the application of the Environmental and Social Compliance Checklist (ESCC). This checklist

is designed through the adoption of eight key parameters aligned with the International Finance Corporation

(IFC) Performance Standards. Bank Mandiri conducts comprehensive qualitative assessments of wholesale

debtors' adherence to key sustainability criteria. These assessments evaluate various aspects, including

the physical and transition risks, the protection and promotion of human rights, compliance with regulations

related to land acquisition and resettlement, and the preservation of biodiversity through environmental impact assessments.

This approach not only ensures the adoption of responsible business practices but also facilitates the

identification of areas requiring improvement or further action, supports debtors in implementing sustainable

practices, and mitigates environmental and social risks.

We have integrated ESG considerations into our end-to-end credit process as a fundamental component of Bank Mandiri's Financing Policy. We have also distributed sector-specific guidelines tailored to high ESG risk industries, which act as a guiding framework for evaluating debtors operating within these specific sectors.

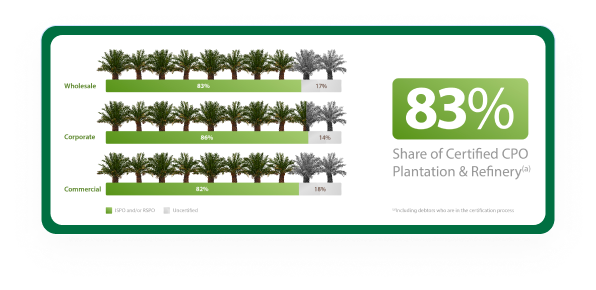

“RSPOisa global standardfor oil palmplantationstodemonstrateanenvironmentally friendly productionprocess.” -https://rspo.org/

As one of the largest Palm Oil lenders in Indonesia, Bank Mandiri is committed to managing environmental and social risks faced by the CPO sector by ensuring the implementation of sustainable agriculture practices.

Our approach seeks to provide an effective framework for addressing the risk by encouraging, and advising our CPO clients on promoting sustainable practices with hope of fostering the growth of the environmental justice movement, ensuring the CPO sector experiences the benefits of a sustainable future.

Through our work in the environmental sector, Bank Mandiri is committed to leading the way toward a just and fair sustainability in one of our priority sectors, CPO – for a better tomorrow. This commitment is shown on how we encourage our CPO clients to possess ISPO/RSPO certifications, as shown within the chart below.

Bank Mandiri is aware of the ongoing risks associated with the CPO sector. Through due diligence and appropriate clients’ management, Bank Mandiri will endeavor to manage and reduce these risks. As our responsibility in balancing the economy, environmental, and social sustainability in CPO sectors, Bank Mandiri is committed to financing our CPO clients with prudence and in accordance with the principles of sustainable agriculture practices.

Sustainable Credit Policy Related to Agriculture Sector

For the Palm Oil Plantation & CPO sectoral policy, Bank Mandiri requires the fulfillment of ISPO (Indonesia Sustainable Palm Oil) certification. Bank Mandiri pays strict attention to debtors’ environmental and labor policies (including Occupational Health and Safety/OHS), procedures for preventing and handling land fires according to applicable standards, No Deforestation, No Peat, No Exploitation (NDPE) policies, and Waste Treatment Plant (IPL).

To promote macroeconomic growth, the Indonesian government has focused on developing national infrastructure over the past few years.

However, in the implementation of infrastructure development, Indonesia faces challenges that can delay the achievement of the goals. The established gap between regions in Indonesia is a major obstacle in infrastructure development, especially in the western and eastern regions of Indonesia. The Indonesian government continues to develop various infrastructure policies and programs to achieve national development targets, including increasing connectivity between regions. The continued growth of this sector naturally poses environmental, social and ethical issues such as noise and air emissions, wastewater, physical, biological and chemical hazards, safety and security risks, habitat change and fragmentation. As our responsibility, Bank Mandiri must be aware of the risks associated with clients and their operations in the Infrastructure Construction Services sector and manage risks through appropriate due diligence and clients’ management. The objective of the Financing & Investment policy for the Infrastructure Construction Services sector is to establish sustainable standards for Infrastructure Construction Services clients.

Sustainable Credit Policy Related to Construction Sector

Within our Construction sector policy, Bank Mandiri pays attention to Environmental and Social aspects according to applicable standards and regulations, including the fulfillment of Environmental Management Certifications such as ISO 14001 and OHS (Occupational Health and Safety) management certifications such as OHSAS 18001 or other similar standards. Sustainable Credit Policy Related to Construction Sector (Attach PDF baru: “Sustainable Credit Policy Related to Construction Sector”

According to the data provided by the Association of Southeast Asian Countries (ASEAN), Indonesia is the largest energy user, with a total energy use of nearly 40% among ASEAN members (IRENA, 2017).

