As part of our commitment to sustainability, Bank Mandiri has established two strategic initiatives in financing and banking products,

becoming the first national bank to introduce the Sustainable Finance Framework (SFF) and the Transition Finance Framework (TFF).

The SFF serves as a strategic policy framework to support financing for green and social activities, aligning with both national and global sustainability agendas.

S&P Global Ratings, as a Second Party Opinion provider, has assessed Bank Mandiri’s SFF as aligned with global sustainability standards and principles, including

the Green Loan Principles and Social Loan Principles issued by the Loan Market Association (LMA), as well as the Green Bond Principles, Social Bond Principles, and

Sustainability Bond Guidelines issued by the International Capital Market Association (ICMA).

Meanwhile, the TFF is designed to expand financing coverage for transition-related activities, providing financial support to sectors that are not yet fully

environmentally friendly but have concrete plans and commitments to significantly reduce carbon emissions in the short to medium term.

Both frameworks are dynamic in nature and will be periodically reviewed and expanded as needed to amend and/or add additional eligible activities and/or criteria to meet any applicable regulatory requirements.

Download Sustainable Finance Framework

Download Transition Finance Framework

In addition to the evaluation criteria, we have specific policies and/or Standard Operating Procedures (SOPs) to ensure sustainable practices in our business processes, Approved by Board of Directors (BoD)

Bank Mandiri is committed to not financing businesses that engage in the following activities (Exclusion List):

- Environmentally Adverse Projects

- Illegal Logging Operations

- Peatland-related Financing

- Gambling Industries

- Pornographic content & Human Right Violations

- Prohibit Drugs and Narcotics

- Projects that could harm the environment and protected areas, such as UNESCO World Heritage Sites

- Sectors prohibited by laws and regulations.

Bank Mandiri mandates that clients have ESG-related requirement, such as:

- Environmental impact assessment (AMDAL):

- Environmental Management Effort and Environmental Monitoring Effort (UKL-UPL)

- Public Disclosure Program for Environmental Compliance (PROPER)

- other criteria in accordance with applicable laws and regulations.

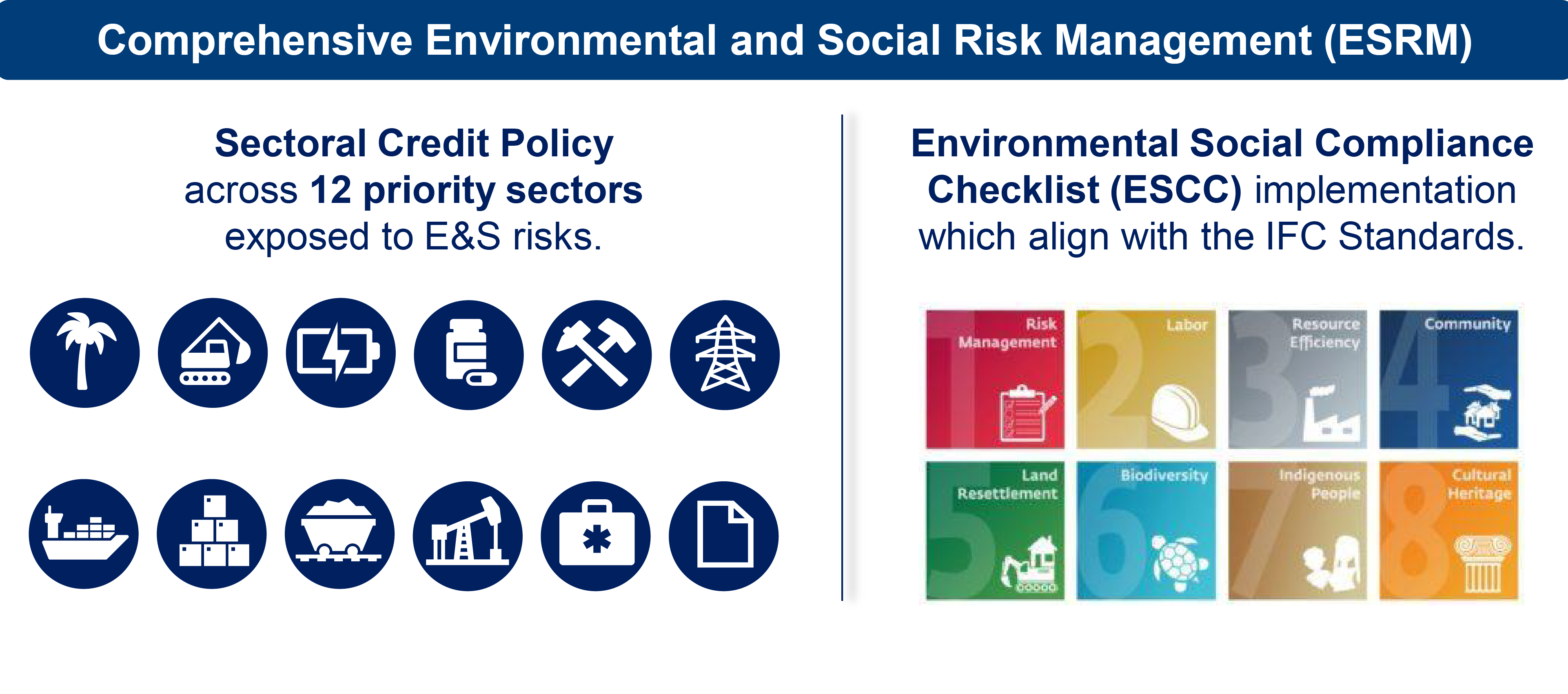

In addition to developing

sectoral credit policies, Bank Mandiri also implements Environment Social Risk Management (ESRM)

through the application of the Environmental and Social Compliance Checklist (ESCC). This checklist

is designed through the adoption of eight key parameters aligned with the International Finance Corporation

(IFC) Performance Standards. Bank Mandiri conducts comprehensive qualitative assessments of wholesale

debtors' adherence to key sustainability criteria. These assessments evaluate various aspects, including

the physical and transition risks, the protection and promotion of human rights, compliance with regulations

related to land acquisition and resettlement, and the preservation of biodiversity through environmental impact assessments.

This approach not only ensures the adoption of responsible business practices but also facilitates the

identification of areas requiring improvement or further action, supports debtors in implementing sustainable

practices, and mitigates environmental and social risks.

We have integrated ESG considerations into our end-to-end credit process as a fundamental component of Bank Mandiri's Financing Policy. We have also distributed sector-specific guidelines tailored to high ESG risk industries, which act as a guiding framework for evaluating debtors operating within these specific sectors.

Bank Mandiri has established a binding credit policy for customers in this sector to:

- Have Environmental Management certification such as ISO 14001 or other documents acceptable to the Bank.

- Have at least a Blue PROPER assessment and/or an approved AMDAL or UKL-UPL report by the Environmental Agency (BLH).

- For public companies, it is mandatory to have a sustainability report.

- Make endeavors to improve energy efficiency and reduce emissions, with adequate electricity and water supply.

- Have a Wastewater Treatment Plant (IPAL)/Waste Treatment Plant (IPL)/Liquid Waste Disposal Permit (IPLC)/and B3 waste treatment facility, evidenced by documents acceptable to the Bank.

- For pulp & paper trading, have endeavors/declaration letters to fulfill

principles/commitments including:

- Selling products or services aimed at not harming the environment

- Eco-friendly, efficient, cost-effective, and energy-efficient distribution processes

- Allocating a budget for eco-friendly marketing

- Not overusing resources

- Having sustainability certificates, such as Forest Stewardship Council (FSC), Programme for the Endorsement of Forest Certification (PEFC), or similar environmental sustainability certificates.