Indonesia is one of the countries with the fastest growing energy consumption in the world. The increasing trend of Energy & Water consumption in Indonesia poses environmental, social and government risks. One of the emerging risks is related to energy security, the risk of the energy crisis that is engulfing global economic stability, causing the need for Indonesia to ensure the availability of sustainable energy. The use of coal, which still dominates domestic energy demand, results in an increase in greenhouse gas emissions resulting from burning coal and thereby exacerbates air pollution and problems related to contamination and water scarcity. However, Indonesia is committed to continuing to promote energy transitions towards clean energy to achieve the National Net Zero target and support the Paris Agreement commitments. Bank Mandiri as a responsible bank continues to support this energy transition strategy through policy adjustments, conducting due diligence and clients’ engagement.

Sustainable Credit Policy Related to Energy Sector

For the Energy sectoral policy, particularly the construction of a new Coal-fired Power Plant, Bank Mandiri considers the financing period to align with the government’s energy transition timeline and pays attention to the debtor’s environmental (carbon emissions, coal ash, water and waste management) and employment policies.

The food and beverage sector is considered as a major contributor to the Indonesian economy.

The food and beverage industry is under scrutiny for the risks and impacts of poor sustainability practices, in particular with increasing consumer attention to social and environmental impacts. Food safety is considered very important to ensure that the product is in the right condition and fit for consumption, as any violation of food safety regulations can result in the loss of a business operating license permanently or temporarily. Therefore, food safety is considered as an issue that needs to be prioritized. The main environmental problem posed by the food and beverage industry is related to the large amount of waste generated. Another prominent ESG risk in the industry relates to labor conditions. Bank Mandiri is aware of the ongoing risks associated with the food and beverage sector. Through due diligence and appropriate clients’ management, the Bank will endeavor to manage and reduce these risks.

To balance the economy and environmental & social sustainability, Bank Mandiri ensures sustainability practices carried out in each client financed and in accordance with the principles of sustainable practices.

Sustainable Credit Policy Related to FMCG Sector

For the FMCG Sectoral policy, Bank Mandiri requires its debtors to possess environmental policies (such as the use of chemicals and water & waste management) and possess certification from the National Agency of Drug and Food Control (BPOM).

Mineral and Metal Mining provides great economic opportunities for countries with rich natural resources, including Indonesia. Indonesia has a large, and in many cases un-prospected, variety of mineral deposits. Mining, including the extraction of Minerals, accounts for roughly one-tenth of the country’s GDP, and through exports and taxation it contributes substantially to foreign-exchange earnings and development.

However, the mining process poses challenges and risks to the ecosystem. Mining operations at all stages, from exploration until its eventual closure require consideration of its social and environmental impacts. Environmental problems within the mining industry include the usage of hazardous chemicals such as cyanide, tailings disposal, excessive use of water sources and mine closures. Approximately 75% of mine closures leave an environmental impact to the community. Apart from environmental issues, mining operations also raise Social Issues such as the right of local communities and indigenous peoples to have a voice in decision-making about mining projects which is often neglected.

Bank Mandiri is aware of the ongoing risks associated with the Metal Mining sector. Through due diligence and appropriate clients’ management, the Bank will strive to manage and reduce these risks and can support the realization of sustainable mining practices.

Therefore, Bank Mandiri is committed to financing the mining sector prudently and in accordance with the principles of sustainable practices.

Sustainable Credit Policy Related to Metal Mining Secto

For the Metal Mining sectoral policy, Bank Mandiri requires its debtors to implement Good Mining Practices according to applicable laws and regulations, including the Annual Work Plan & Budget (RKAB), which has been approved by the Indonesian Ministry of Energy and Mineral Resources, and/or other relevant documents concerning the Good Mining Practices.

Coal-fired power plant suppliers can play a significant role in addressing critical energy needs and fostering economic development. These power plants have historically been essential in providing a consistent and reliable source of energy, especially in regions where alternative sources are limited or insufficient. By facilitating the generation of electricity through coal, these suppliers contribute to the stability of power grids, ensuring a continuous supply to industries, businesses and, households. Additionally, they play a key role in bolstering economic development by enabling the establishment of energy-intensive industries, which can create jobs and stimulating economic growth.

However, Bank Mandiri acknowledge that coal-fired plant suppliers has the potential to harm the environment significantly, as it is associated with climate change. Therefore, it’s crucial for these suppliers to continue exploring cleaner and more sustainable technologies to mitigate the environmental impacts associated with coal-fired power generation while still meeting energy demands. Bank Mandiri actively choosing to reduce our financial support by ensuring our financing activities for coal-fired power plant are in harmony with government policies aimed at reducing the environmental impact of coal-based power generation, while promoting a more sustainable and environmentally responsible energy future.

Sustainable Credit Policy Related to Coal Sector

Bank Mandiri has established a binding credit policy for customers in this sector to:

- Have a minimum Green PROPER assessment and/or at least have an AMDAL or UKL-UPL report (including reclamation and post-mining guarantees) approved by the Environmental Agency (BLH).

- Have Environmental Management certification such as ISO 14001/ISO 45001 or similar documents acceptable to the Bank.

- Specifically for mining financing as a supplier to PLTU, consideration has been given to the financing period with the coal phase-out strategy according to the applicable PLN’s Electricity Procurement Plan (RUPTL).